A financial option that comes with one of two payoff options: either a fixed amount or nothing at all. They're referred to binary options as there...

Blog

Playing Markets

Bull Market

A market that is rising or is expected to rise.

Bull Flag Candlestick Patterns

A technical pattern that acts as an extension of an established upward trend. It can be identified by a strong move upwards followed by a...

Breakout Trading

A stock price moving outside a defined support or resistance level with increased volume. A breakout trader monitors securities that have been...

Bot Trading

Or, "trading bots." Automated software used to help buy and sell cryptocurrencies under specific buying and selling conditions.

Bond

An instrument of indebtedness of the bond issuer to the bond holder, typically corporate or governmental. They're also units of corporate debt...

Bollinger Bands

A centerline with two price channels (or "bands") above and below it. The centerline acts as an exponential moving average, while the bands are the...

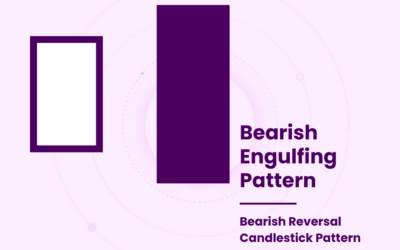

Bearish Engulfing

Bearish engulfing patterns are one of the most well-known candlestick patterns because they are easily identified and give a clear signal. Since...

Bear Markets

When a market shows a prolonged decline in prices. It's generally used to describe a situation where market prices fall 20% or more from recent...