Learning the Markets

Being a millennial, I remember when cryptocurrencies started taking off. I never put too much stock in them. It seemed that digital currencies (particularly BTC) was only used for sketchy or nefarious purposes in the darkest recesses of the deepest web. So I didn’t really care. “They’ll eventually fade into obscurity,” I thought.

But here we are.

The more I’ve learned about Bitcoin, the more obvious it seems that financial markets will continue to move in an online, crypto/blockchain-based direction. A cursory glance at recent financial history supports that argument (as far as I, decidedly a laymen, can tell).

I could be entirely wrong. But far stranger things have happened. So I wanted to hedge my bets.

My Initial Positions

So I got started. Initially, it was just about getting my feet wet. I created a coinbase account and started playing around. Set a few stops, had a few losses, and (surprisingly) made a few gains.

The Dunning-Kruger Effect

Initially, I admit to falling victim to the Dunning-Kruger Effect. Dunning and Kruger argued that the less a person know about something, the more they feel like they know. An argument that sums up my first couple of months trading Bitcoin.

When I got started with crypto trading, I felt like Gordon Gekko Jr, artfully executing masterful trades and humbly collecting my returns.

Time makes fools of us all, I suppose 🤦♂️

But the more I’ve learned about markets, trading, and cryptocurrencies, the more I’ve realized I don’t know (the flip-side of Dunning-Kruger).

Sometimes, you just don’t master something in a few weeks.

Bringing It Back Home

So that brings me to the heart of the matter, this trading journal.

It seemed smart to track my progress to better learn from my mistakes and catalogue what I’ve learned from them.

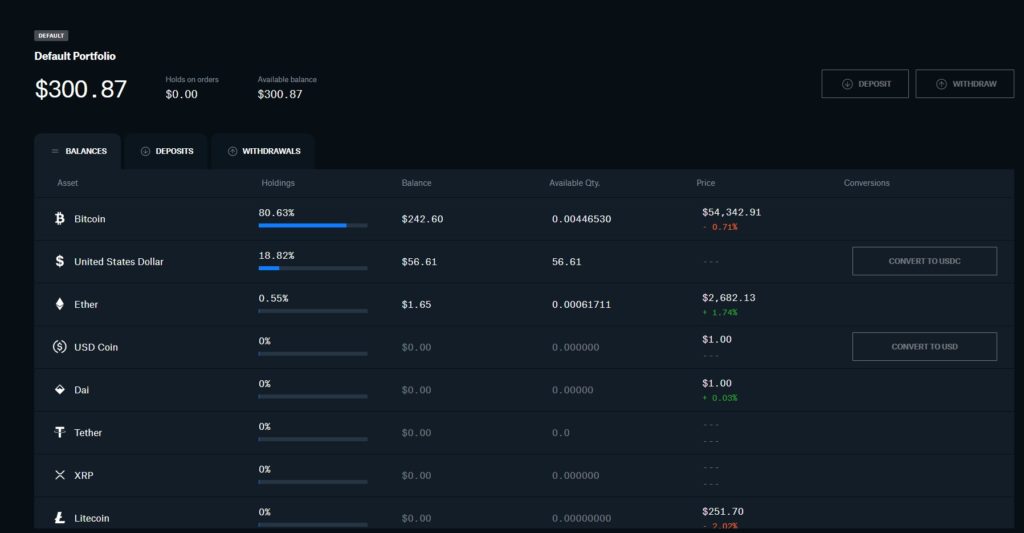

I started by putting 100$ into BTC. After a few moves, some dabbling with Etherium, and depositing more money, I was in about $300.

Now, despite my moves, I still stand at $300. To be fair, the last month or so, my strategy was to just sit and wait out the dips. To go at it from an “investor model.”

But with the rapid swings of cryptocurrencies, I’ve seen there are moves to be made. Dips to buy and peaks to sell.

So I’ll be taking a more active approach in the coming weeks and months. Though I’m assuredly no trading or crypto master, I like to learn. And I like to learn quickly. So as I start making more and more moves, they’ll be tracked. Hopefully for the purposes of learning from my own mistakes 😂