So you want to learn about candlestick patterns that show up during bearish continuation, huh?

Smart choice.

Identifying bearish continuation can help you find opportunities for winning trades. These patterns can help you do just that.

Bearish Continuation Candlestick Patterns

- Bearish In Neck

- Bearish Mat Hold

- Bearish On Neck

- Downside Tasuki Gap

- Falling Three Methods

- Falling Window

Identifying Bearish Candlestick Continuation Patterns

Candlestick patterns that signal bearish continuation are very distinct.

Not only do they signal that market conditions are likely to remain the same, they also imply a direction.

Of course, they do not guarantee that the downtrend is going to last. But do hint at more downward movement to come.

However, most candlestick patterns hover around a 50% hit rate. So they are not a “sure thing” by any means. Still, traders look for them for a reason.

Even when they fail, they can act as a indication of the opposite. That’s one reason why it is helpful to learn about all of the types of candlestick patterns—including bearish reversal patterns, bullish continuation patterns, and bullish reversal patterns.

More than anything, it might be best to look at them as points of interest.

Plus, learning about them increases your overall understanding of price action.

This is technical analysis, after all.

It may not be easy but it is lucrative.

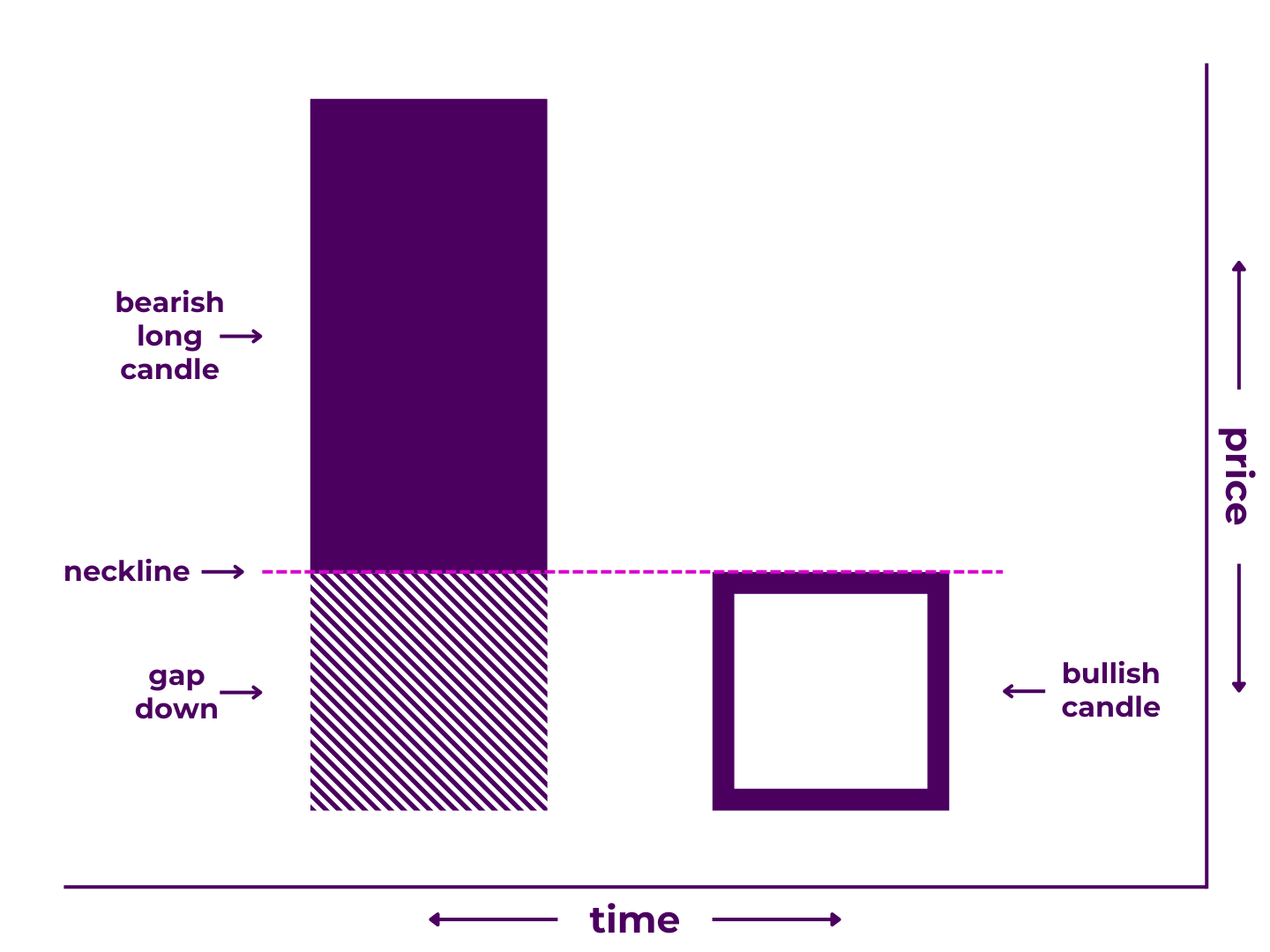

Bearish In Neck

A bearish in neck pattern is a 2-candlestick formation that may signal a bearish continuation.

It may appear in a downtrend and is made up of a large bearish candle followed by a gap down and smaller bullish candle that fills the gap and closes near the close of the first candle.

In trading terms:

- During the first period, price continued the pre-existing downtrend.

- The second period opened with a modest gap down but price moved back up, filled the gap, and closed at the same price as the first period.

Bearish in neck patterns show that the bears attempted to press their advantage on candle one and between candles one and two, but then allowed some reprieve by the end of candle two.

Pattern Type: Bearish Continuation

Number of Candlesticks: 2

Looks Like/Narrative Meaning: a pause in the action or rallying point

Technical Specifications***

Technically, a bearish in neck pattern must:

- Appear during a downtrend

- Begin with a bearish long candle

- Have a gap down after the first candle

- End with a bullish candle that fills the gap and closes even with the bottom of the first candle’s body

In practicality though, many traders will make various exceptions.

- The first candle doesn’t necessarily have to be a long candle, as long as its body is longer than the body of the second candle.

- The close of the second candle can be slightly above or below the close of the first candle.

- It can take two candles to fill the gap, as long as the combined body length of the second and third candles is shorter than the length of the first.

***Depending on who you ask, any of these standards may be more or less important. Moreover, some of these variations may be more properly classified as other bearish candlestick patterns.

Related Patterns

- Similar to Bearish Counterattack Lines Pattern

- Similar to Bearsih On Neck Pattern

- Subtype of In Neck Pattern

- Opposite of Bullish In Neck Pattern

For more detail, read our full breakdown on Trading Bearish In Neck Candlestick Patterns.

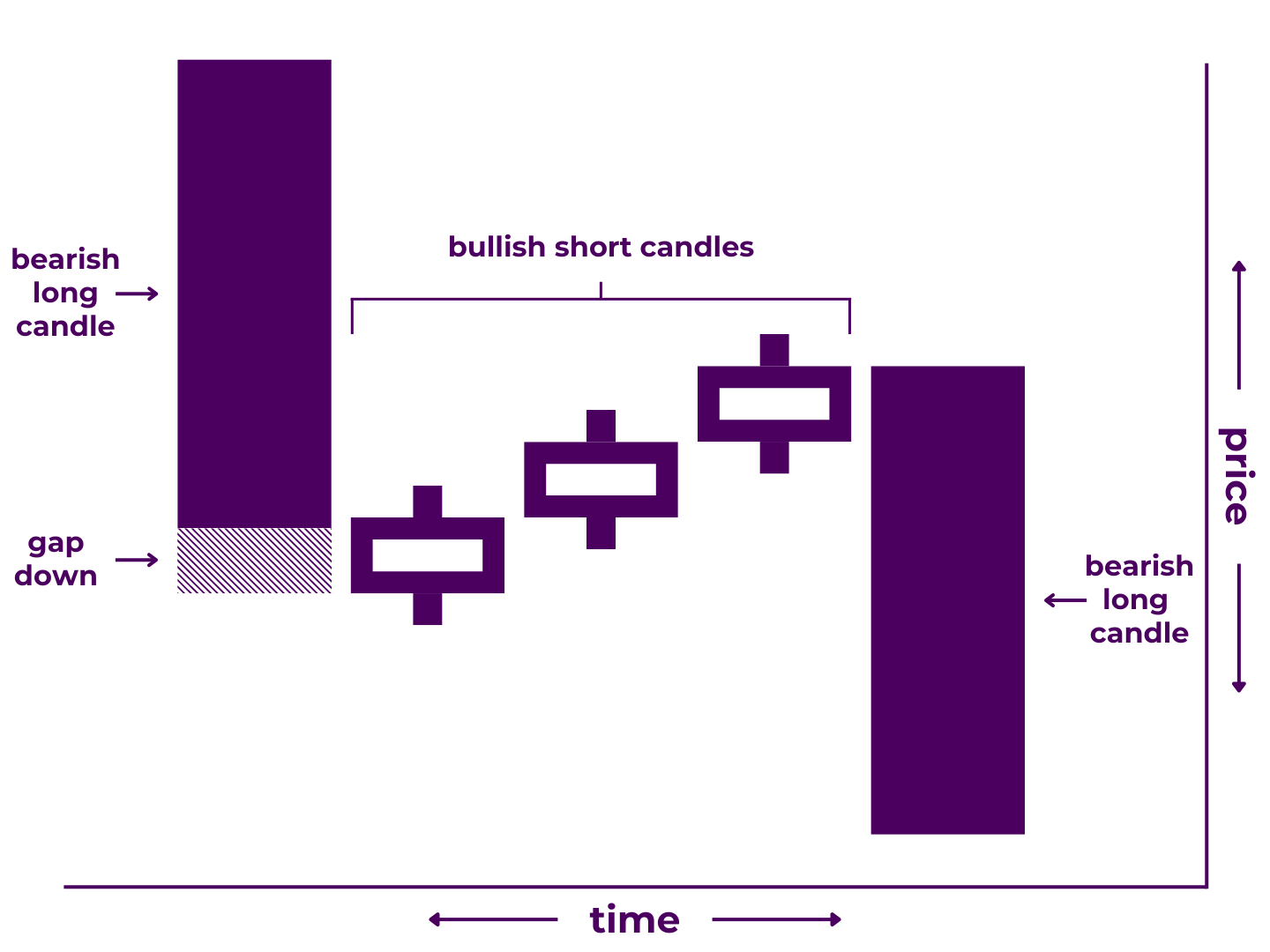

Bearish Mat Hold

A bearish mat hold pattern is a 5-candlestick formation that may signal a bearish continuation.

It may appear in a downtrend and is made up of a large bearish candlestick followed by a gap down and three smaller bullish (or neutral) candles that fill the gap but never close above the first candle’s open, then another large bearish candle that closes below all previous candles.

In trading terms:

- During the first period, price continued the pre-existing downtrend.

- The second period opened with a gap down that was filled over the course of the next three periods as price moved back up but never closed higher than the first period’s open.

- During the fifth period, price resumed downward movement and closed lower than any of the preceding four periods.

Bearish mat hold patterns show that the bears attempted to press their advantage on candle one (and between candles one and two), stalled for the next three candles, before finally regaining control and pressing trend further by the end of the fifth candle.

Pattern Type: Bearish Continuation

Number of Candlesticks: 5

Looks Like/Narrative Meaning: a one-sided beatdown or near-knockout blow

Technical Specifications***

Technically, a bearish mat hold pattern must:

- Appear during a downtrend

- Begin with a bearish long candle

- Have a gap down after the first candle that gets filled over the course of the next three candles

- Have three consecutive bullish (or neutral) short candlesticks after the first candlestick that never close above the open of the first candlestick

- End with another bearish long candlestick that closes below the body and wicks of all preceding candlesticks in the pattern

In practicality though, many traders will make various exceptions.

- The first candle doesn’t necessarily have to be a long candle, as long as its body is longer than candles two, three, and four.

- The middle three candles don’t necessarily have to be short candles, as long as all of them are shorter than candle one.

- One or more of the middle candles can be bearish, as long as the gap gets filled before the fifth candle begins.

- There can be more than three candles between the first and last candles, as long as the gap gets filled and none of the middle candles close outside the body of the first.

- The gap can go, especially in markets where gaps are less common, like cryptocurrency.

- The final candle doesn’t necessarily have to close below all of the wicks of the prior candles, as long it closes below their bodies.

***Depending on who you ask, any of these standards may be more or less important. Moreover, some of these variations may be more properly classified as other bearish candlestick patterns.

Related Patterns

- Similar to Falling Three Methods Pattern

- Subtype of Mat Hold Pattern

- Opposite of Bullish Mat Hold Pattern

For more detail, read our full breakdown on Trading Bearish Mat Hold Candlestick Patterns.

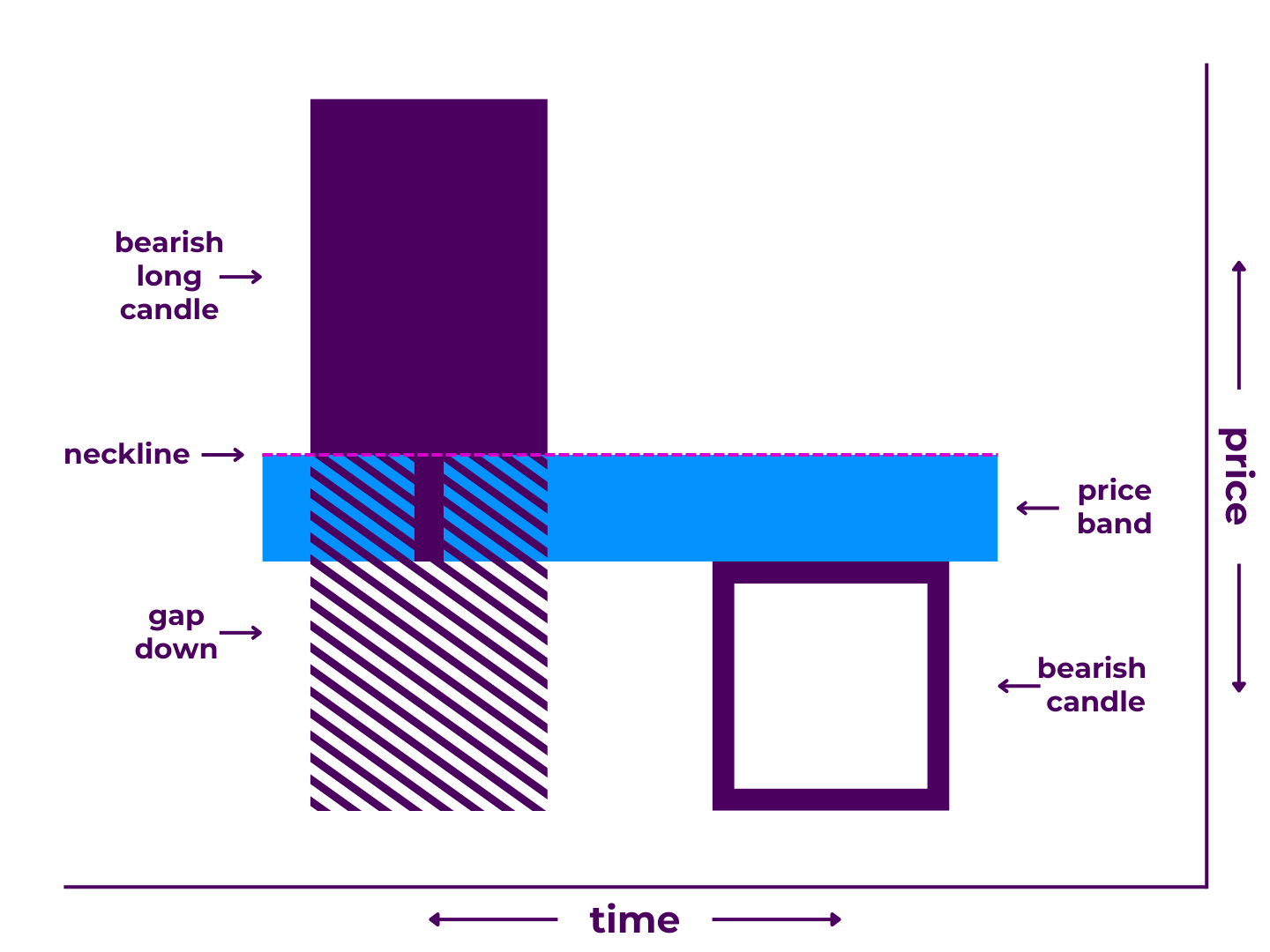

Bearish On Neck

A bearish on neck pattern is a 2-candlestick formation that may signal a bearish continuation.

It may appear in a downtrend and is made up of a large bearish candle followed by a gap down and a smaller bullish candle that partially fills the gap and closes near the low of the previous candle.

In trading terms:

- During the first period, price continued the pre-existing downtrend.

- The second period opened with a gap down below the first period’s low, then moved back up, partially filled the gap, and closed at the same price as the first period’s low.

Bearish on neck patterns show that the bears attempted to press their advantage on candle one and between candles one and two, then held their ground fairly well over the course of candle two.

Pattern Type: Bearish Continuation

Number of Candlesticks: 2

Looks Like/Narrative Meaning: “no man’s land” or a mustering line

Technical Specifications***

Technically, a bearish on neck pattern must:

- Appear during a downtrend

- Begin with a bearish long candle that has a lower wick, such as a bearish belt hold.

- Have a gap down after the first candle that exceeds the lower wick of the first candle

- End with a bullish candle that partially fills the gap and closes even with the lower wick of the first candle

In practicality though, many traders will make various exceptions.

- The first candle doesn’t necessarily have to be a long candle, as long as its body is longer than the body of the second candle.

- The first candle doesn’t necessarily have to have a lower wick, as long as there is a gap that is only partially filled by the next candle.

- The close of the second candle candle be slightly above or below the lower wick of the first candle, as long as it does not get too near the close of the first candle.

- It can take two candles to reach the lower wick of the first candle, as long as the combined body length of the second and third candles is shorter than the body of the first candle.

***Depending on who you ask, any of these standards may be more or less important. Moreover, some of these variations may be more properly classified as other bearish candlestick patterns.

Related Patterns

- Similar to Bearish Counterattack Lines Pattern

- Similar to Bearish In Neck Pattern

- Subtype of On Neck Pattern

- Opposite of Bullish On Neck Pattern

For more detail, read our full breakdown on Trading Bearish On Neck Candlestick Patterns.

Downside Tasuki Gap

A downside tasuki gap pattern is a 3-candlestick formation that may signal a bearish continuation.

It may appear during a downtrend and is made up of a large bearish candle, a gap down, and another large bearish candle, followed by a bullish candle that partially closes the gap between the first two.

In trading terms:

- During the first period, price continued the pre-existing downtrend.

- The second period opened with a gap down and continued driving downward.

- During the third period, price moved back up and closed somewhere in the middle of the gap.

Downside tasuki gap patterns show that the bears pressed their advantage on candle one, continued between candles one and two, continued further through the end of candle two, until finally suffering a relatively minor setback on candle three.

Pattern Type: Bearish Continuation

Number of Candlesticks: 3

Looks Like/Narrative Meaning: a momentary respite or an attempted counterattack

Technical Specifications***

Technically, a downside tasuki gap pattern must:

- Appear during a downtrend

- Begin with a bearish long candle

- Have a gap down after the first candle

- Have another bearish long candle after the gap

- End with a bullish long candle that partially fills the gap

In practicality though, many traders will make various exceptions.

- The first candle doesn’t necessarily have to be a long candle, as long as it is a candlestick that gives a strong bearish bias (such as a gravestone doji).

- The second candle doesn’t necessarily have to be a long candle, as long as it is bearish and does not fill the gap.

- The third candle doesn’t necessarily have to be a long candle, as long as it doesn’t fully fill the gap.

- The third candle doesn’t have to fill the gap at all, as long as it moves against trend.

- It can take multiple bullish candles to reach the gap, as long as all other criteria are met and the gap remains partially unfilled.

***Depending on who you ask, any of these standards may be more or less important. Moreover, some of these variations may be more properly classified as other bearish candlestick patterns.

Related Patterns

- Extension of Falling Window Pattern

- Subtype of Tasuki Gap Pattern

- Opposite of Upside Tasuki Gap Pattern

For more detail, read our full breakdown on Trading Downside Tasuki Gap Candlestick Patterns.

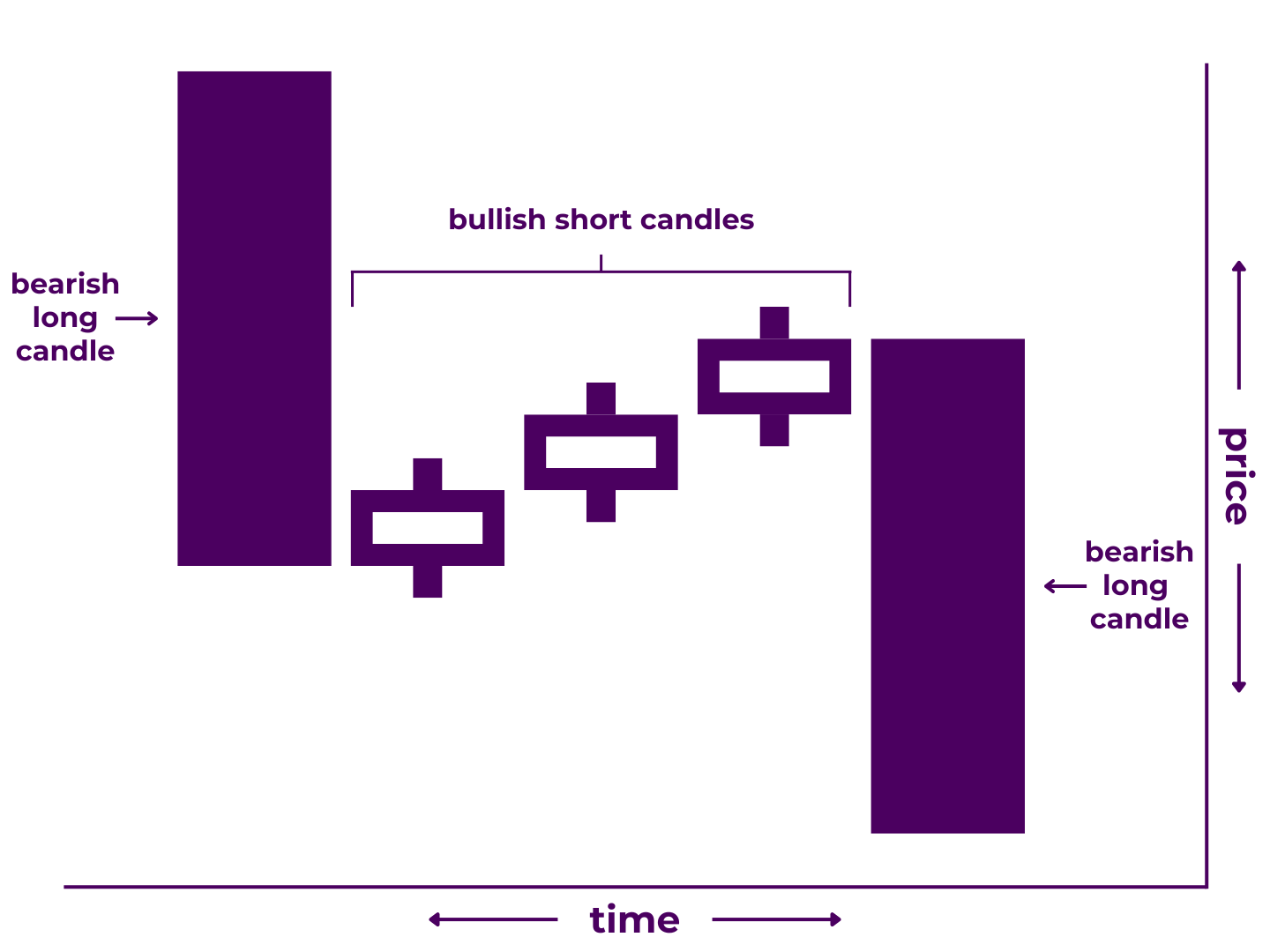

Falling Three Methods

A falling three methods pattern is a 5-candlestick formation that may signal a bearish continuation.

It may appear in a downtrend and is made up of a large bearish candlestick, three smaller bullish (or neutral) candles that never close above the first candle’s open, then another large bearish candle that closes below all previous candles.

In trading terms:

- During the first period, price continued the pre-existing downtrend.

- During the next three periods, price moved up but never closed higher than the first period’s open.

- During the fifth period, price resumed downward movement, and closed lower than any of the preceding four periods.

Falling three methods patterns show that the bears attempted to press their advantage on candle one, stalled for the next three candles, before finally regaining control and pressing trend further by the end of the fifth candle.

Pattern Type: Bearish Continuation

Number of Candlesticks: 5

Looks Like/Narrative Meaning: one-sided beatdown or near-knockout blow

Technical Specifications***

Technically, a falling three methods pattern must:

- Appear during a downtrend

- Begin with a bearish long candle

- Have three consecutive bullish (or neutral) short candlesticks after the first candlestick that never close above the open of the first candlestick

- End with another bearish long candlestick that closes below the body and wicks of all preceding candlesticks in the pattern

In practicality though, many traders will make various exceptions.

- The first candle doesn’t necessarily have to be a long candle, as long as its body is longer than candles two, three, and four.

- The middle three candles don’t necessarily have to be short candles, as long as all of them are shorter than candle one.

- One or more of the middle candles can be bearish, as long as all of them close within the range of candle one.

- There can be more than three candles between the first and last candles, as long as none of the middle candles close outside the body of the first.

- The final candle doesn’t necessarily have to close below all of the wicks of the prior candles, as long it closes below their bodies.

***Depending on who you ask, any of these standards may be more or less important. Moreover, some of these variations may be more properly classified as other bearish candlestick patterns.

Related Patterns

- Similar to Bearish Mat Hold Pattern

- Subtype of Three Methods Pattern

- Opposite of Rising Three Methods Pattern

For more detail, read our full breakdown on Trading Falling Three Methods Candlestick Patterns.

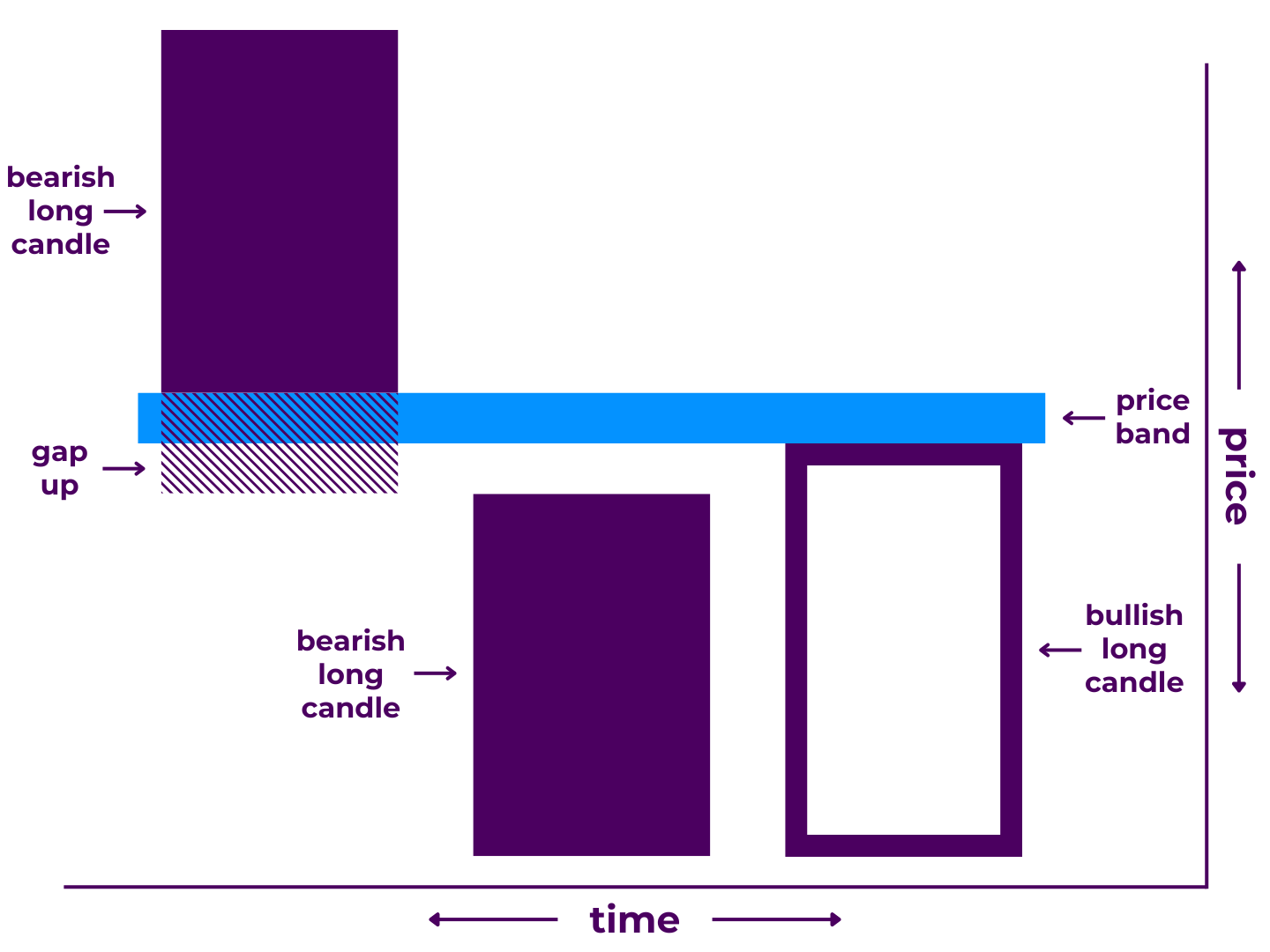

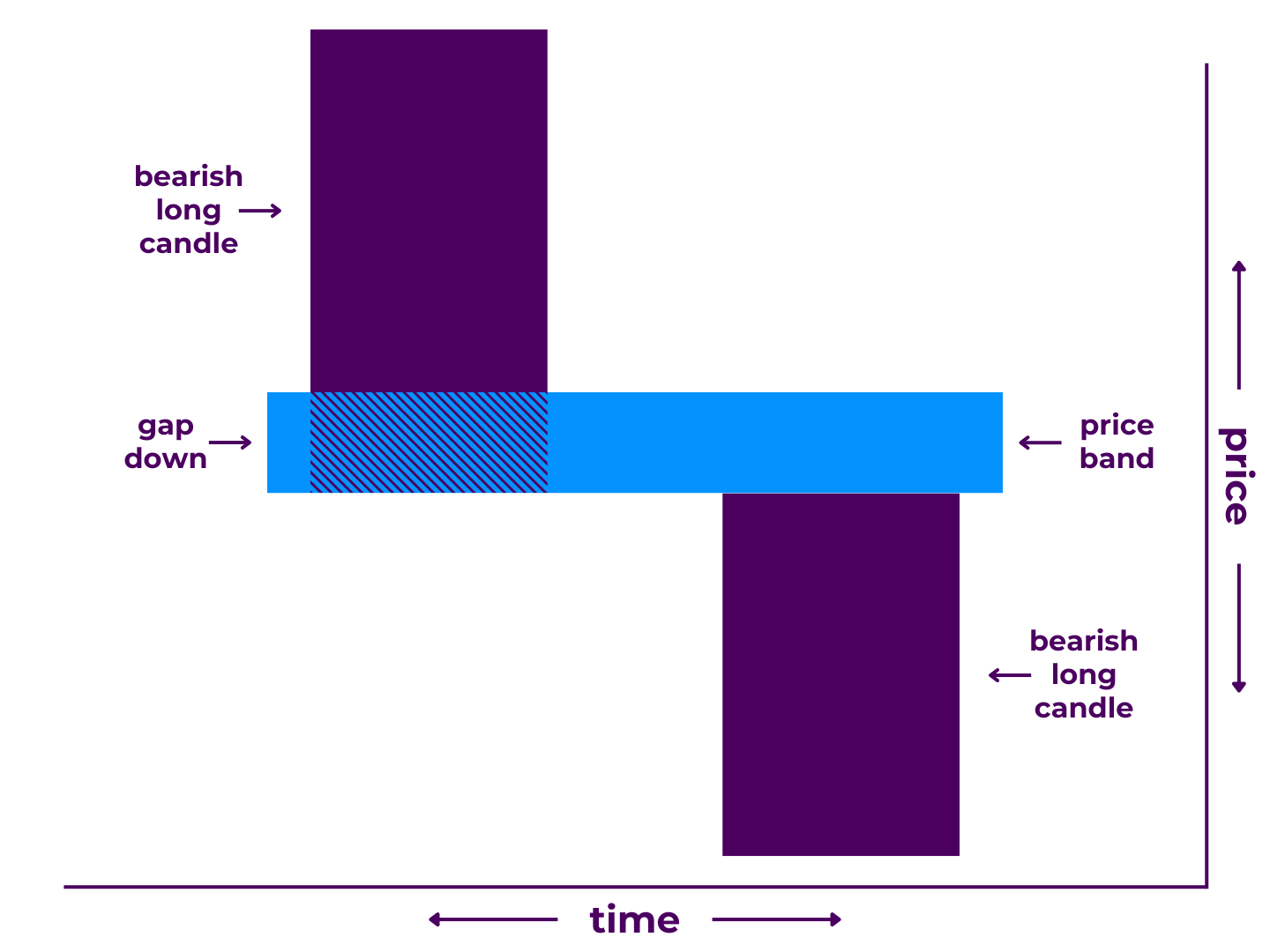

Falling Window

A falling window pattern is a 2-candlestick formation that may signal a bearish continuation.

It may appear during a downtrend and is made up of two large bearish candles with a gap between them.

In trading terms:

- During the first period, price continued the pre-existing downtrend.

- The second period opened with a gap down and continued driving downward.

Falling window patterns show that the bears pressed their advantage on candle one, continued between candles one and two, and continued further through the end of candle two.

Pattern Type: Bearish Continuation

Number of Candlesticks: 2

Looks Like/Narrative Meaning: a runaway train or uncontested offensive

Technical Specifications***

Technically, a falling window pattern must:

- Appear during a downtrend

- Begin with a bearish long candle

- Have a gap down after the first candle

- End with another bearish long candle

In practicality though, many traders will make various exceptions.

- The first candle doesn’t necessarily have to be a long candle, as long as it is a candlestick that gives a strong bearish bias (such as a gravestone doji).

- The second candle doesn’t necessarily have to be a long candle, as long as it is bearish and does not fill the gap.

***Depending on who you ask, any of these standards may be more or less important. Moreover, some of these variations may be more properly classified as other bearish candlestick patterns.

Related Patterns

- Precursor of Falling Tasuki Gap Pattern

- Subtype of Window Pattern

- Opposite of Rising Window Pattern

For more detail, read our full breakdown on Trading Falling Window Candlestick Patterns.

Takeaways

As you can see, there are many different bearish candlestick continuation patterns.

Luckily, you don’t have to memorize them all to become a successful trader. Learning the principles of price action and technical analysis are far more important. However, studying candlestick patterns is one of the best ways to do so.

In the end, understanding candle patterns is but one piece of the trading puzzle. You’ll need more weapons at your disposal to understand how to win the battle of the charts. Still, by learning the different types of candlestick patterns, you’re one step closer to creating a complete trading strategy.

Know of an important candlestick pattern we missed? Have some special insight into trading a specific pattern? Contribute to the conversation in the comments below! Or, share this post with a trader it might help. And if you haven’t already, check out our Candlestick Patterns Guide to learn the best ways to trade candlestick patterns.

0 Comments