So you want to learn about candlestick gap patterns, huh?

Smart choice.

Recognizing different types of candlestick patterns is a useful skill all traders should master.

Here, we will go over the top 12 candlestick patterns with gaps.

- Abandoned Baby

- Counterattack Line

- Engulfing

- Harami

- Harami Cross

- In Neck

- Mat Hold

- On Neck

- Tasuki Gap

- Three Inside

- Three Outside

- Window

Identifying Candlestick Patterns with Gaps

Many of the most well-known candlestick patterns have gaps.

We’re not 100% why there are so many patterns that include gaps. But if we had to guess, it probably has something to do with gaps being more common in traditional markets. This simply means that there is a lot of manpower devoted to interpretation of price action that includes gaps.

Regardless, they basically work like any other candlestick pattern. They may have two candlesticks, three candlesticks, or five candlesticks. Some are reversal patterns while others are continuation patterns.

None guarantee future outcomes but instead represent the past.

The only significant differences between candlestick patterns without gaps are:

- Patterns with gaps are more likely to occur in traditional markets.

- Candlestick patterns without gaps have slightly more straightforward criteria.

Either way, it is crucial to wait for the full pattern to complete before you give it any weight. It’s quite common for a group of candlesticks to begin to form a recognizable pattern only for the final candle to break the formation. So always wait for the final candle to close before you label any group of candlesticks a “pattern.”

Furthermore, experienced traders use additional points of confirmation for a signal before making any trading decisions. Oftentimes, candlestick patterns are better suited as final confirmation for the reversal or continuation.

Still, you have to learn to see them if you’re ever going to be able to use them.

Here are the top 12 of the most well-known candlestick patterns with gaps in alphabetical order:

Abandoned Baby

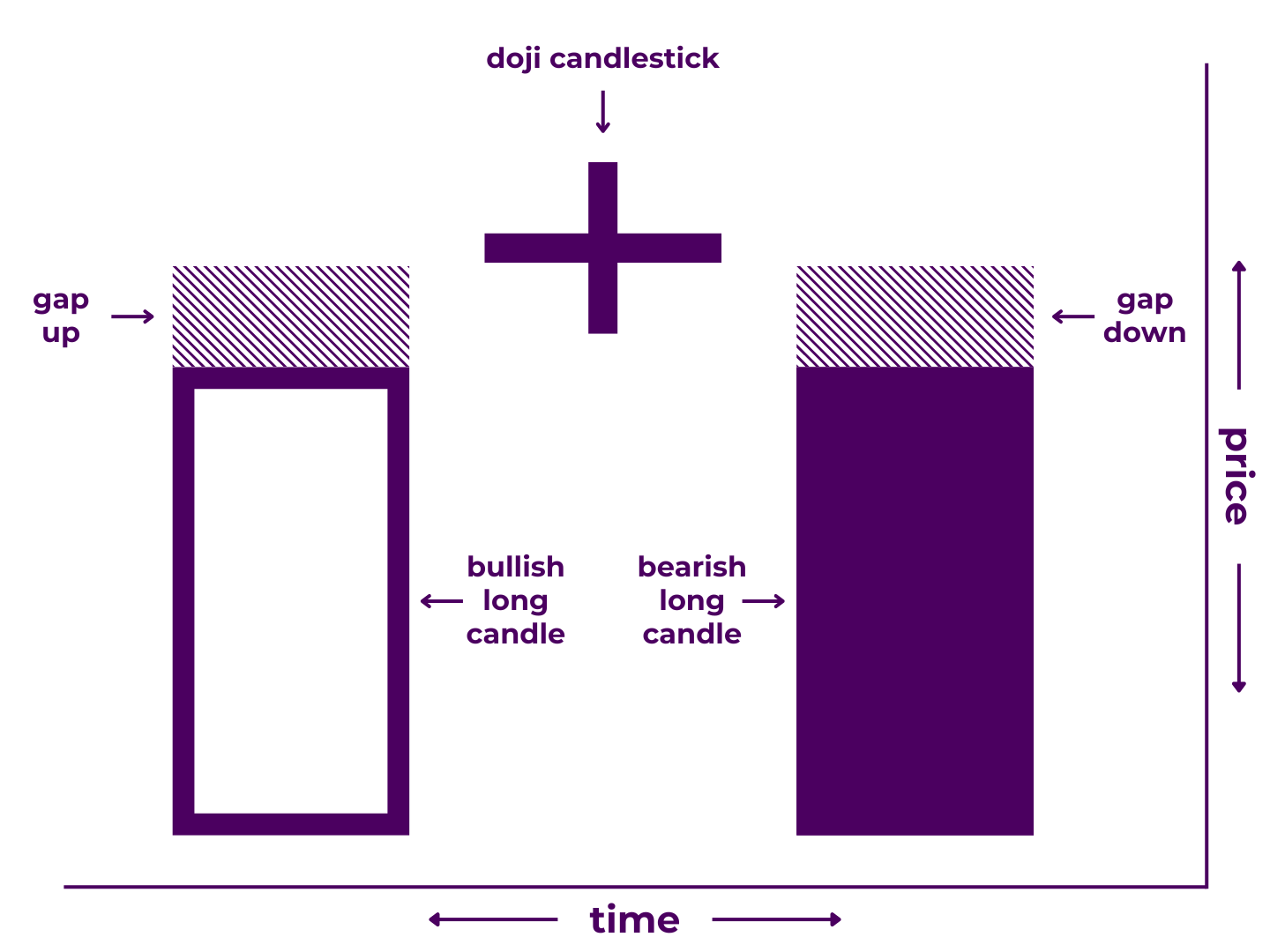

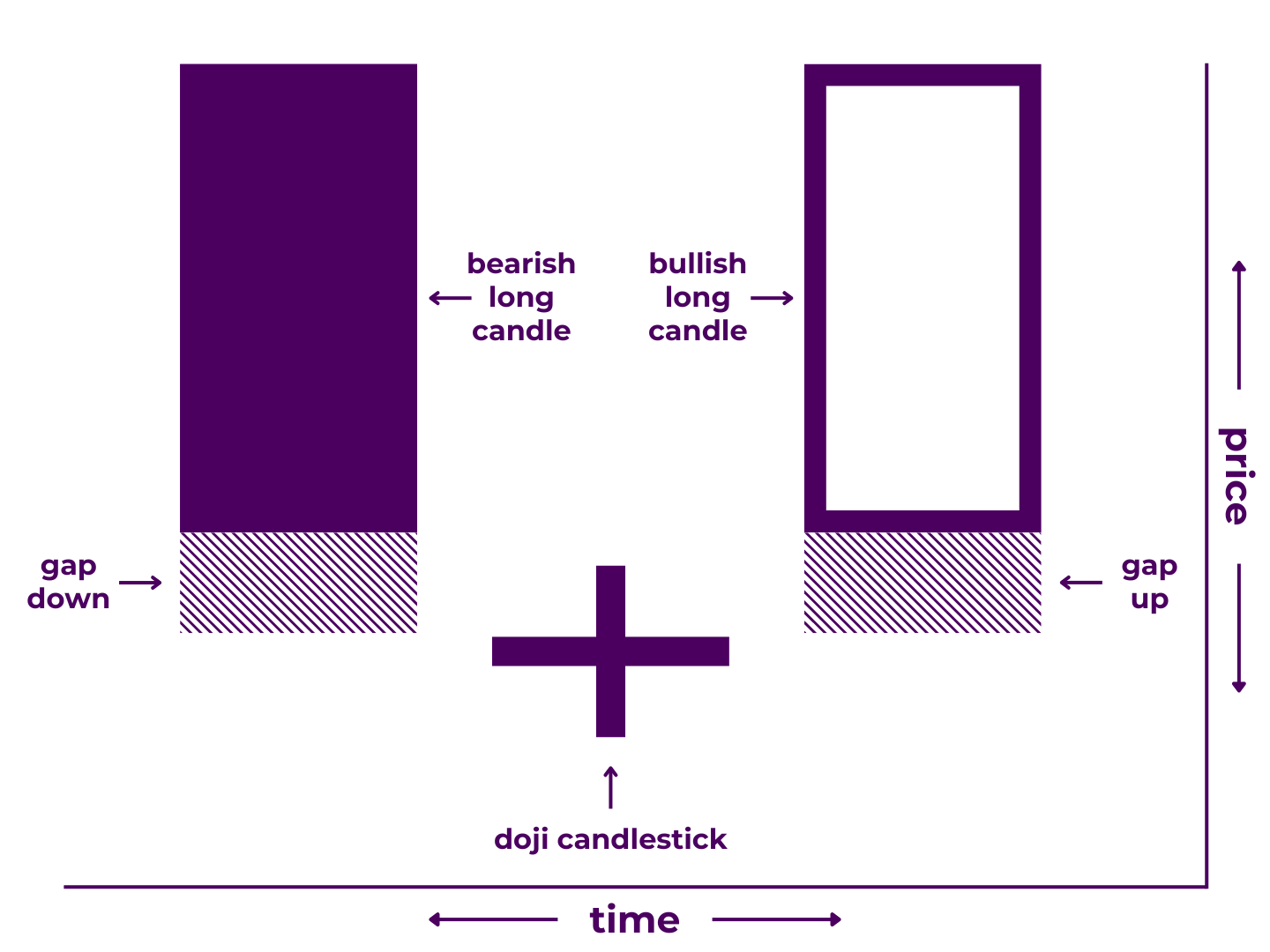

An abandoned baby pattern is a 3-candlestick formation that may signal a reversal.

It is made up of a large candle moving in the direction of current trend, a doji that gaps, and another large candle that gaps and moves in the opposite direction of the first (and trend).

It comes in both bearish and bullish variations.

Bearish ones look like this:

Bullish ones look like this:

In trading terms:

- During the first period, the price drove strongly in the same direction as the overall trend.

- The second period opened with a gap, after which neither the bulls nor the bears were able to maintain control.

- The third period opened with another gap then price drove strongly in the opposite direction of the first period and trend.

Abandoned baby patterns show that one side attempted to press their advantage on candle one, stalled on candle two, and finally surrendered all the momentum on candle three.

Pattern Type: Reversal

Number of Candlesticks: 3

Looks Like/Narrative Meaning: U-turn or counterpunch

Technical Specifications***

Technically, an abandoned baby pattern must:

- Begin with a long candle moving with trend

- End with a candle of similar size moving against trend

- Have a doji as the second candle

- Have a gap before and after the doji

Potential exceptions:

- The first and third candles can be different lengths, as long as they are both long line candles and/or test important price levels.

- The second candle doesn’t necessarily have to be a doji, as long as it is a short line candle.

- The gaps can go, especially in markets where gaps are less common like cryptocurrency.

- There can be more than one doji (or short candle) between the first and final candlestick.

***Depending on who you ask, any of these standards may be more or less important. Moreover, some of these variations may be more properly classified as other reversal candlestick patterns.

Related Patterns:

- Similar to Doji Star Pattern

- Similar to Star Pattern

For more detail, read our full breakdown on How to Trade Abandoned Baby Candlestick Patterns.

Counterattack Line

A counterattack line pattern is a 2-candlestick formation that may signal a reversal.

It is made up of a long candle moving in the direction of current trend followed by a second candle that opens with a gap that then moves in the opposite direction, filling the gap to close near the first candle’s close.

It comes in both bearish and bullish variations.

Bearish ones look like this:

Bullish ones look like this:

In trading terms:

- During the first period, the price drove in the direction of trend.

- The second period opens with a gap but price moves against trend, immediately filling the gap, ending with a similar close to the following period.

Counterattack line patterns show that one side attempted to press their advantage on candle one, continued to do so between candles, but then lost all momentum by the close of candle two.

Pattern Type: Reversal

Number of Candlesticks: 2

Looks Like/Narrative Meaning: a turning point or drawing of battle lines

Technical Specifications***

Technically, a counterattack line pattern must:

- Begin with a long candle moving with trend

- End with a candle of similar size moving against trend

- Completely fill the gap after the first period

In practicality though, many traders will make various exceptions.

- The candles don’t necessarily have to be long candles, as long as they are the same size.

- The candles don’t necessarily have to be the same size, as long as they are long candles.

- It can take two candles to fill the gap, as long as the combined length of the second and third candles equals the length of the first.

***Depending on who you ask, any of these standards may be more or less important. Moreover, some of these variations may be more properly classified as other reversal candlestick patterns.

Related Patterns:

- Similar to In Neck Pattern

- Similar to On Neck Pattern

For more detail, read our full breakdown on How to Trade Counterattack Lines Candlestick Patterns.

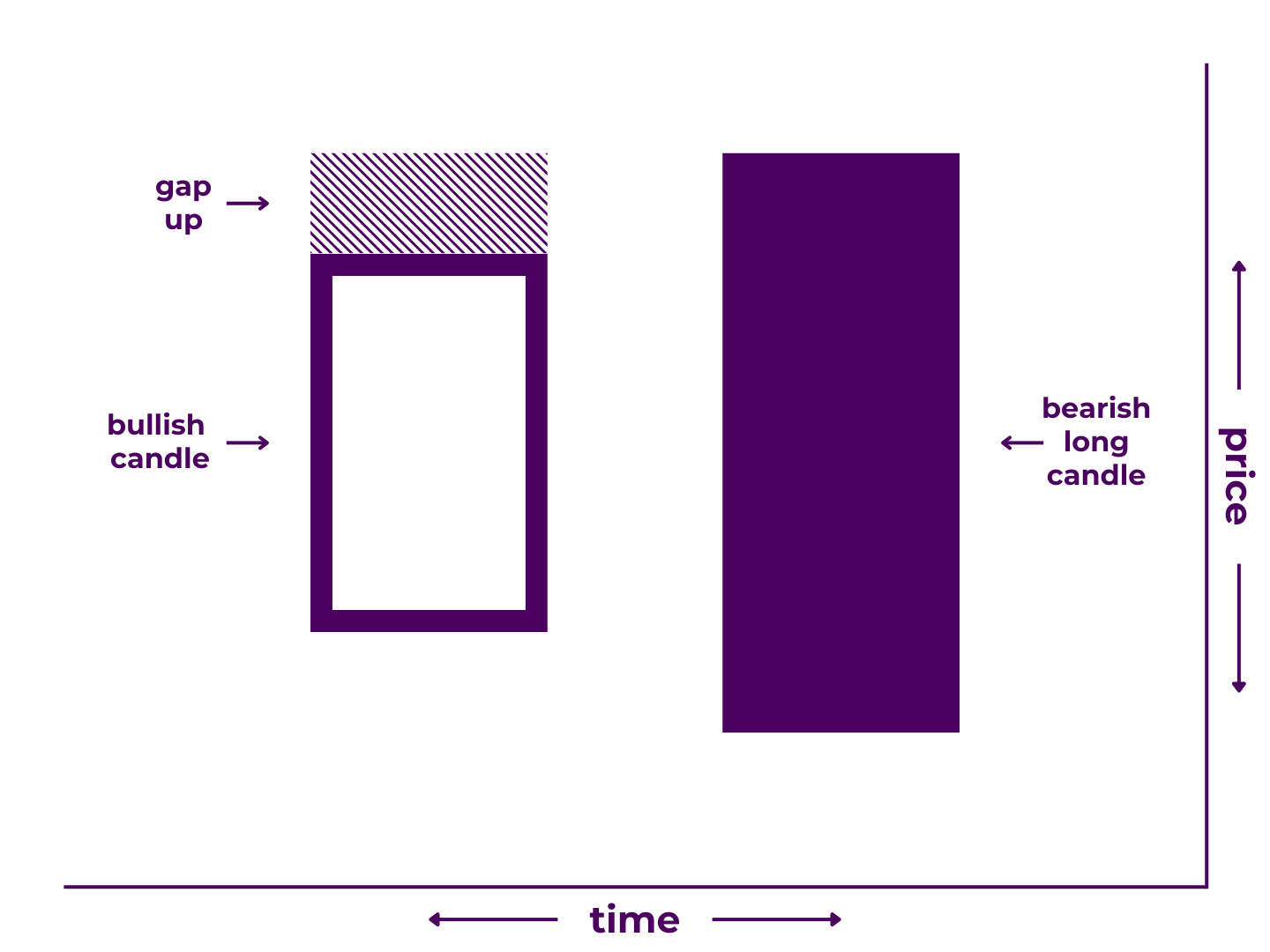

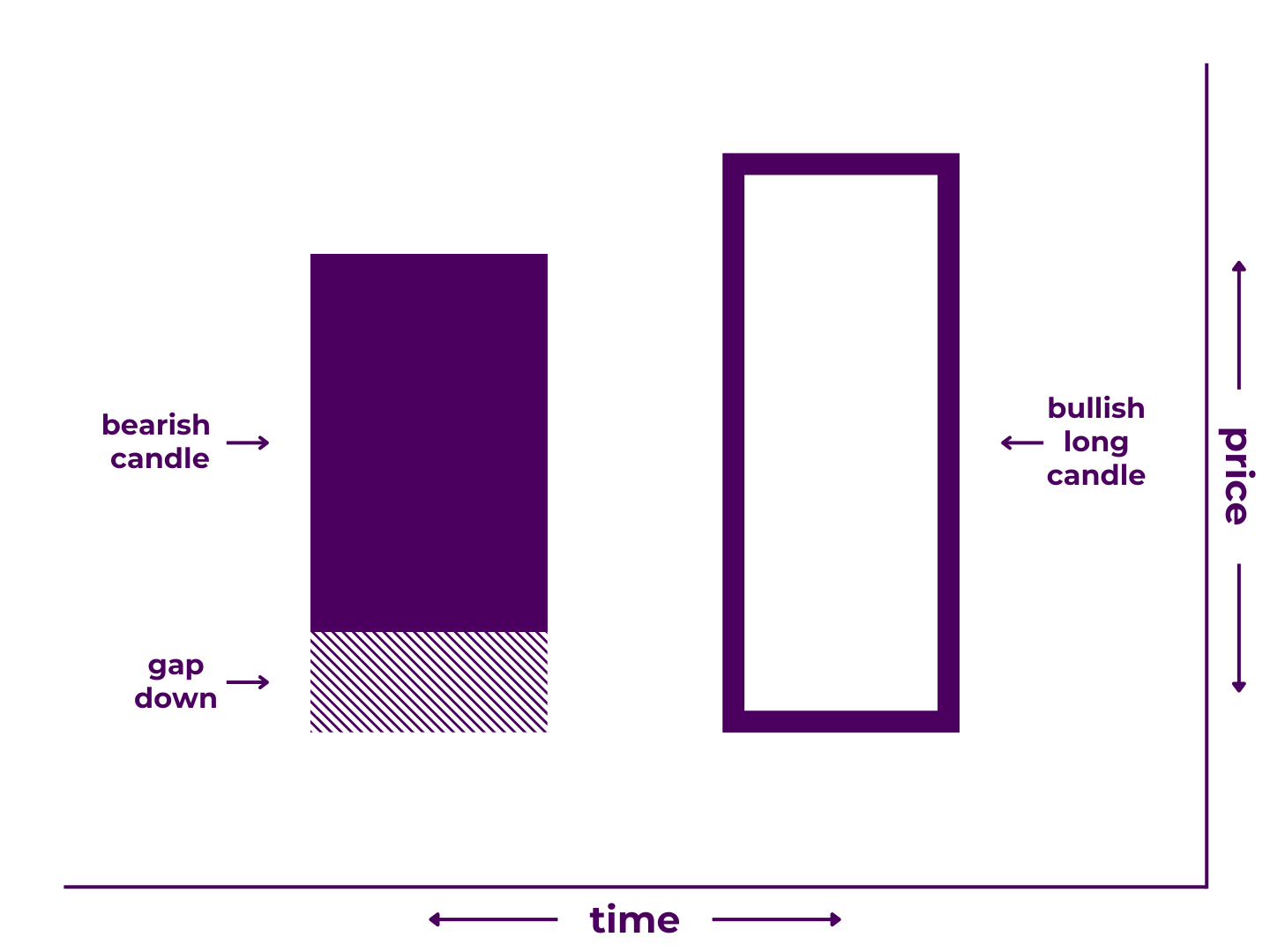

Engulfing

An engulfing candlestick pattern is a 2-candlestick formation that may signal a reversal.

It is made up of one candle moving in the direction of current trend followed by a second candle that opens and closes above and below that of the first candle, or vice versa.

It comes in both bearish and bullish variations.

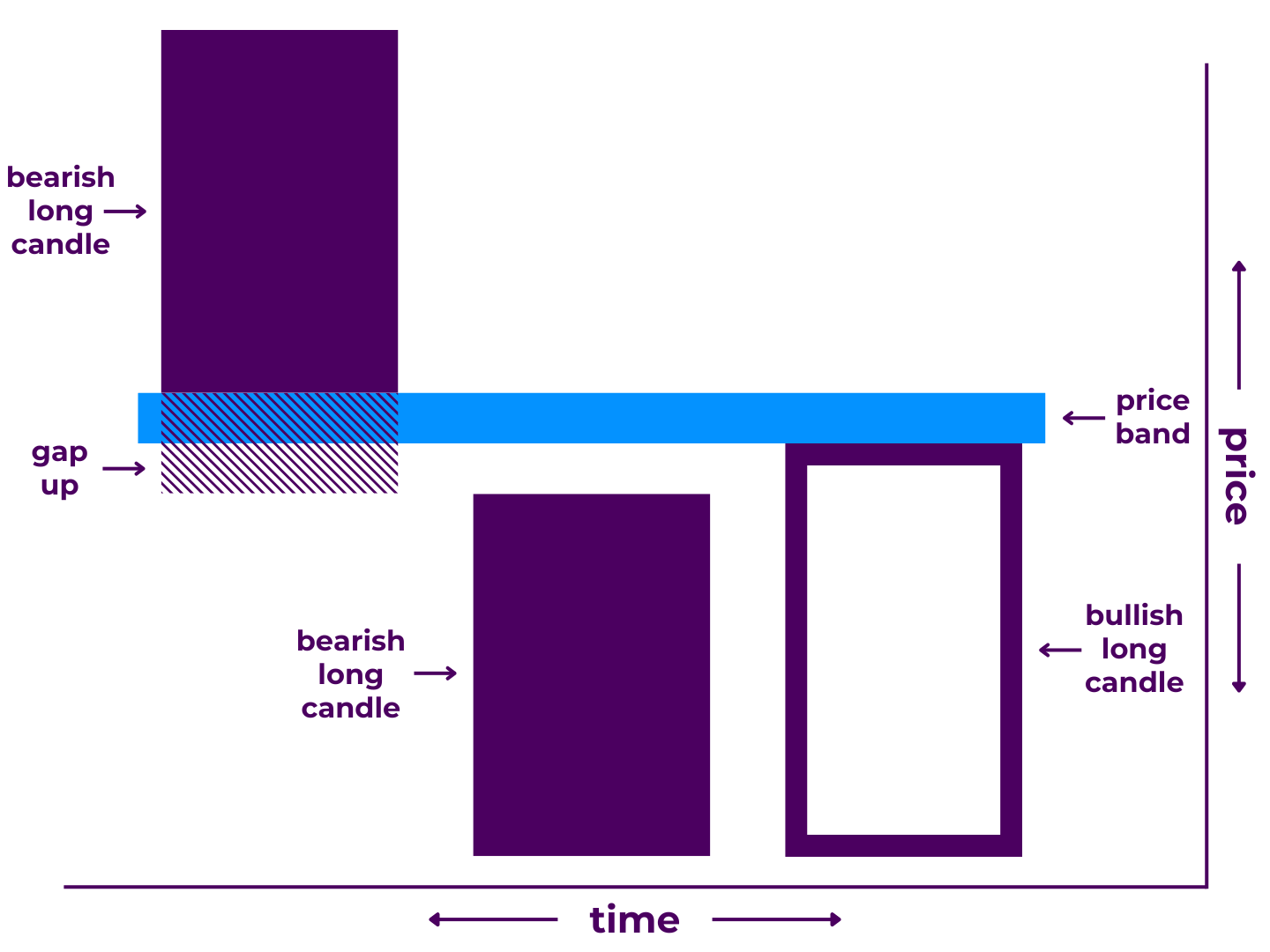

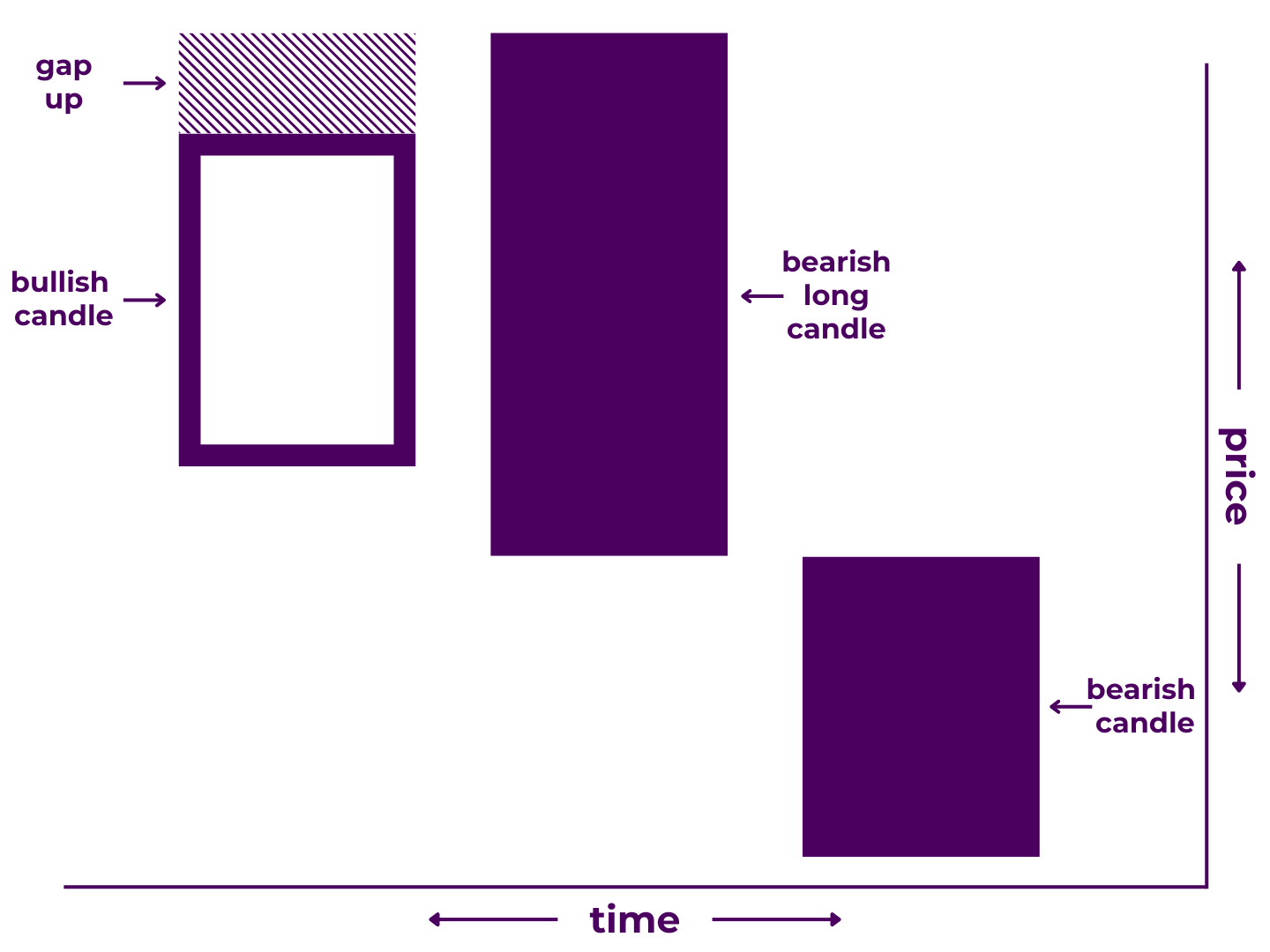

Bearish ones look like this:

Bullish ones look like this:

In trading terms:

- During the first period, price continued the ongoing trend.

- The second period opens with a gap in the direction of trend that is quickly filled as price proceeds to reclaim all the ground from the first day and then some, closing outside the open and close of the previous candle.

Engulfing candlestick patterns show that the momentum fizzled out on candle one, demonstrated by a counter-trend move on candle two.

Pattern Type: Reversal

Number of Candlesticks: 2

Looks Like/Narrative Meaning: dam break or counterpunch

Technical Specifications***

Technically, an engulfing candle pattern must:

- Begin with a candle moving in the direction of trend

- End with a candle of greater size moving against trend

- Have the first candle’s body contained completely within the body of the second

In practicality though, many traders will make various exceptions.

- The first candle can be a neutral candle (ie. a doji), as long as it is fully contained within the body of the second.

- The first candle can move against trend, as long as it is fully contained within the body of the second.

- The open of the second candle can be even with the close of the first candle, especially in markets where gaps are less common like cryptocurrency.

***Depending on who you ask, any of these standards may be more or less important. Moreover, some of these variations may be more properly classified as other reversal candlestick patterns.

Related Patterns

- Precursor of Three Outside Pattern

For more detail, read our full breakdown on How to Trade Engulfing Candlestick Patterns.

Harami

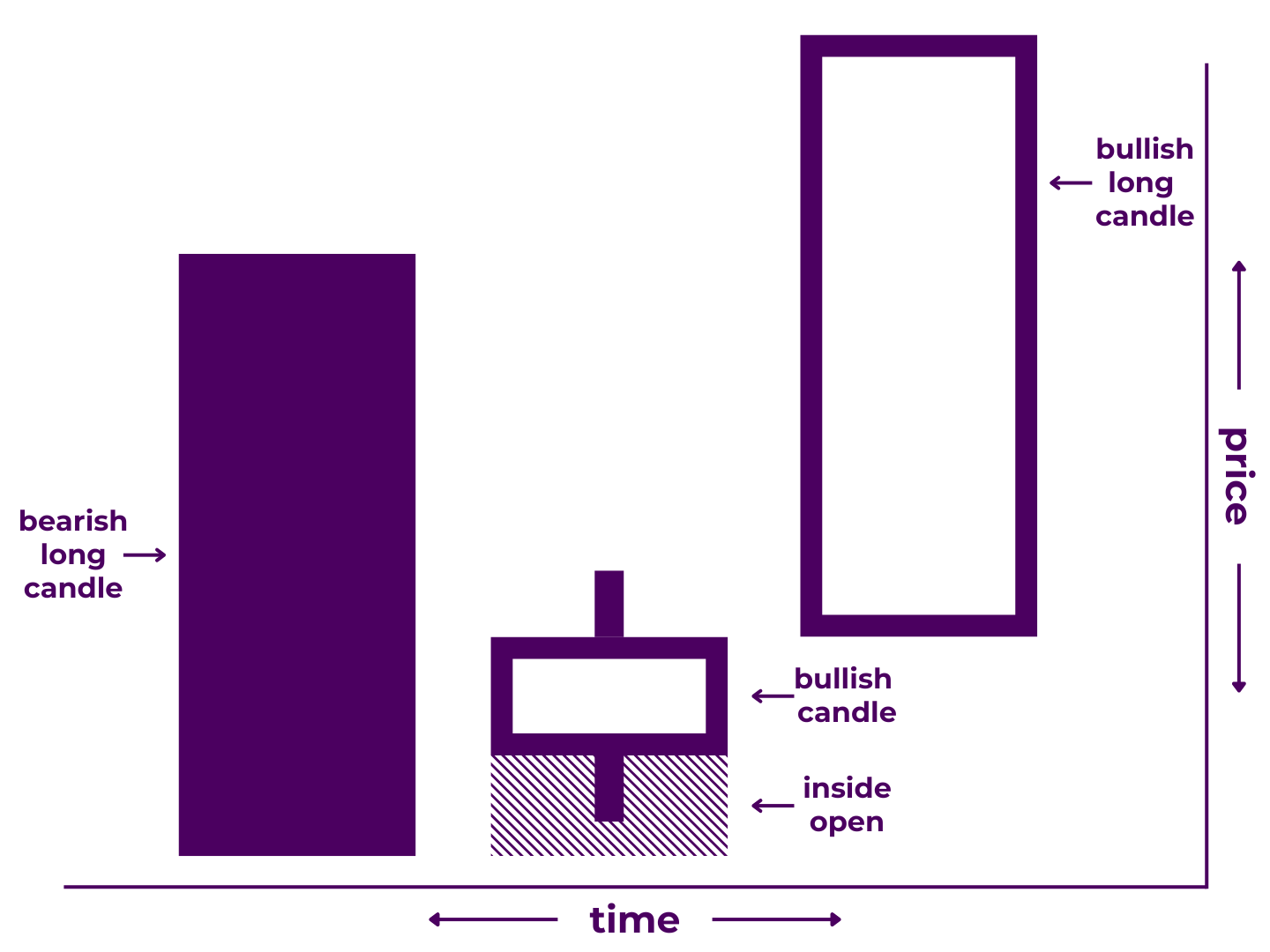

A harami pattern is a 2-candlestick formation that may signal a reversal.

It is made up of a long candle moving in the direction of current trend followed by a small candle moving in the opposite direction. The trading range of the second candle must be completely contained within that of the first.

It comes in both bearish and bullish variations.

Bearish ones look like this:

Bullish ones look like this:

In trading terms:

- During the first period, price continued the ongoing trend.

- Before the second period opened, price moved against the trend, opening within the range of the prior candle body.

- During the second period, price moved against trend to a modest degree, closing within the range of the prior candle body.

Harami patterns show that one side attempted to press their advantage on candle one, lost momentum between candles, and fully stalled out by the close of candle two.

Pattern Type: Reversal

Number of Candlesticks: 2

Looks Like/Narrative Meaning: birth of a counter-trend or counter-trend incubator

Technical Specifications***

Technically, a harami pattern must:

- Begin with a long candle moving with trend

- End with a short candle moving slightly against trend

- Have the second candle’s body and wicks contained completely within the body of the first

In practicality though, many traders will make various exceptions.

- The first candle doesn’t have to be a long candle, as long as it contains the second candle and moves in the direction of trend.

- The second candle doesn’t have to move against trend as long as it is neutral and/or very small.

- The second candle’s wick doesn’t have to be contained within the body of the first, as long as its body is.

- The open of the second candle can be even with the close of the first candle, especially in markets where gaps are less common like cryptocurrency.

- If additional, consecutive candles after the second candle remain contained within the body of the first candle, all would be included in the harami pattern.

***Depending on who you ask, any of these standards may be more or less important. Moreover, some of these variations may be more properly classified as other reversal candlestick patterns.

Related Patterns

- Similar to Harami Cross Pattern

- Precursor of Three Inside Pattern

For more detail, read our full breakdown on How to Trade Harami Candlestick Patterns.

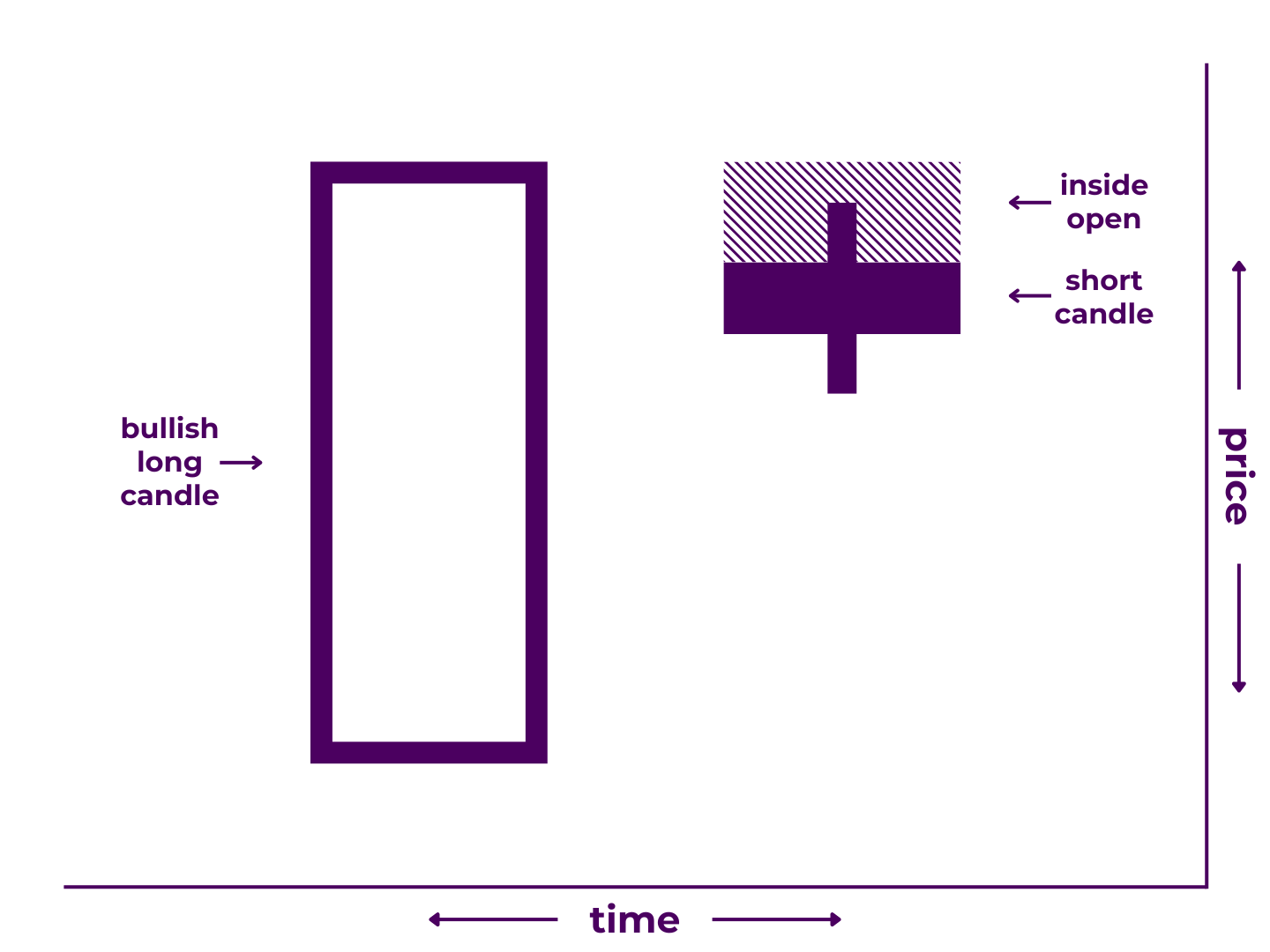

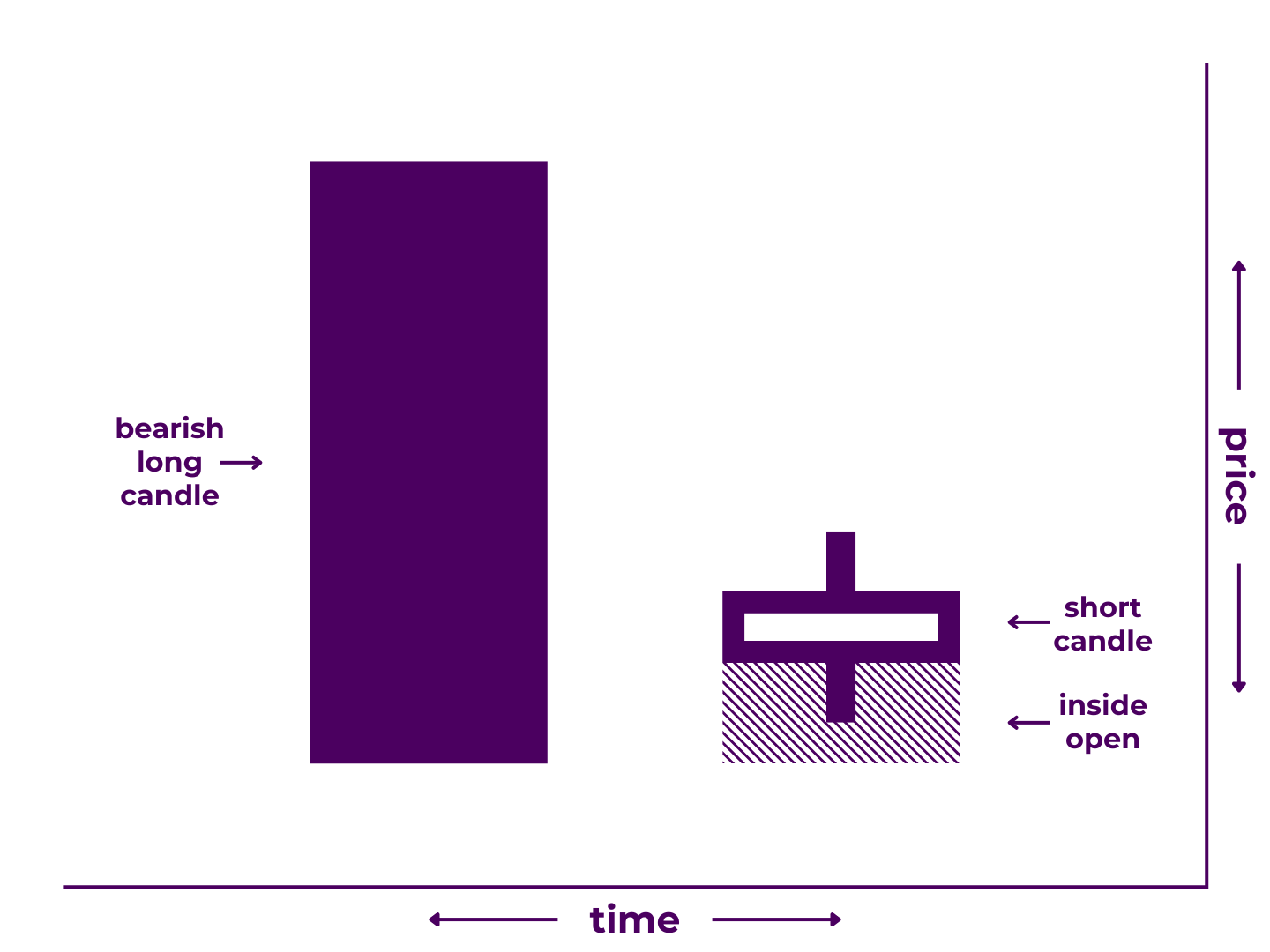

Harami Cross

A harami cross pattern is a 2-candlestick formation that may signal a reversal.

It is made up of a long candle moving in the direction of current trend followed by a doji candlestick. The trading range of the second candle must be completely contained within that of the first.

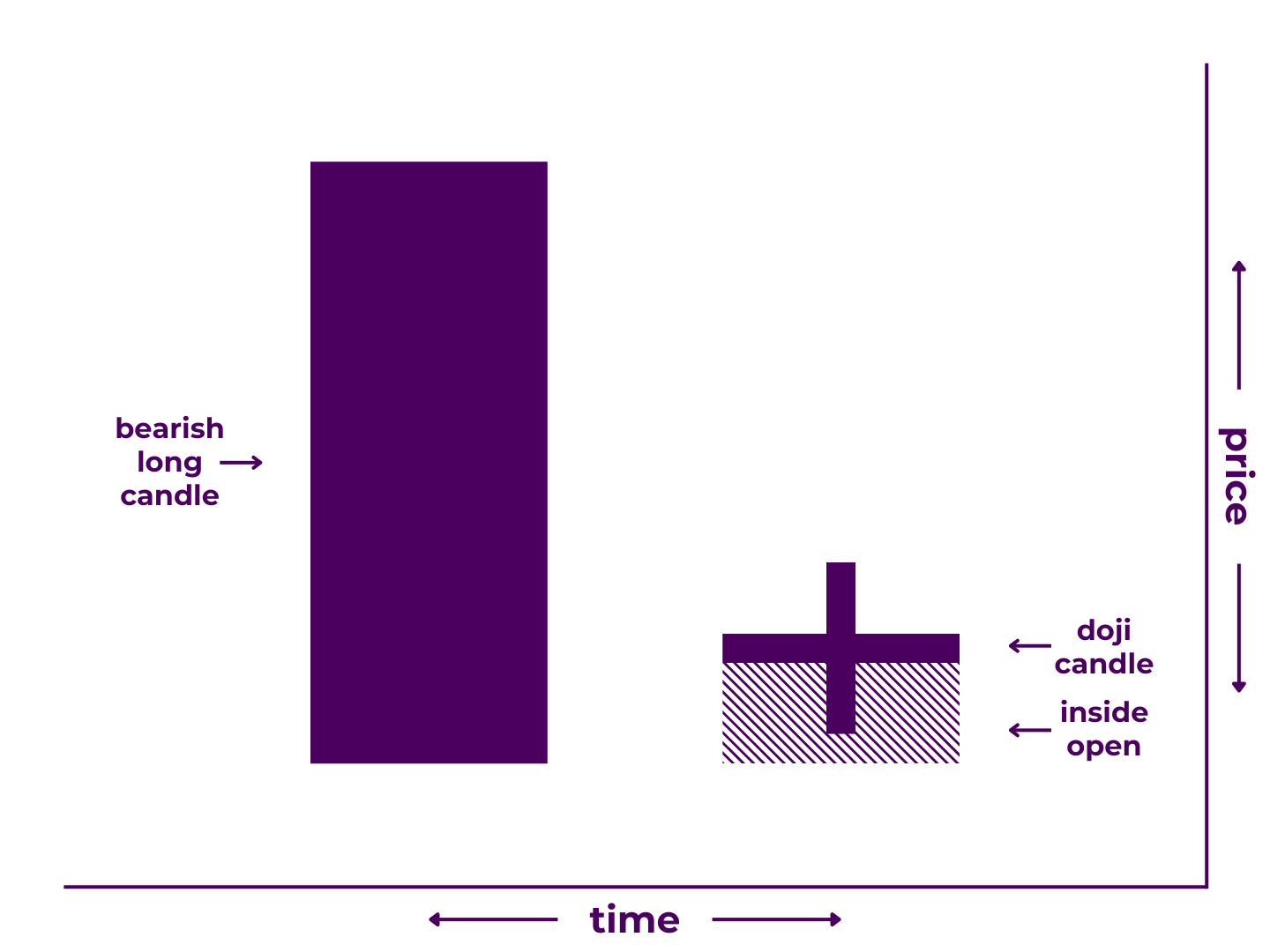

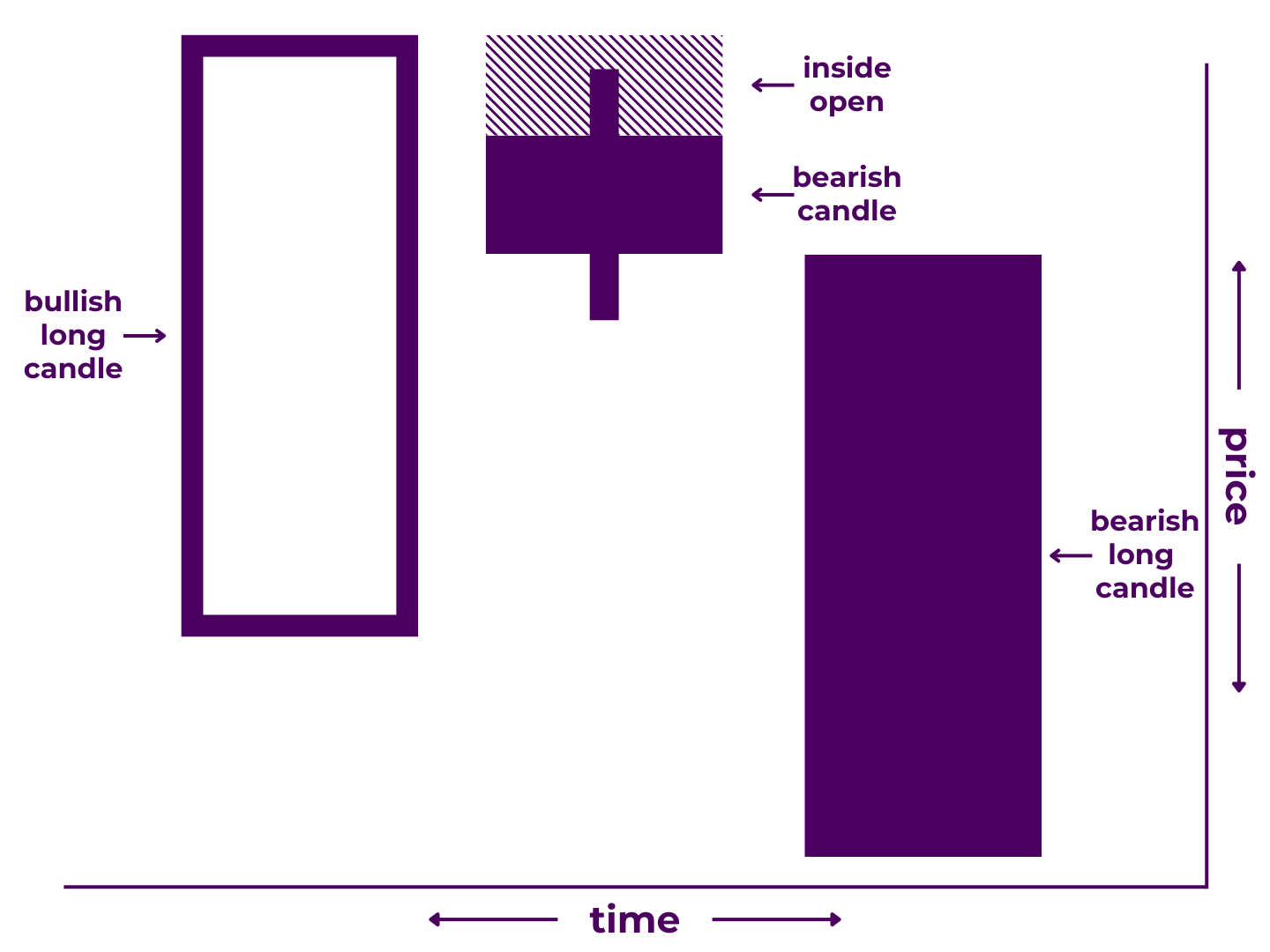

It comes in both bearish and bullish variations.

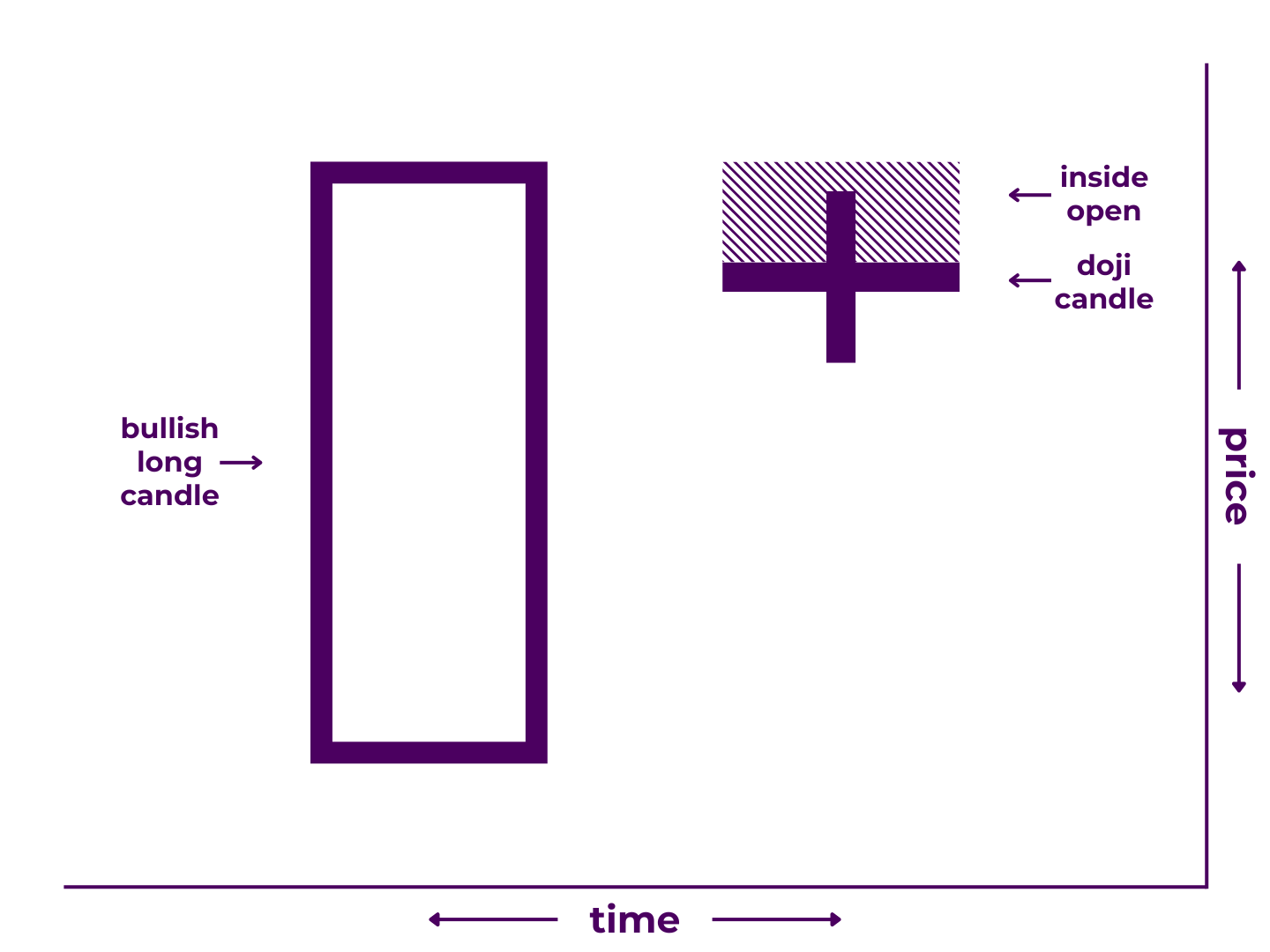

Bearish ones look like this:

Bullish ones look like this:

In trading terms:

- During the first period, price continued the ongoing trend.

- Before the second period opened, price moved against the trend, opening within the range of the prior candle body.

- During the second period, price stayed within the range of the prior candle body and closed at (or very near to) the open.

Harami cross patterns show that one side attempted to press their advantage on candle one, lost momentum between candles, and fully stalled out by the close of candle two.

Pattern Type: Reversal

Number of Candlesticks: 2

Looks Like/Narrative Meaning: birth of a counter-trend or counter-trend incubator

Technical Specifications***

Technically, a harami cross pattern must have:

- Begin with a long candle moving with trend

- End with a doji candlestick

- Have the second candle’s body and wicks contained completely within the body of the first

In practicality though, many traders will make various exceptions.

- The first candle doesn’t have to be a long candle, as long as it contains the second candle and moves in the direction of trend.

- The second candle’s wicks don’t have to be contained within the body of the first, as long as the open and close are.

- The open and close of the second candle can be even with the close of the first candle, especially in markets where gaps are less common like cryptocurrency.

- If additional, consecutive doji after the second candle remain contained within the body of the first candle, all would be included in the harami pattern.

***Depending on who you ask, any of these standards may be more or less important. Moreover, some of these variations may be more properly classified as other reversal candlestick patterns.

Related Patterns

- Similar to Harami Pattern

- Precursor of Three Inside Pattern

For more detail, read our full breakdown on How to Trade Harami Cross Candlestick Patterns.

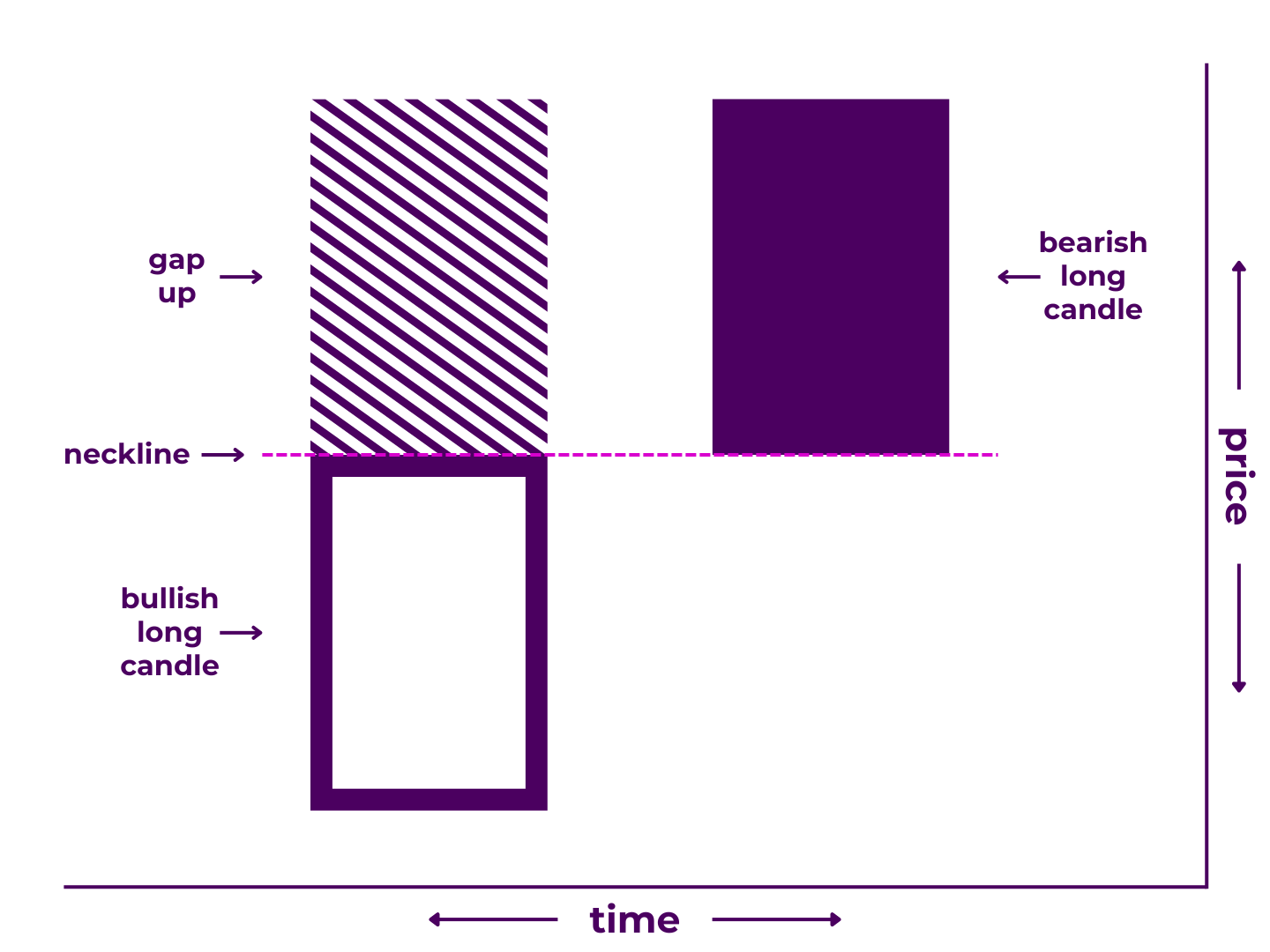

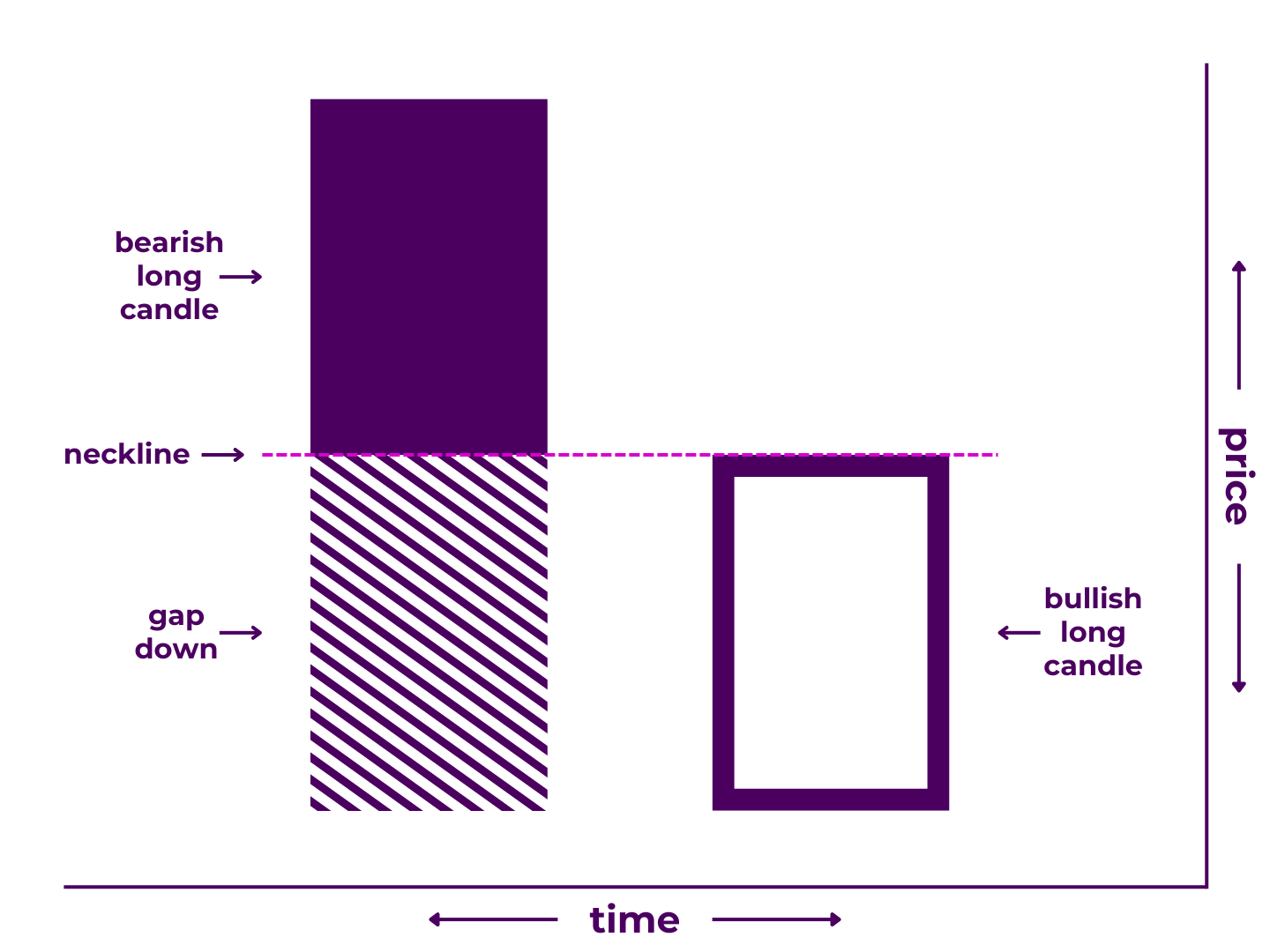

In Neck

An in neck pattern is a 2-candlestick formation that may signal continuation.

It is made up of a long candle moving in the direction of current trend followed by a gap and a shorter candle that fills the gap to close near the close of the previous candle.

It comes in both bearish and bullish variations.

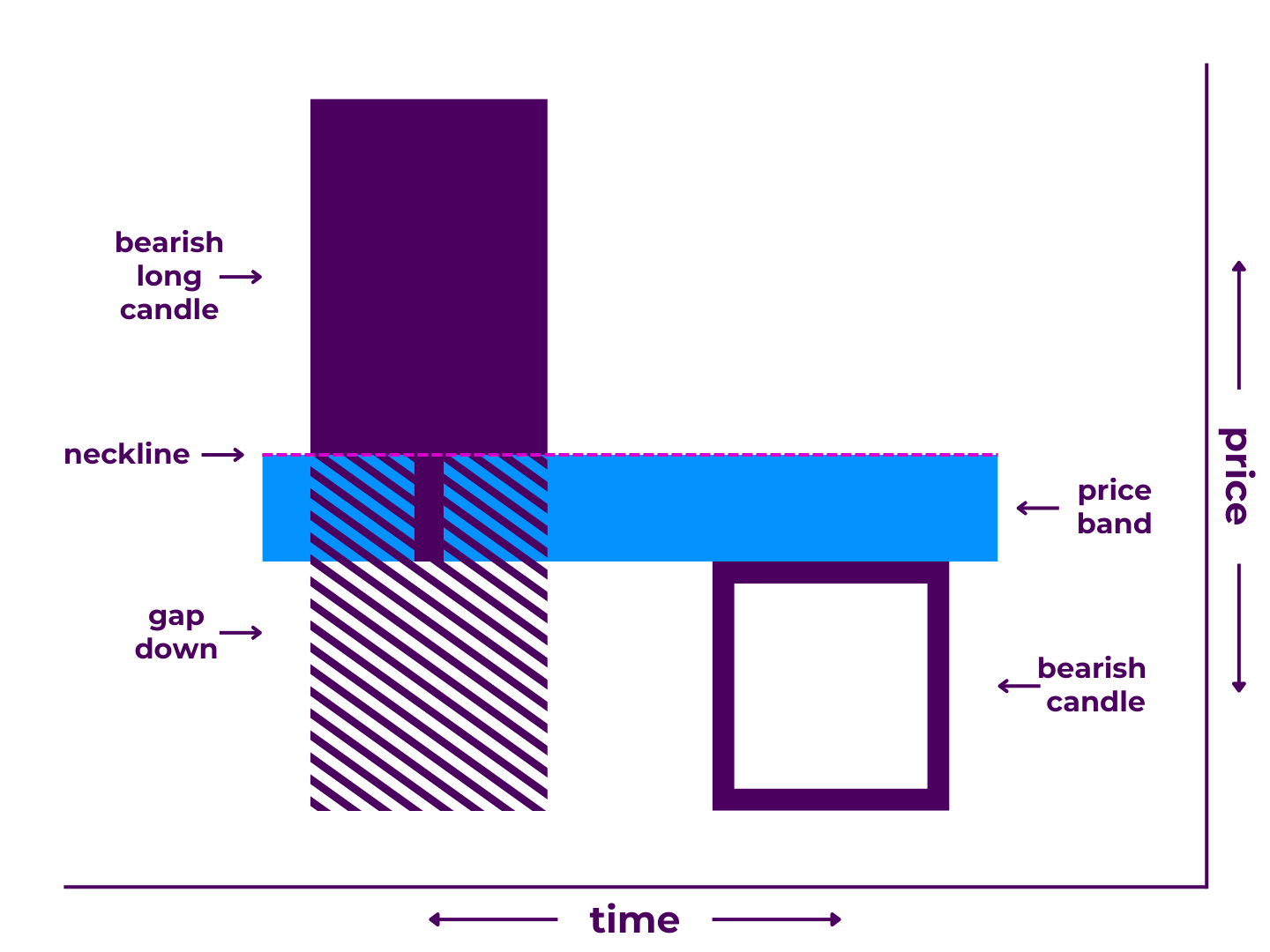

Bearish ones look like this:

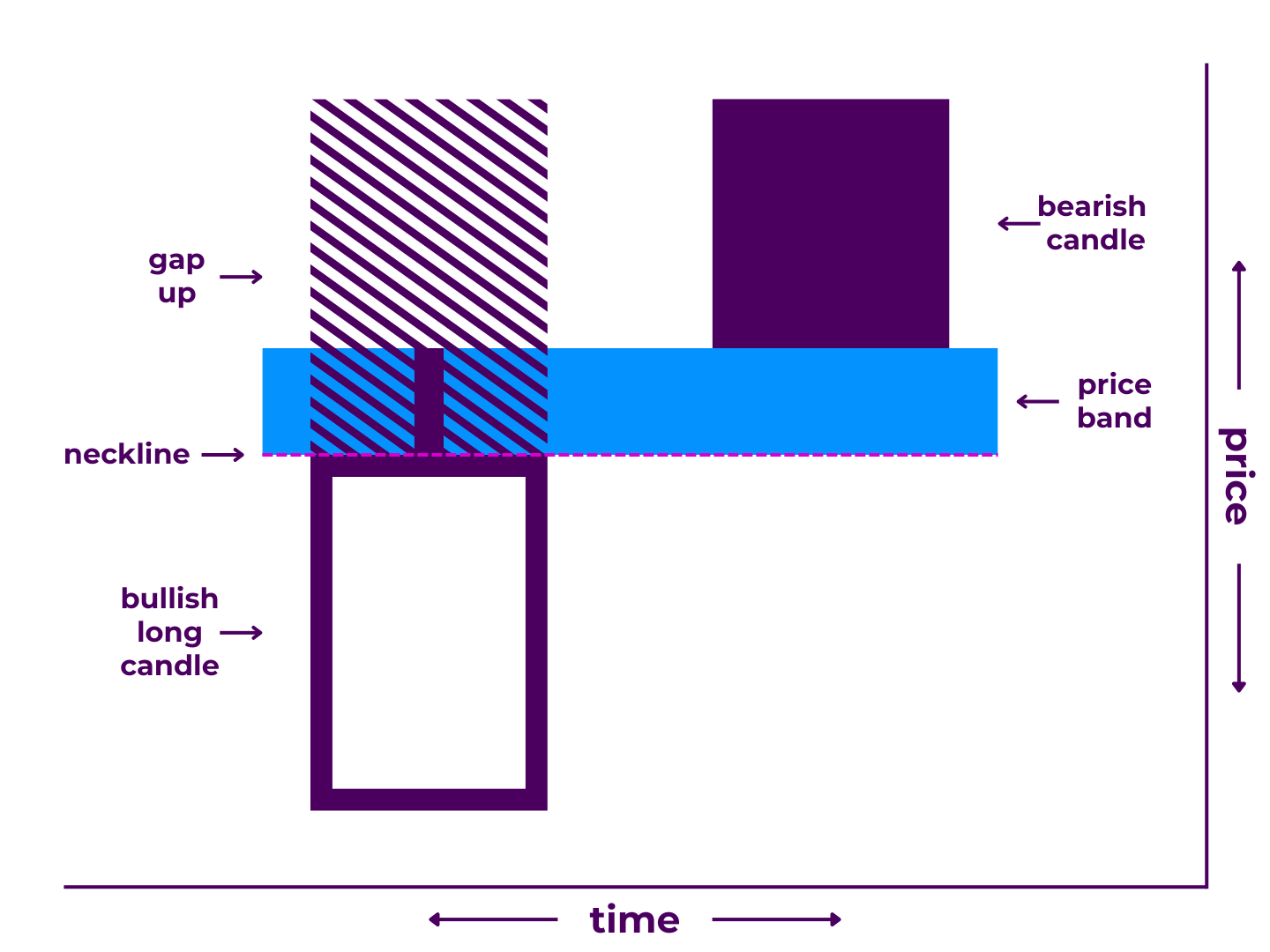

Bullish ones look like this:

In trading terms:

- During the first period, price action continued the ongoing trend.

- The second period opens with a gap that is filled but price gets no further, ending with a similar close to the following period.

In neck patterns show that the trending side attempted to press their advantage on candle one, continued to do so between candles, but then allowed some reprieve by the close of candle two.

Pattern Type: Continuation

Number of Candlesticks: 2

Looks Like/Narrative Meaning: a pause in the action or rallying point

Technical Specifications***

Technically, an in neck pattern must:

- Begin with a long candle moving with trend

- End with a short candle moving against trend

- Completely fill the gap created after the first period

In practicality though, many traders will make various exceptions.

- The first candle doesn’t necessarily have to be a long candle, as long as its body is longer than the body of the second candle.

- The close of the second candle can be slightly above or below the close of the first candle.

- It can take two candles to fill the gap, as long as the combined length of the second and third candles is shorter than the length of the first.

***Depending on who you ask, any of these standards may be more or less important. Moreover, some of these variations may be more properly classified as other continuation candlestick patterns.

Related Patterns

- Similar to Counterattack Lines Pattern

- Similar to On Neck Pattern

For more detail, read our full breakdown on How to Trade In Neck Candlestick Patterns.

Mat Hold

A mat hold pattern is a 5-candlestick formation that may signal a continuation.

It is made up of a large candlestick moving in the direction of current trend, followed by a gap and three shorter candles that move against trend but do not close beyond the open of the first candle, then another large candle that closes beyond all prior candles in the direction of trend.

It comes in both bearish and bullish variations.

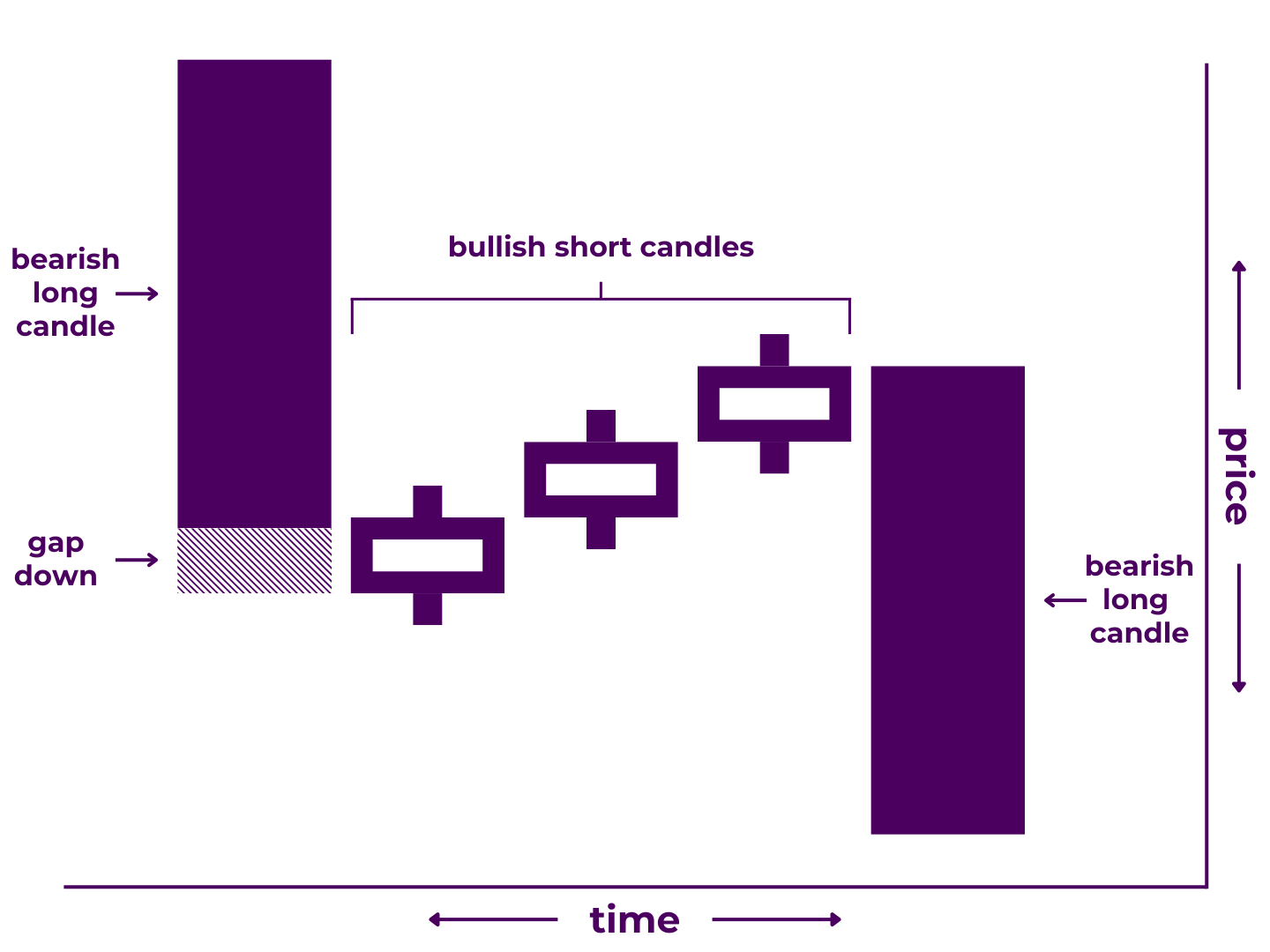

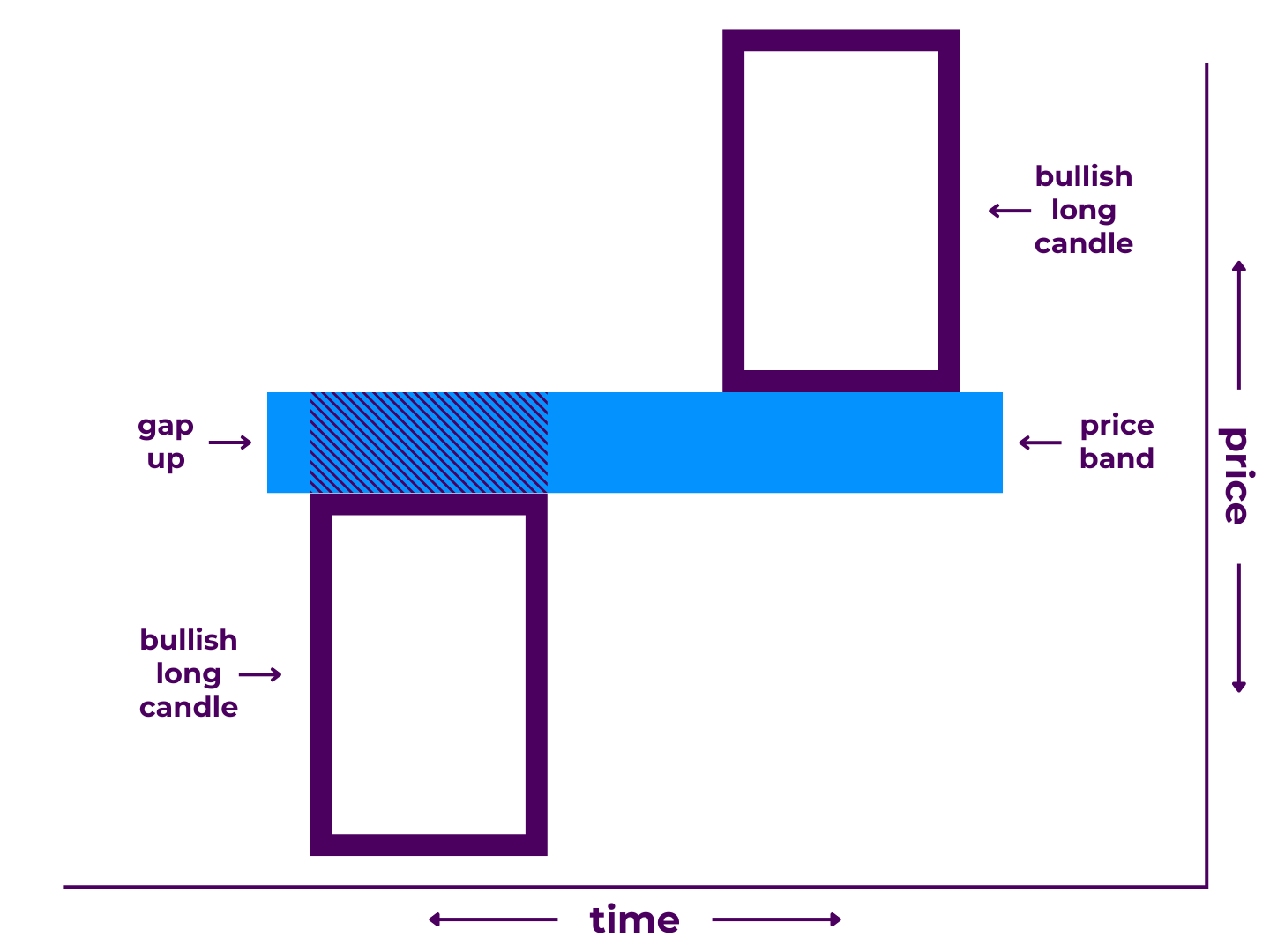

Bearish ones look like this:

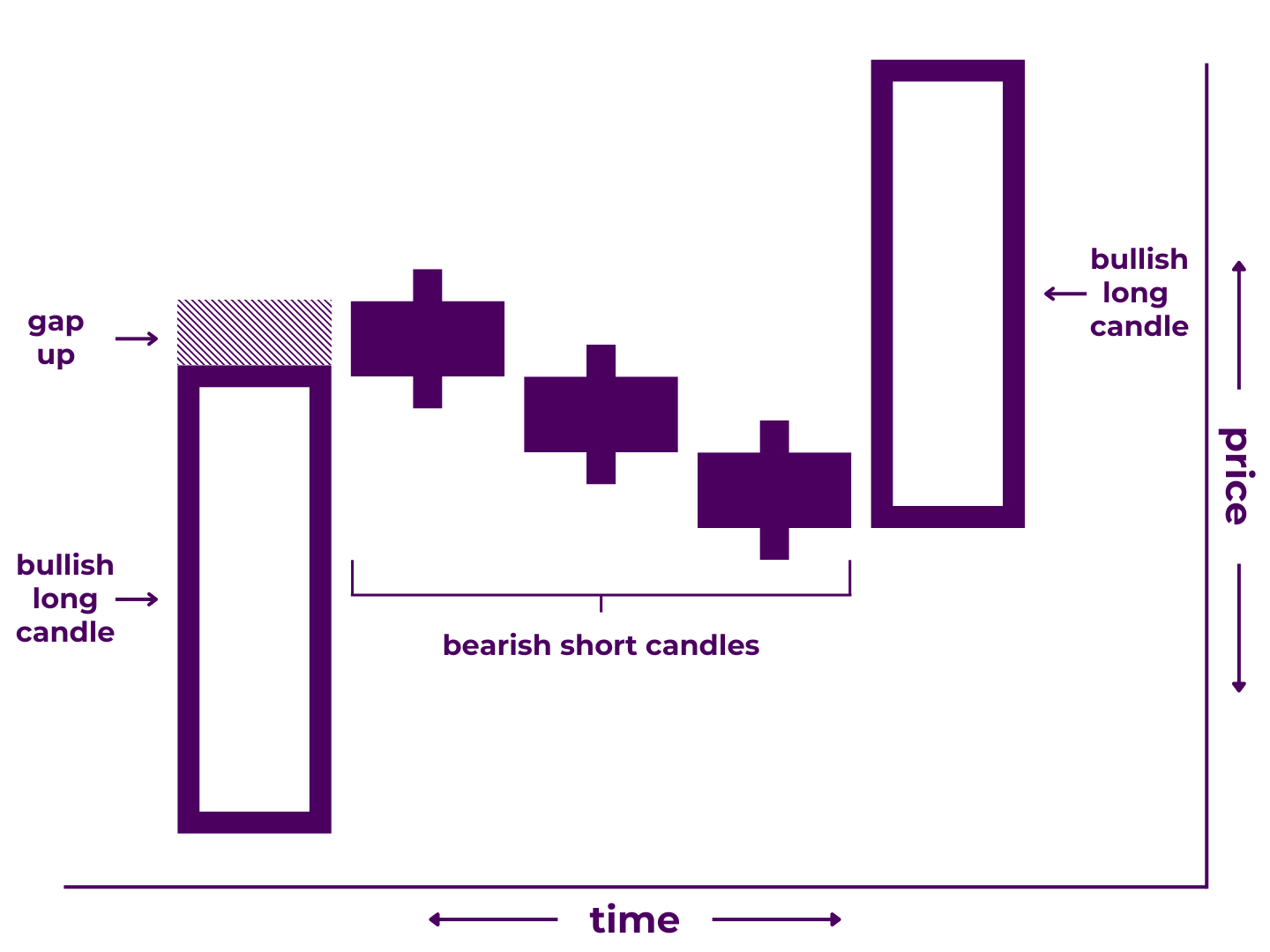

Bullish ones look like this:

In trading terms:

- During the first period, the price drove strongly in the direction of trend.

- The second period opened with a gap that got filled over the course of the next three periods as price moved against trend but never closed beyond the open of the first period.

- During the fifth period, price resumed and exceeded the movement of the first period.

Mat hold patterns show that one side attempted to press their advantage on candle one (and between candles one and two), stalled for the next three candles, before finally regaining control and pressing trend further.

Pattern Type: Continuation

Number of Candlesticks: 5

Looks Like/Narrative Meaning: a one-sided beatdown or near-knockout blow

Technical Specifications***

Technically, a mat hold pattern must:

- Begin with a long candle moving with trend

- Have a gap in the direction of trend after the first candle that get filled over the course of the next three candles

- Have three consecutive short candlesticks after the first candlestick, that move against trend

- Not have any of the middle candles close beyond the open of the first candle

- End with another long candle moving with trend, that closes beyond the body and wicks of all prior candles in the pattern

In practicality though, many traders will make various exceptions.

- The first candle doesn’t necessarily have to be a long candle, as long as none of the smaller candles close beyond the first candle’s open.

- The middle three candles don’t all have to be short candlesticks and move against the trend, as long as none close beyond the open of the first candle.

- The gap can go, especially in markets where gaps are less common like cryptocurrency.

- The final candle doesn’t necessarily have to close beyond all the wicks of the prior candles, as long as it closes beyond the bodies.

***Depending on who you ask, any of these standards may be more or less important. Moreover, some of these variations may be more properly classified as other continuation candlestick patterns.

Related Patterns

- Similar to Three Methods Pattern

For more detail, read our full breakdown on How to Trade Mat Hold Candlestick Patterns.

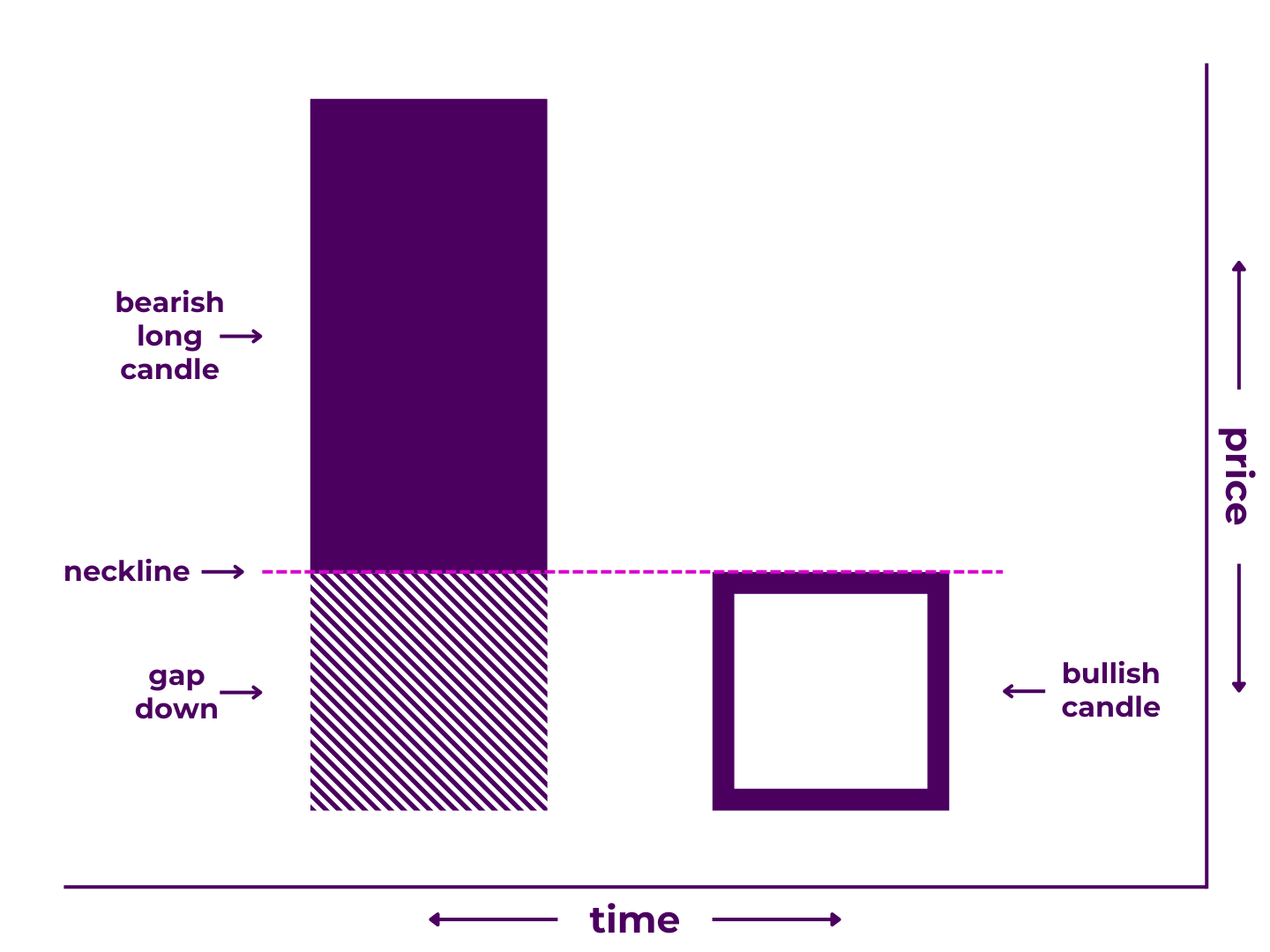

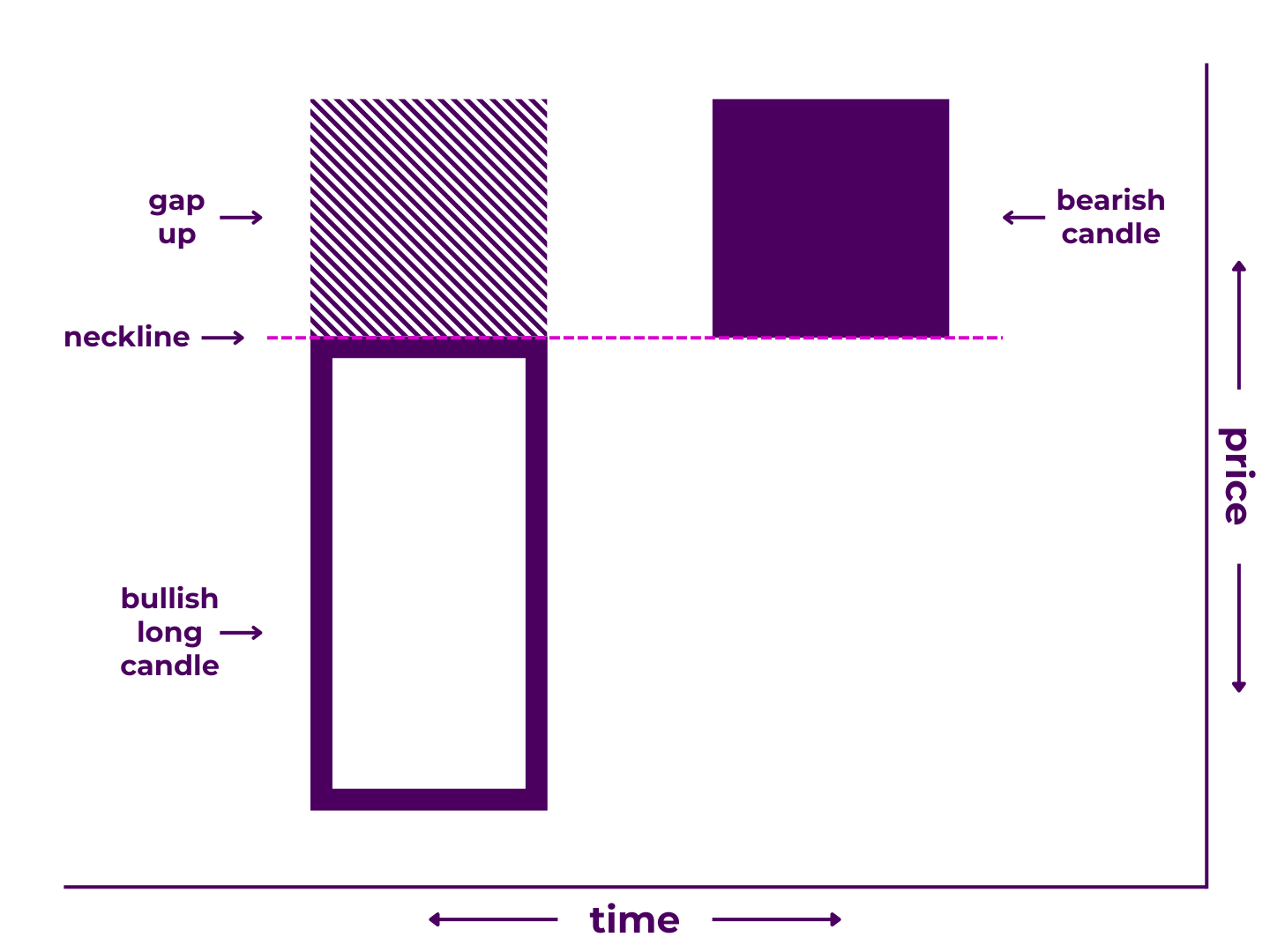

On Neck

An on neck pattern is a 2-candlestick formation that may signal a potential continuation.

It is made up of a long candle moving in the direction of trend followed by a gap and a shorter candle that fails to fill the gap, closing near the high or low of the previous candle.

bearish and bullish variations.

Bearish ones look like this:

Bullish ones look like this:

In trading terms:

- During the first period, price action continued the ongoing trend.

- The second period opens with a gap that is only partially filled, closing near the high or low of the previous period.

On neck patterns show that the trending side attempted to press their advantage on candle one, continued to do so between candles, then held their ground fairly well on candle two.

Pattern Type: Continuation

Number of Candlesticks: 2

Looks Like/Narrative Meaning: “no man’s land” or a mustering line

Technical Specifications***

Technically, an on neck pattern must:

- Begin with a long candle moving with trend that has a wick in the direction of trend, such as a belt hold candlestick

- End with a short candle moving against trend

- Have a gap after the first candle that exceeds the wick of the first candle

- Partially fill the gap created after the first period, to the wick of the first candle

In practicality though, many traders will make various exceptions.

- The first candle doesn’t necessarily have to be a long candle, as long as its body is significantly longer than the body of the second candle.

- The first candle doesn’t necessarily have to have a wick in the direction of trend, as long as there is a gap that is only partially filled by the next candle.

- The close of the second candle can be slightly above or below the wick of the first candle, as long as it does not get too near the close for the second candle.

- It can take two candles to reach the first candle’s wick, as long as the combined length of the second and third candles is significantly shorter than the body of the first candle.

***Depending on who you ask, any of these standards may be more or less important. Moreover, some of these variations may be more properly classified as other continuation candlestick patterns.

Related Patterns

- Similar to Counterattack Lines Pattern

- Similar to In Neck Pattern

For more detail, read our full breakdown on How to Trade On Neck Candlestick Patterns.

Tasuki Gap

A tasuki gap pattern is a 3-candlestick formation that may signal a continuation.

It is made up of a candle moving in the direction of trend, followed by a gap, another candle moving in the direction of trend, and then a candle moving against trend that partially closes the gap between the first two.

It comes in both bearish and bullish variations, known respectively as the downside tasuki gap and upside tasuki gap.

Bearish ones look like this:

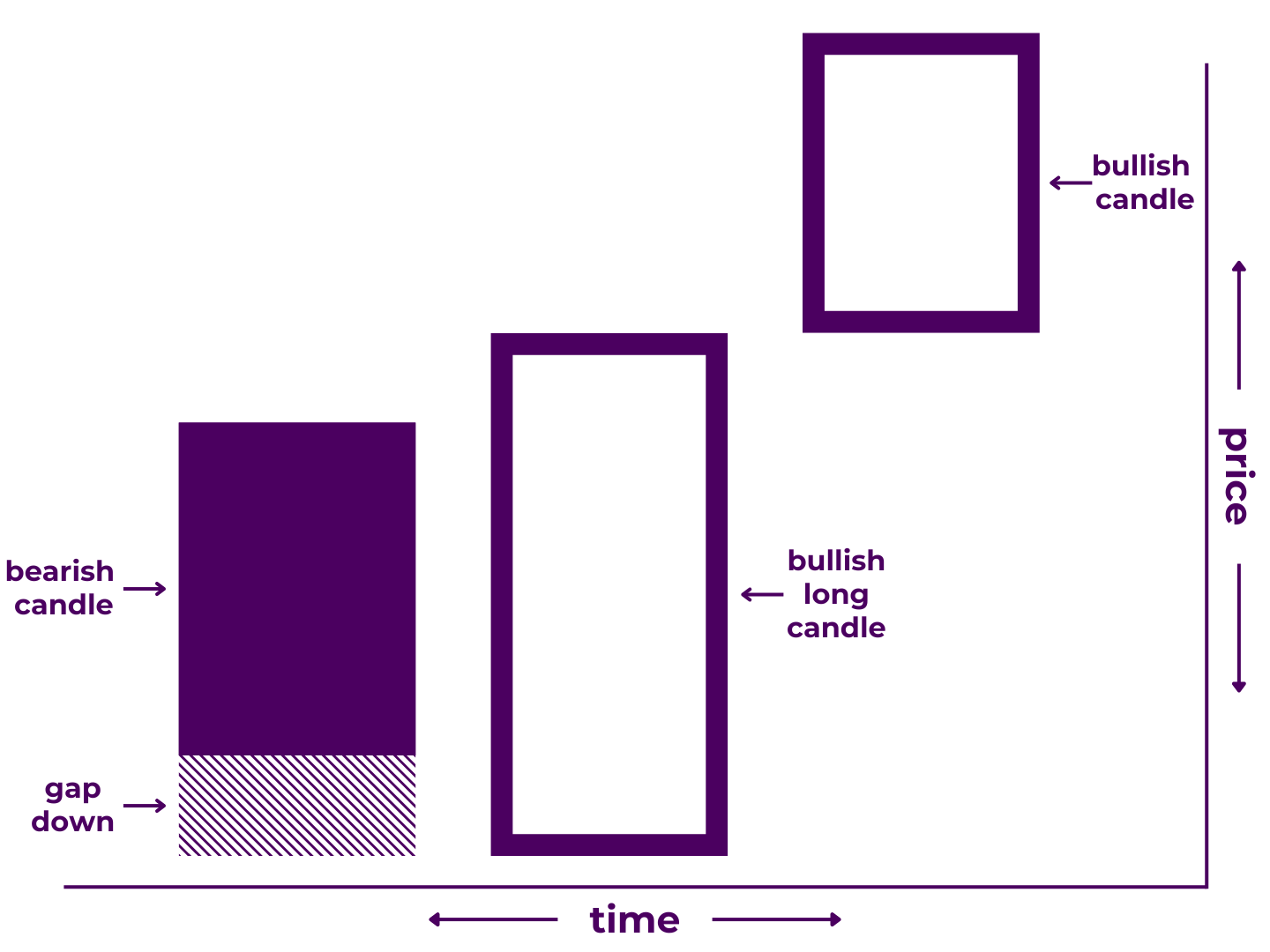

Bullish ones look like this:

In trading terms:

- During the first period, price drove strongly in the direction of trend.

- Between periods, price continued driving in the same direction.

- During the second period, price yet again continued driving in the direction of trend.

- During the third period, price moved against trend to close somewhere in the middle of the gap.

Tasuki gap patterns show that one side pressed their advantage on candle one, continued between candles one and two, continued further through the end of two, until finally suffering a relatively minor setback on candle three.

Pattern Type: Continuation

Number of Candlesticks: 3

Looks Like/Narrative Meaning: a momentary respite or an attempted counterattack

Technical Specifications***

Technically, a tasuki gap pattern must:

- Begin with a long candle moving with trend

- Have a trend-side gap after after the first candle

- Have a second long candle moving with trend after the gap

- End with a long candle moving against trend that partially fills the gap

In practicality though, many traders will make various exceptions.

- The first candle doesn’t necessarily have to be a long candle, as long as it is a candlestick that gives a strong bias in the direction of trend (such as a dragonfly doji or gravestone doji).

- The second candle doesn’t necessarily have to be a long candle, as long as the first one is and the gap remains unfilled.

- The third candle doesn’t necessarily have to be a long candle, as long as it doesn’t fully fill the gap and moves against trend.

- The third candle doesn’t have to fill the gap at all, as long as it moves against trend.

- It can take multiple countertrend candles to reach the gap, as long as all other criteria are met and the gap remains partially unfilled.

***Depending on who you ask, any of these standards may be more or less important. Moreover, some of these variations may be more properly classified as other continuation candlestick patterns.

Related Patterns

- Extension of Window Pattern

For more detail, read our full breakdown on How to Trade Tasuki Gap Candlestick Patterns.

Three Inside

A three inside pattern is a 3-candlestick formation that may signal a reversal.

It is made up of a large candle moving in the direction of trend followed by a shorter countertrend candle that opens and closes within the body of the first, then another countertrend candle that breaks through and closes beyond the open of the first candle.

It comes in both bearish and bullish variations, known respectively as the three inside up and three inside down.

Bearish ones look like this:

Bullish ones look like this:

In trading terms:

- During the first period, price drove strongly in the direction of trend.

- Before the second period opened, price moved against the trend, opening within the range of the prior candle body.

- During the second period, price moved against trend to a modest degree, closing within the range of the prior candle body.

- During the third period, price continued moving against trend, this time closing beyond the open of the first period.

Three inside patterns show that one side attempted to press their advantage on candle one, suffered immediate push back between market hours and through on candle two, and finally lost all momentum by the end of candle three.

Pattern Type: Reversal

Number of Candlesticks: 3

Looks Like/Narrative Meaning: U-turn or counterpunch

Technical Specifications***

Technically, a three inside pattern must:

- Begin with a long candle moving with trend

- Have a second candle that is an inside candle and moves against trend

- End with a long candle that breaks through the level set by first candle’s open and closes beyond it

In practicality though, many traders will make various exceptions.

- The first candle doesn’t necessarily have to be a long candle, as long as the second candle is an inside candlestick that moves against trend.

- The first second candle doesn’t necessarily have to be against trend, as long as it is an inside candle.

- There can be more than one inside candle between the first and final candles, as long as the final candle closes beyond the first candle’s open.

***Depending on who you ask, any of these standards may be more or less important. Moreover, some of these variations may be more properly classified as other reversal candlestick patterns.

Related Patterns

- Extension of Harami

- Extension of Harami Cross

For more detail, read our full breakdown on How to Trade Three Inside Candlestick Patterns.

Three Outside

A three outside pattern is a 3-candlestick formation that may signal a reversal.

It is made up of one candle moving in the direction of the current trend, followed by a large engulfing candlestick moving against trend, and finally a third candlestick that continues the move against trend.

It comes in both bearish and bullish variations, known respectively as the three outside down and three outside up.

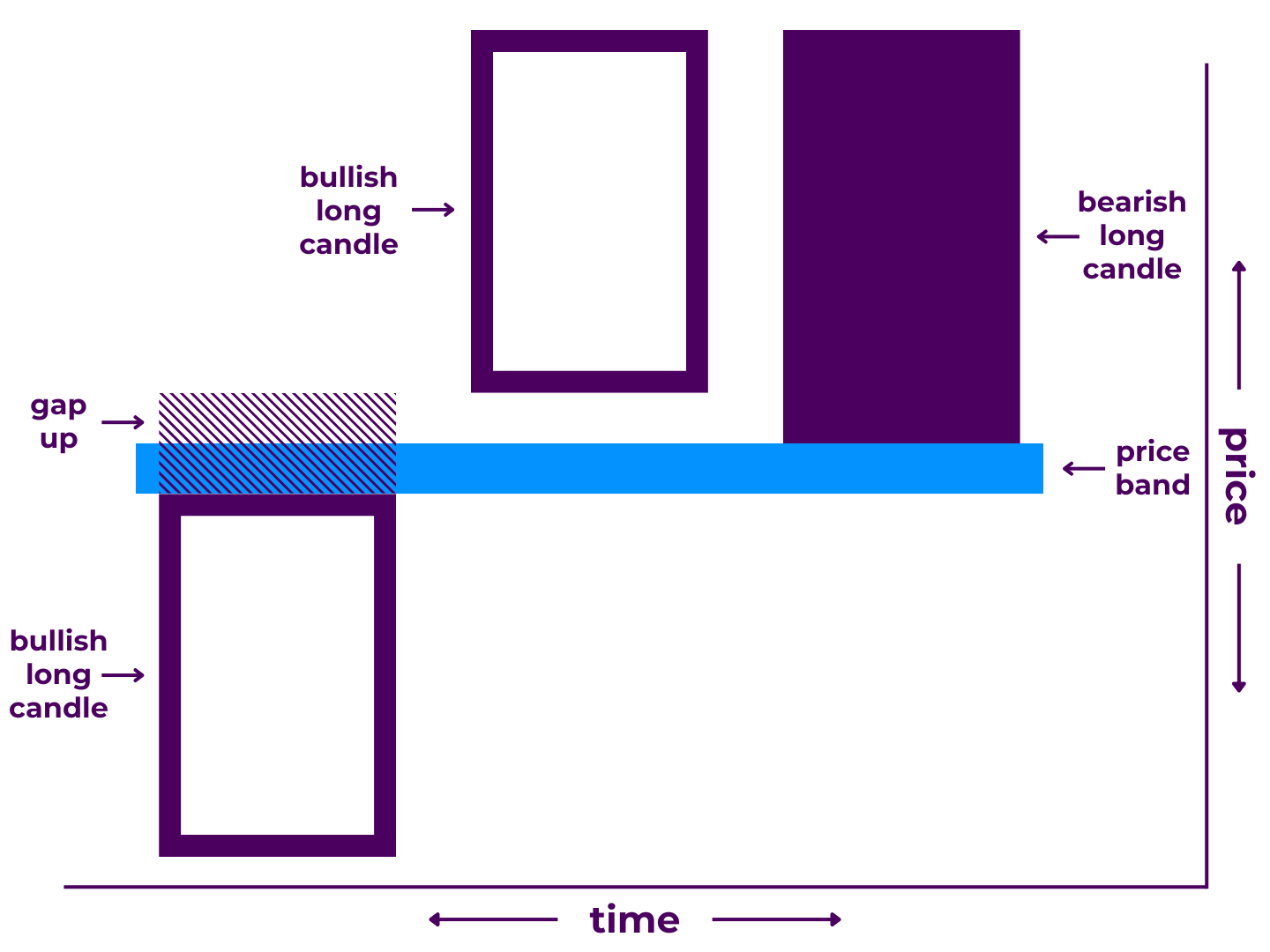

Bearish ones look like this:

Bullish ones look like this:

In trading terms:

- During the first period, price continued the ongoing trend.

- Before the second period opened, price continued moving with trend, creating a gapped open.

- During the second period, price moved against trend dramatically, closing beyond the open of the first period.

- During the third period, price moved against trend even further.

Three outside patterns show that one side attempted to press their advantage on candle, then again between candles one and two, were completely upended by the end of candle two, and continued to lose ground on candle three.

Pattern Type: Reversal

Number of Candlesticks: 3

Looks Like/Narrative Meaning: complete turnaround or devastating counterstrike

Technical Specifications***

Technically, a three outside pattern must:

- Begin with a (non-short) candle moving in the direction of trend

- Have a long engulfing candlestick moving against trend as the second candle

- End with a third candle moving in the same direction as the second (and against trend)

In practicality though, many traders will make various exceptions.

- The first candle can be a neutral/short candle (ie. a doji), as long as it is fully contained within the body of the second.

- The first candle can move against trend, as long as it is fully contained within the body of the second.

- The open of the second candle can be even with the close of the first candle, especially in markets where gaps are less common like cryptocurrency.

***Depending on who you ask, any of these standards may be more or less important. Moreover, some of these variations may be more properly classified as other reversal candlestick patterns.

Related Patterns

- Extension of Engulfing Candlestick Pattern

For more detail, read our full breakdown on How to Trade Three Outside Candlestick Patterns.

Window

A window pattern is a 2-candlestick formation that may signal a continuation.

It is made up of two large candles moving in the direction of current trend with a gap between them.

It comes in both bearish and bullish variations, known respectively as the falling window and rising window.

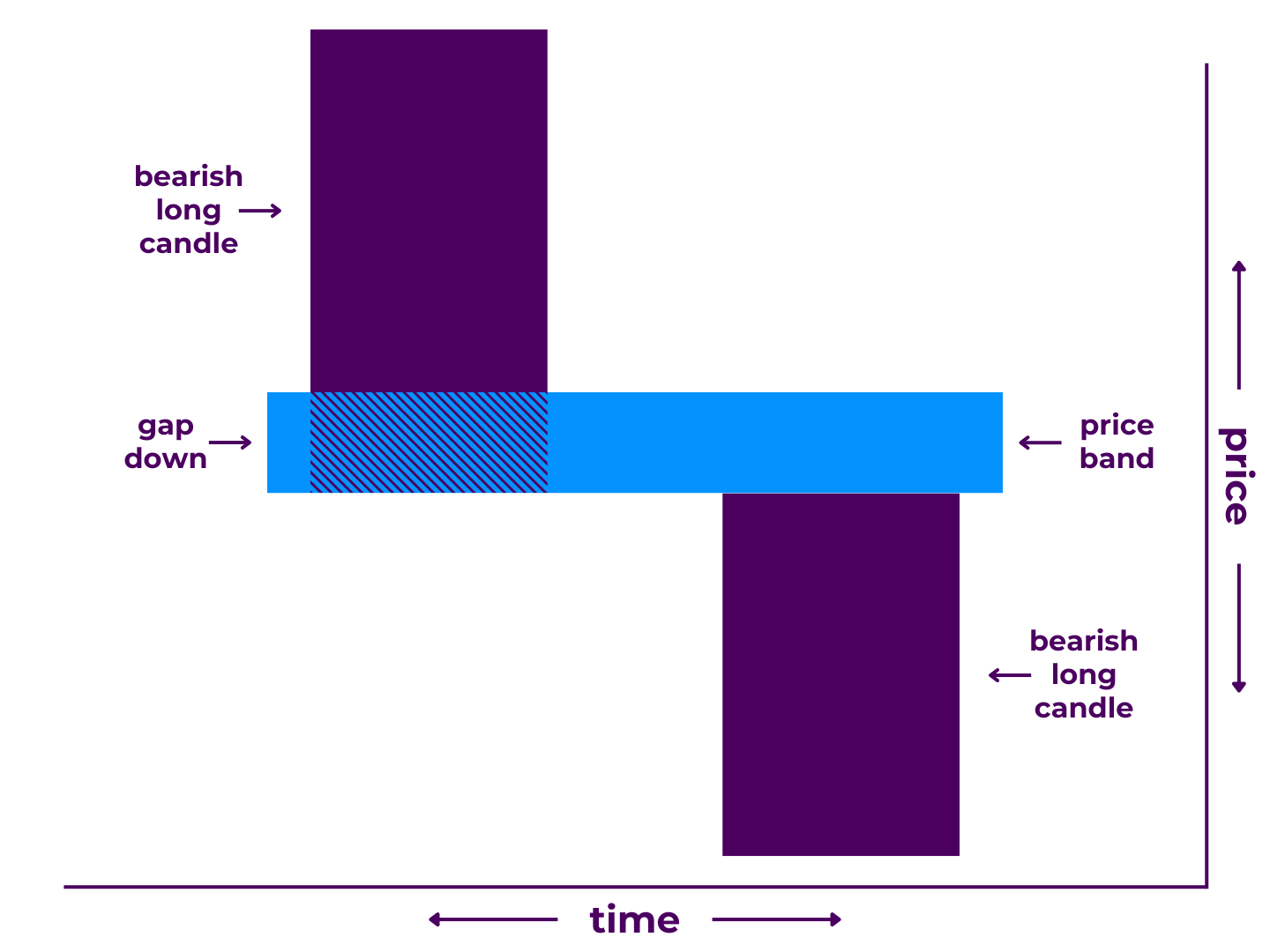

Bearish ones look like this:

Bullish ones look like this:

In trading terms:

- During the first period, price drove strongly in the direction of trend.

- Between periods, price continued driving in the same direction.

- During the second period, price yet again continued driving in the direction of trend.

Window patterns show that one side pressed their advantage on candle one, continued between candles one and two, and continued further through the end of two.

Pattern Type: Continuation

Number of Candlesticks: 2

Looks Like/Narrative Meaning: a runaway train or uncontested offensive

Technical Specifications***

Technically, a window pattern must:

- Have two long candles moving with trend

- Have a gap between both candles

In practicality though, many traders will make various exceptions.

- The first candle doesn’t necessarily have to be a long candle, as long as it is a candlestick that gives a strong bias in the direction of trend (such as a dragonfly doji or gravestone doji).

- The second candle doesn’t necessarily have to be a long candle, as long as the first one is and the gap remains unfilled.

***Depending on who you ask, any of these standards may be more or less important. Moreover, some of these variations may be more properly classified as other continuation candlestick patterns.

Related Patterns

- Precursor of Tasuki Gap Pattern

For more detail, read our full breakdown on How to Trade Window Candlestick Patterns.

Takeaways

Obviously, there are quite a few different candlestick patterns.

However, you don’t have to memorize all the names and exact specifications. Instead, focus on the principles of price action and technical analysis. That way, you’ll see what is going on with any candlestick formation, whether it fits into one of these categories or not.

At the end of the day, understanding candlestick patterns is only one piece of the puzzle. You’ll need more tools in the toolkit to read the full story in the charts—and even more than that if you want to put together a complete trading strategy.

Know of an important candlestick pattern we missed? Have some special insight into trading a specific pattern? Contribute to the conversation in the comments below! Or, share this post with a trader it might help. And if you haven’t already, check out our Candlestick Patterns Guide to learn the best ways to trade candlestick patterns.

0 Comments