So you want to learn about reversal candlestick patterns, huh?

Smart choice.

Recognizing signs of potential reversals is a useful skill all traders should master.

Here, we will go over the top 10 candlestick patterns that may signal reversal.

- Abandoned Baby

- Counterattack Line

- Doji Star

- Engulfing

- Harami

- Harami Cross

- Star

- Three Inside

- Three Outside

- Tweezer

Identifying Candlestick Reversal Patterns

There are many candlestick patterns that imply potential reversal.

Take special note of the words imply and potential.

Candlesticks represent past price action.

Therefore, no group of candlesticks can guarantee a future outcome. Instead, you should look at them as warning signs or points of interest.

In the same vein, it is crucial that you wait for the full pattern to complete before you give them any weight. It’s quite common for a group of candlesticks to begin to form a recognizable pattern only for the final candle to break the formation. Always wait for the last candle to close before labeling any given candlestick pattern.

Moreover, you’d be wise to look for additional points of confirmation for the reversal before making any trading decisions. There are various ways to confirm a reversal and the more of these that align, the more you can trust the signal. In fact, you’re probably better off using candlestick patterns as final confirmation.

Still, you have to learn to see them if you’re ever going to be able to use them.

Here are ten of the top candlestick reversal patterns (in alphabetical order):

Abandoned Baby

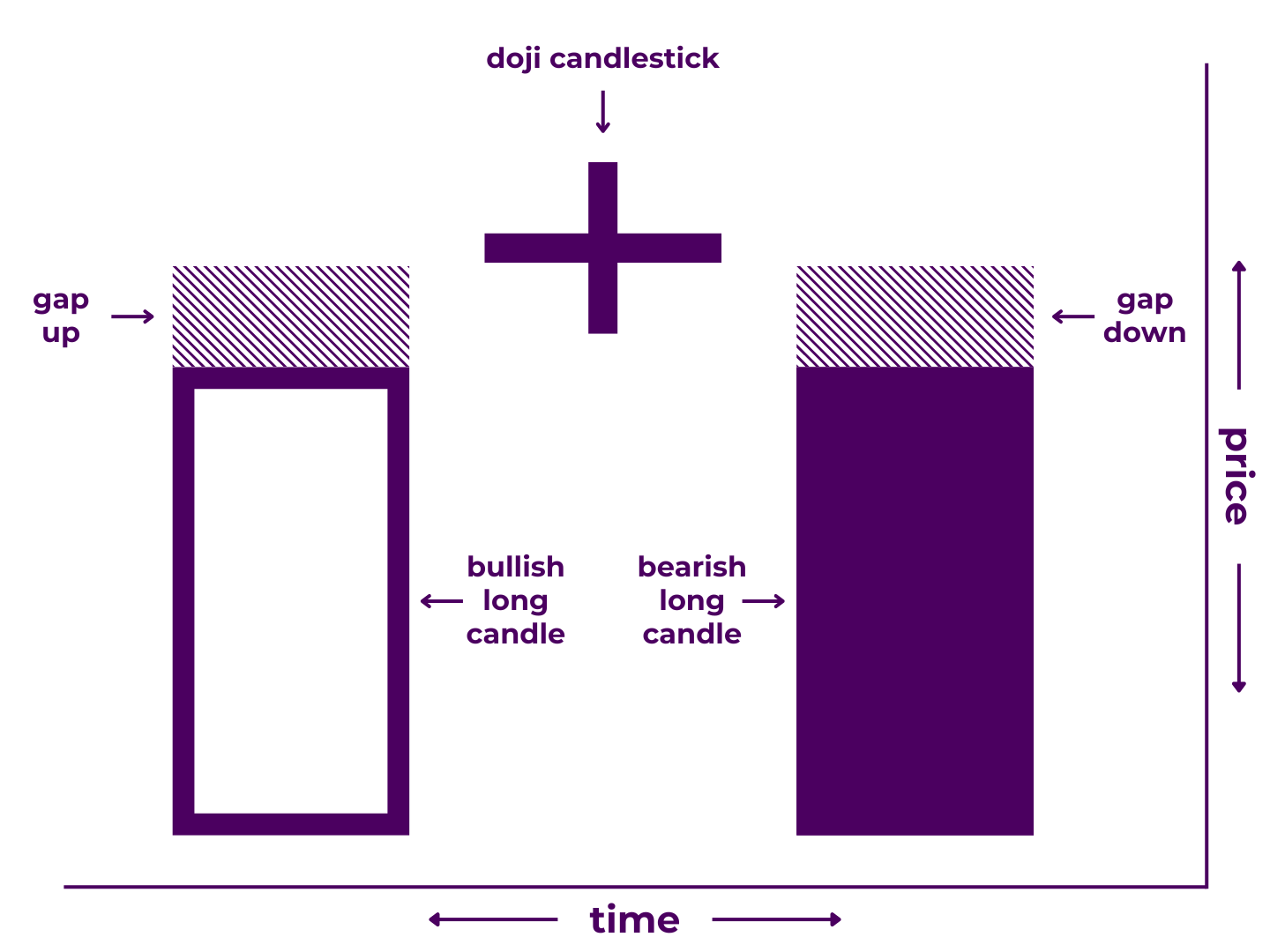

An abandoned baby pattern is a 3-candlestick formation that may signal a reversal.

It is made up of a large candle moving in the direction of current trend, a doji that gaps, and another large candle that gaps and moves in the opposite direction of the first (and trend).

It comes in both bearish and bullish variations.

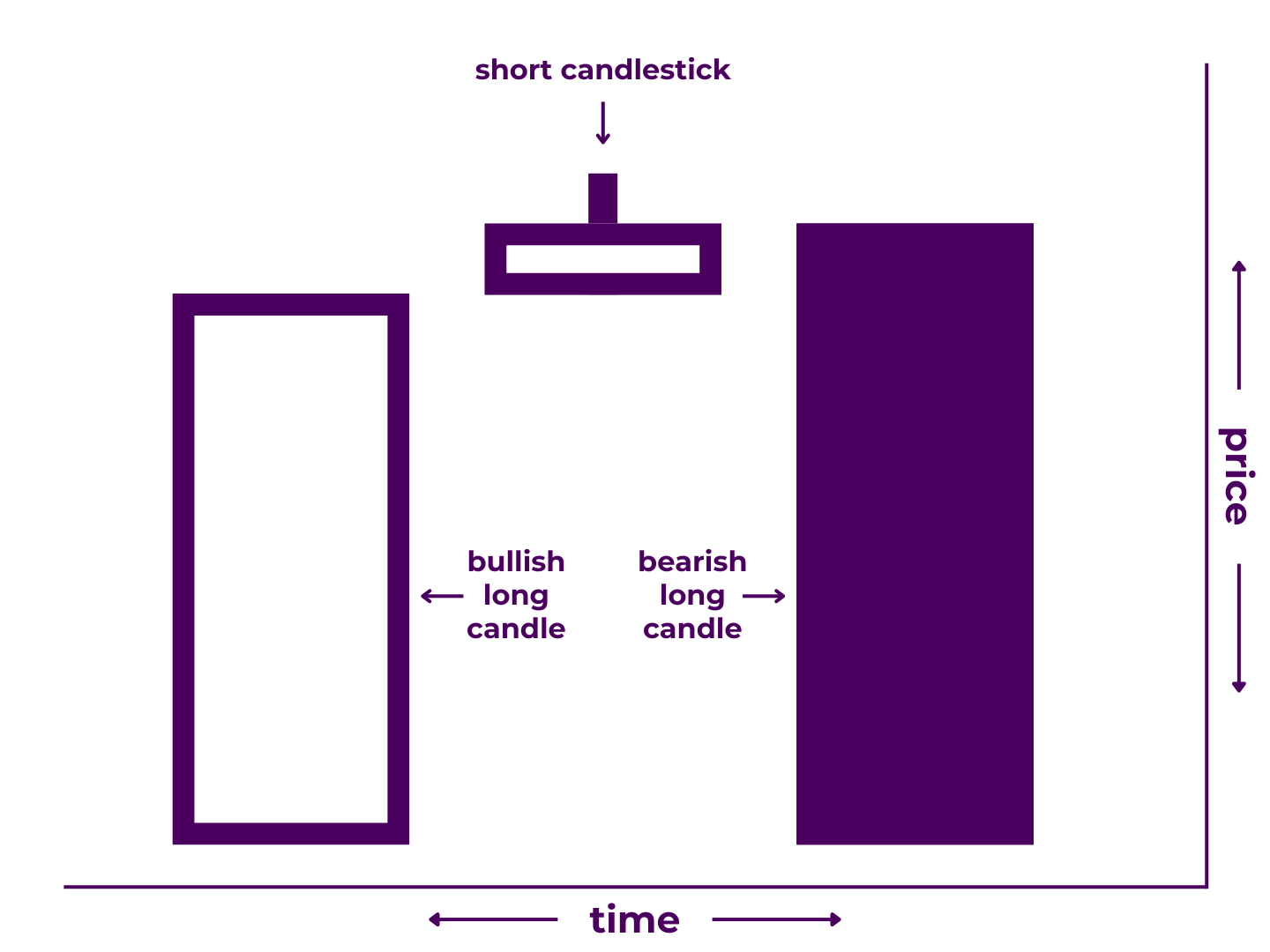

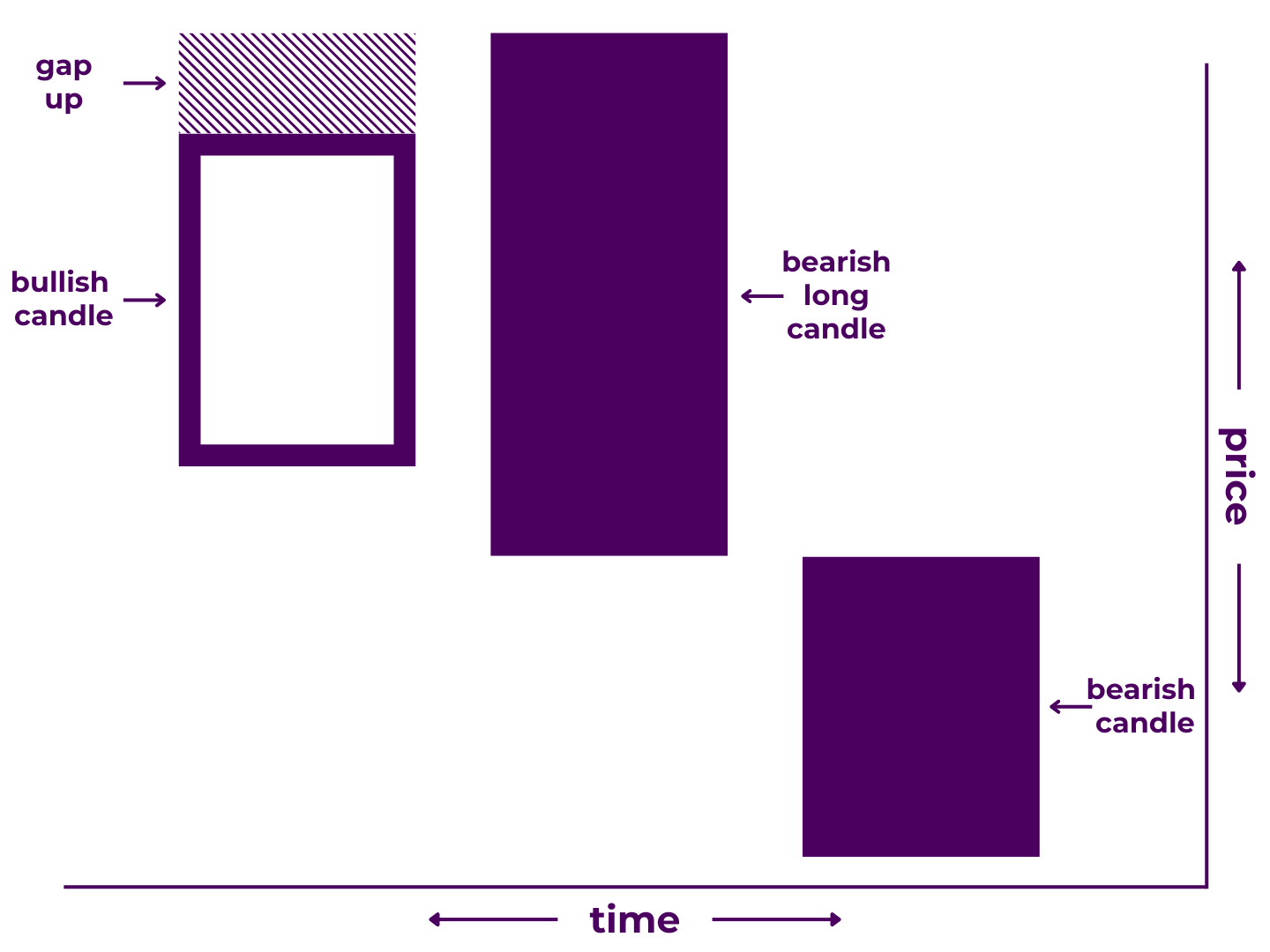

Bearish ones look like this:

Bullish ones look like this:

In trading terms:

- During the first period, the price drove strongly in the same direction as the overall trend.

- The second period opened with a gap, after which neither the bulls nor the bears were able to maintain control.

- The third period opened with another gap then price drove strongly in the opposite direction of the first period and trend.

Abandoned baby patterns show that one side attempted to press their advantage on candle one, stalled on candle two, and finally surrendered all the momentum on candle three.

Pattern Type: Reversal

Number of Candlesticks: 3

Looks Like/Narrative Meaning: U-turn or counterpunch

Technical Specifications***

Technically, an abandoned baby pattern must:

- Begin with a long candle moving with trend

- End with a candle of similar size moving against trend

- Have a doji as the second candle

- Have a gap before and after the doji

Potential exceptions:

- The first and third candles can be different lengths, as long as they are both long line candles and/or test important price levels.

- The second candle doesn’t necessarily have to be a doji, as long as it is a short line candle.

- The gaps can go, especially in markets where gaps are less common like cryptocurrency.

- There can be more than one doji (or short candle) between the first and final candlestick.

***Depending on who you ask, any of these standards may be more or less important. Moreover, some of these variations may be more properly classified as other reversal candlestick patterns.

Related Patterns:

- Similar to Doji Star Pattern

- Similar to Star Pattern

For more detail, read our full breakdown on How to Trade Abandoned Baby Candlestick Patterns.

Counterattack Line

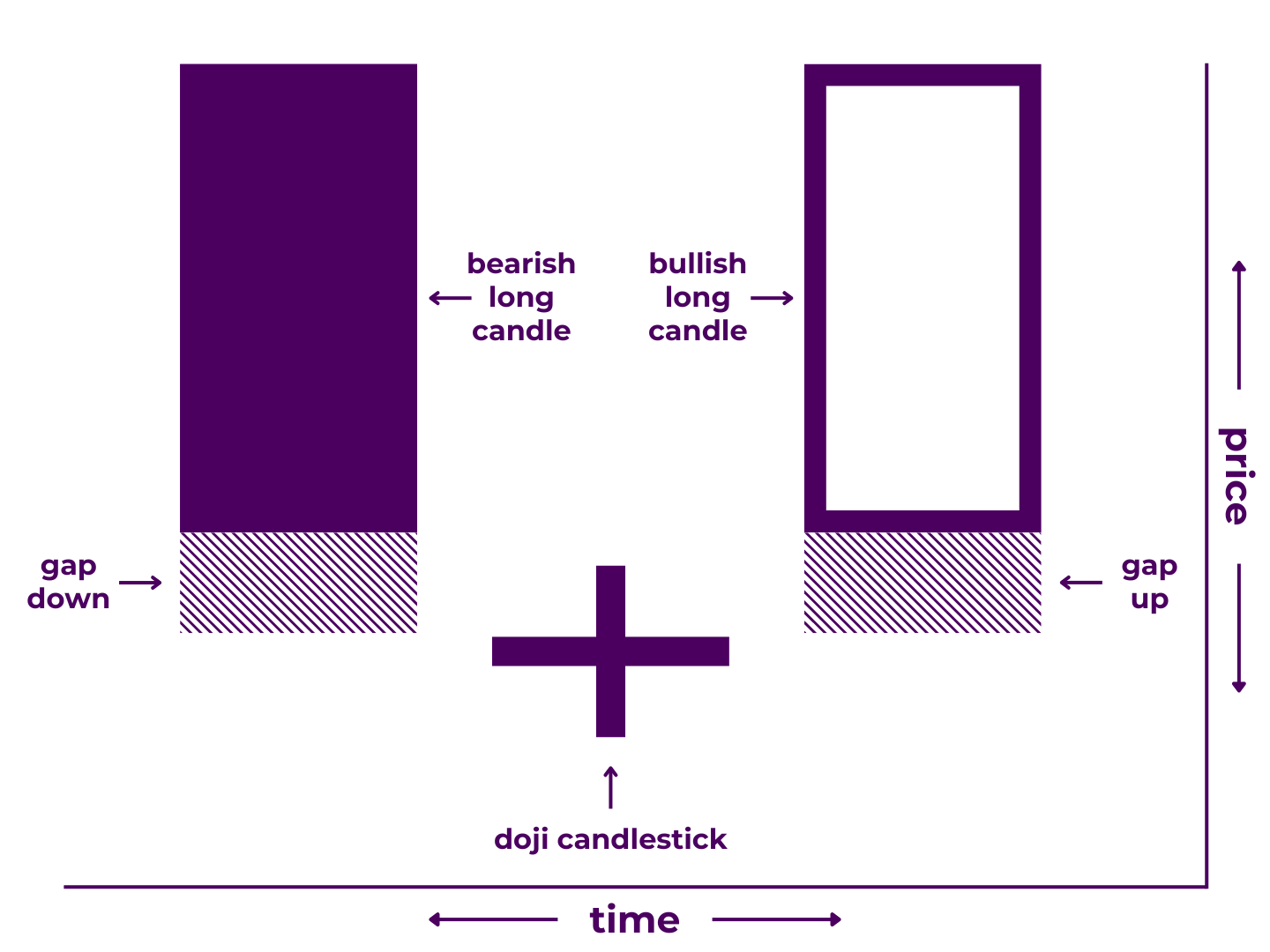

A counterattack line pattern is a 2-candlestick formation that may signal a reversal.

It is made up of a long candle moving in the direction of current trend followed by a second candle that opens with a gap that then moves in the opposite direction, filling the gap to close near the first candle’s close.

It comes in both bearish and bullish variations.

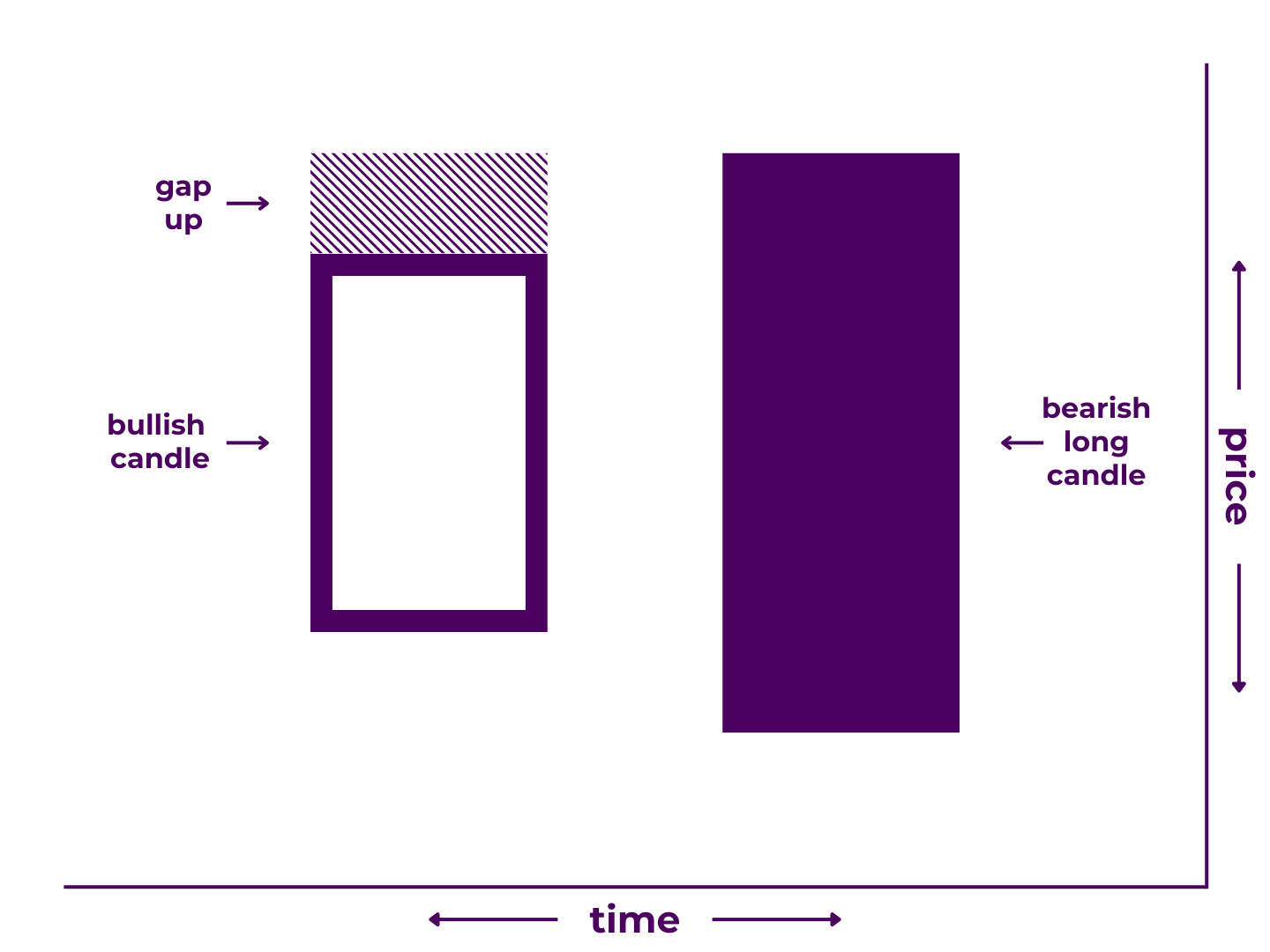

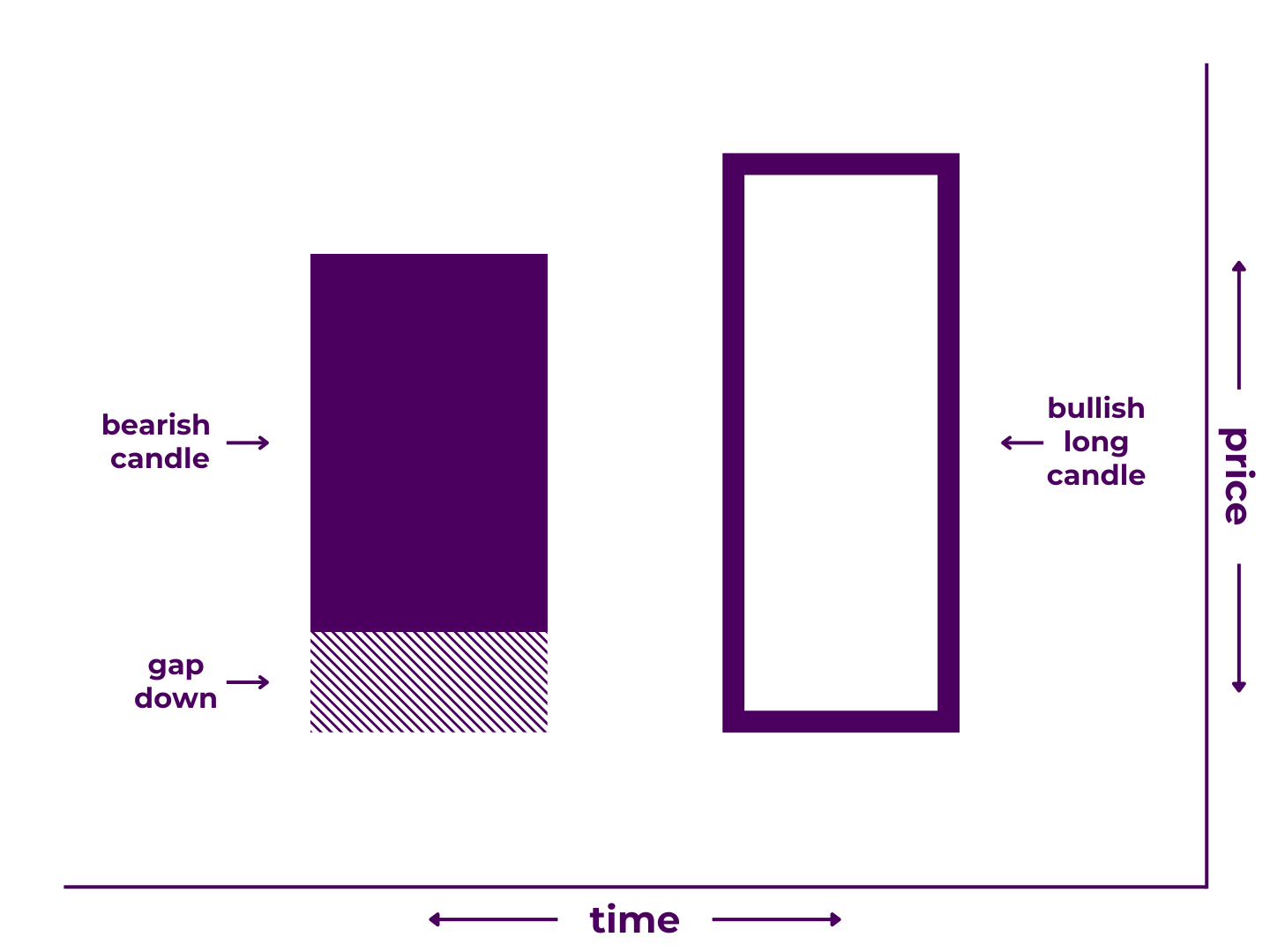

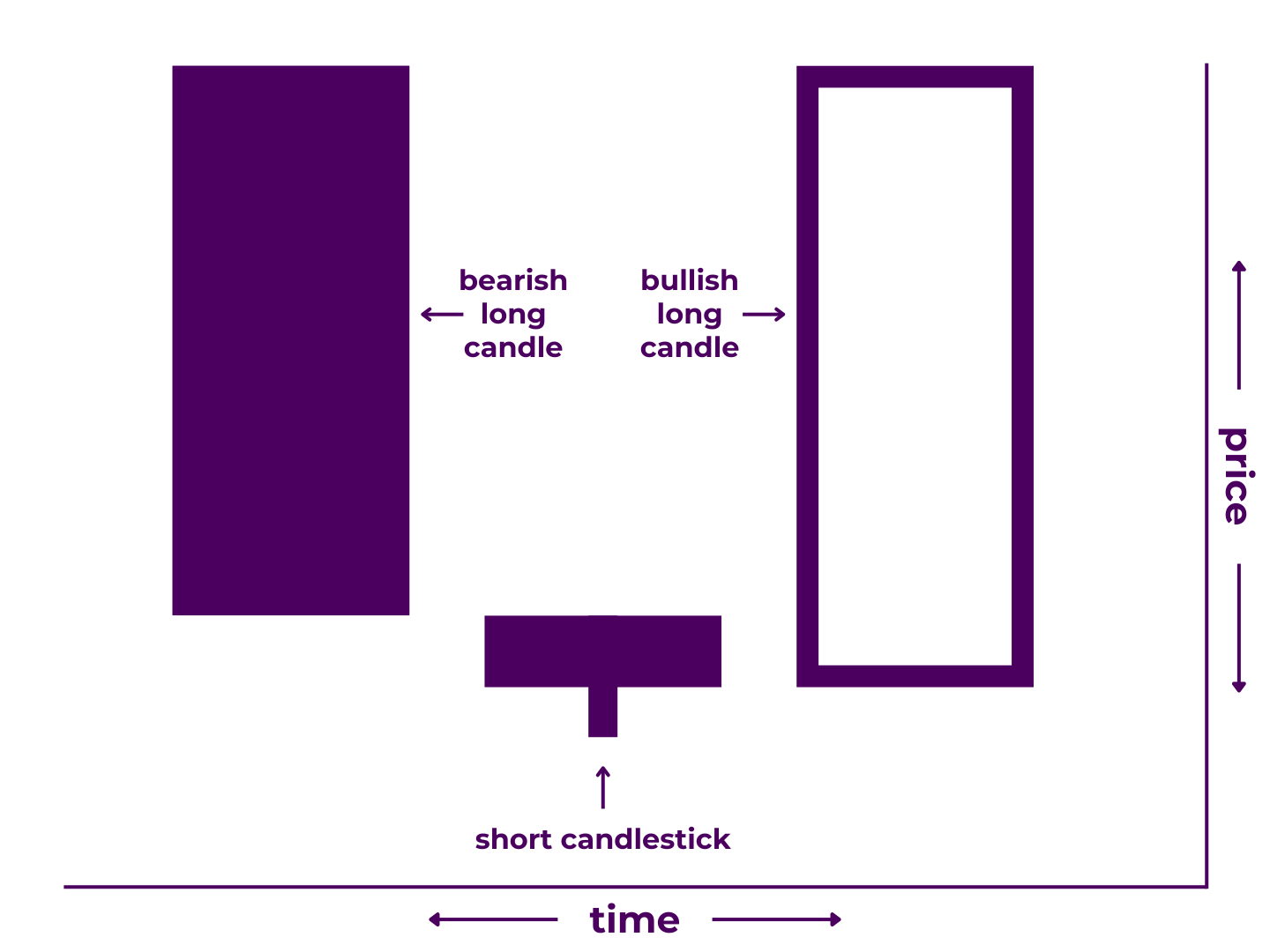

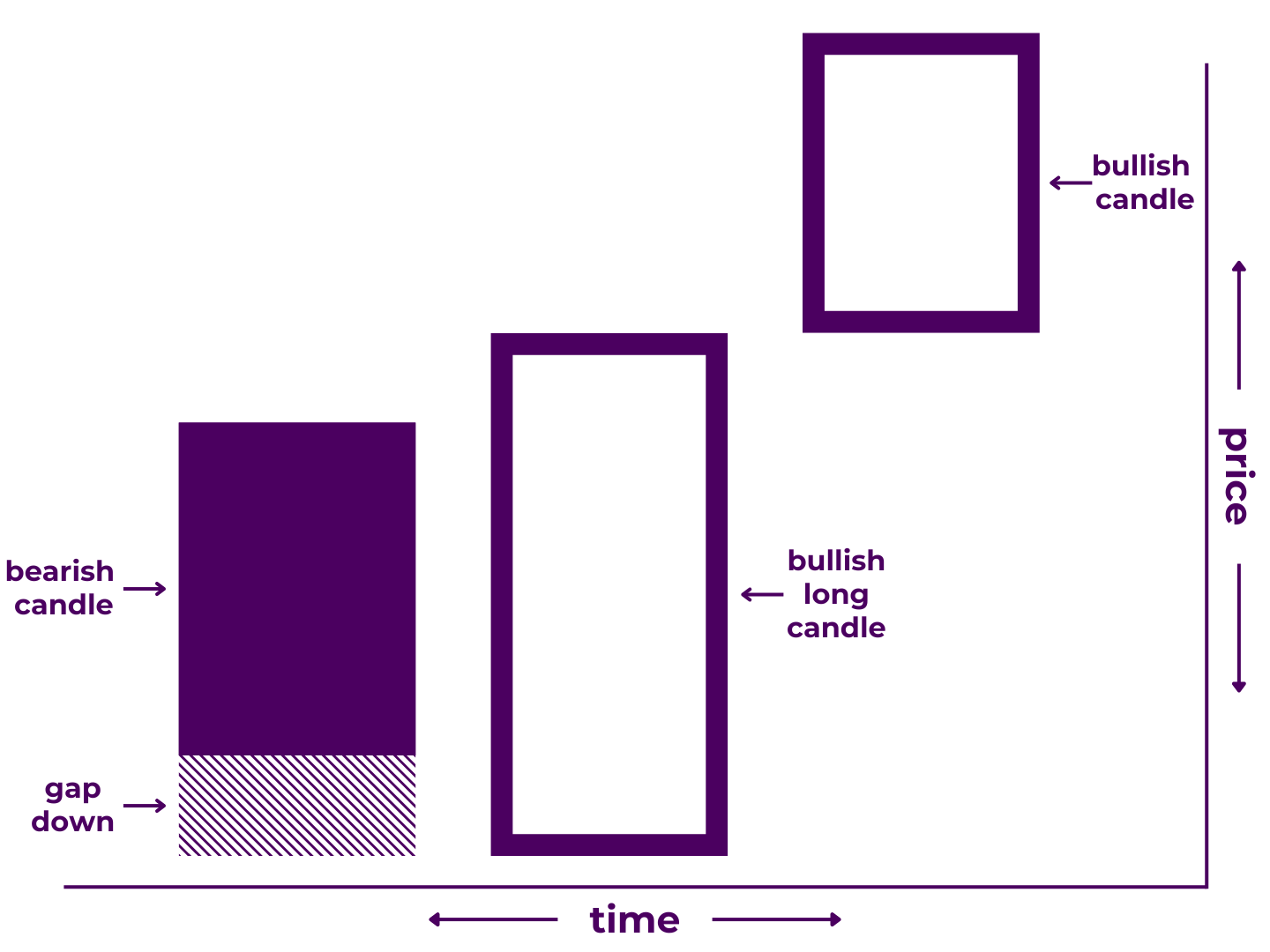

Bearish ones look like this:

Bullish ones look like this:

In trading terms:

- During the first period, the price drove in the direction of trend.

- The second period opens with a gap but price moves against trend, immediately filling the gap, ending with a similar close to the following period.

Counterattack line patterns show that one side attempted to press their advantage on candle one, continued to do so between candles, but then lost all momentum by the close of candle two.

Pattern Type: Reversal

Number of Candlesticks: 2

Looks Like/Narrative Meaning: a turning point or drawing of battle lines

Technical Specifications***

Technically, a counterattack line pattern must:

- Begin with a long candle moving with trend

- End with a candle of similar size moving against trend

- Completely fill the gap after the first period

In practicality though, many traders will make various exceptions.

- The candles don’t necessarily have to be long candles, as long as they are the same size.

- The candles don’t necessarily have to be the same size, as long as they are long candles.

- It can take two candles to fill the gap, as long as the combined length of the second and third candles equals the length of the first.

***Depending on who you ask, any of these standards may be more or less important. Moreover, some of these variations may be more properly classified as other reversal candlestick patterns.

Related Patterns:

- Similar to In Neck Pattern

- Similar to On Neck Pattern

For more detail, read our full breakdown on How to Trade Counterattack Lines Candlestick Patterns.

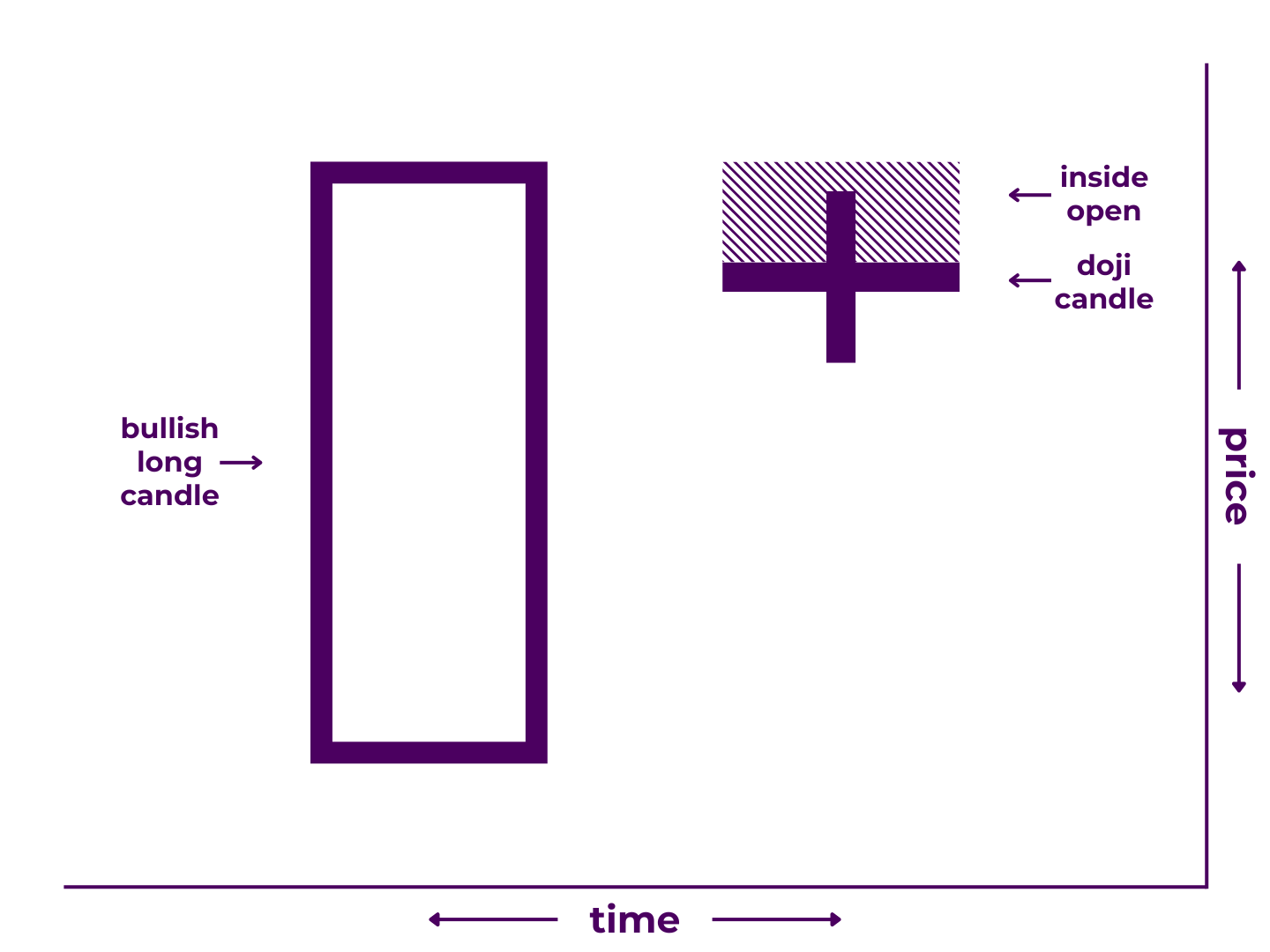

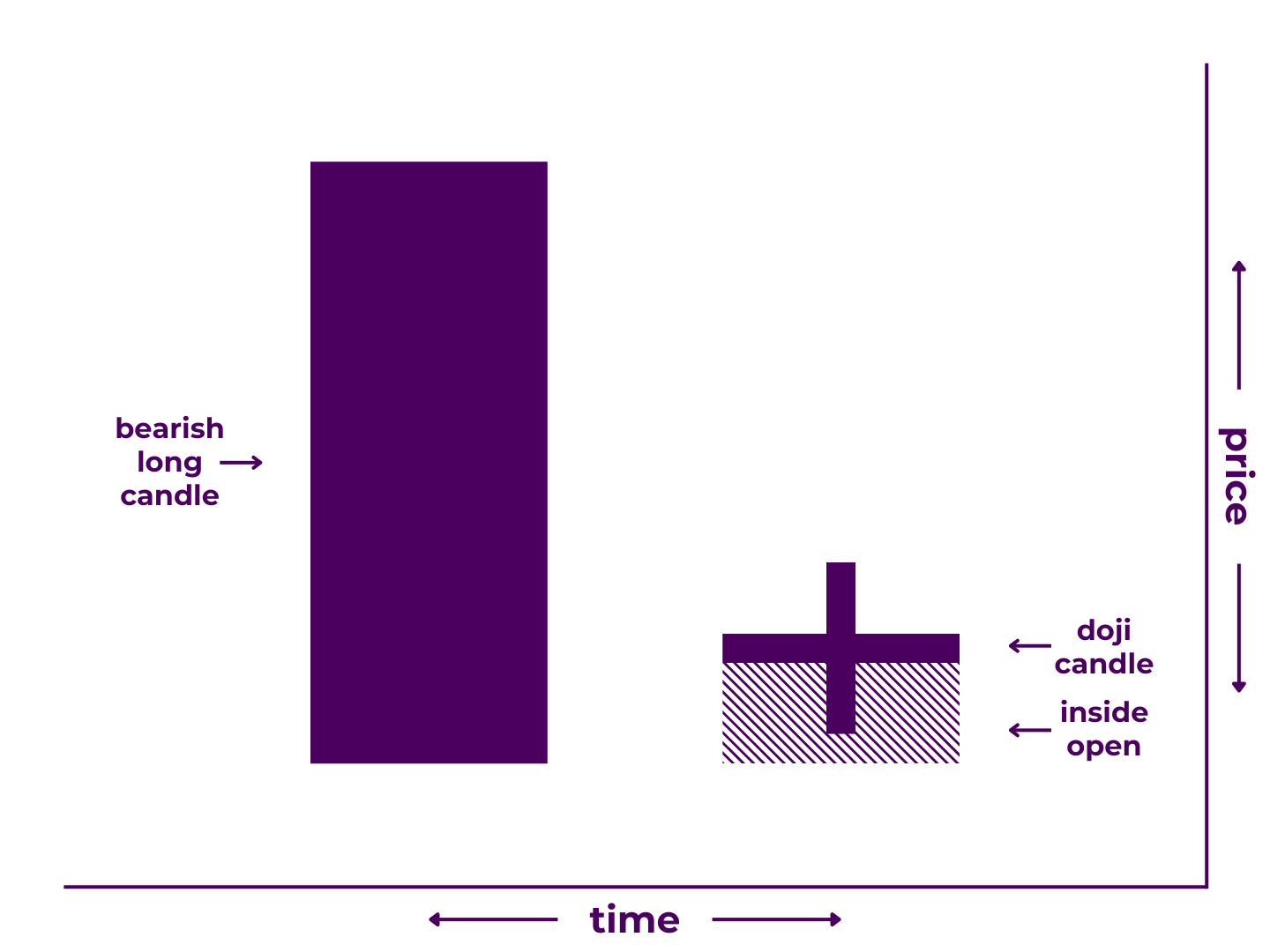

Doji Star

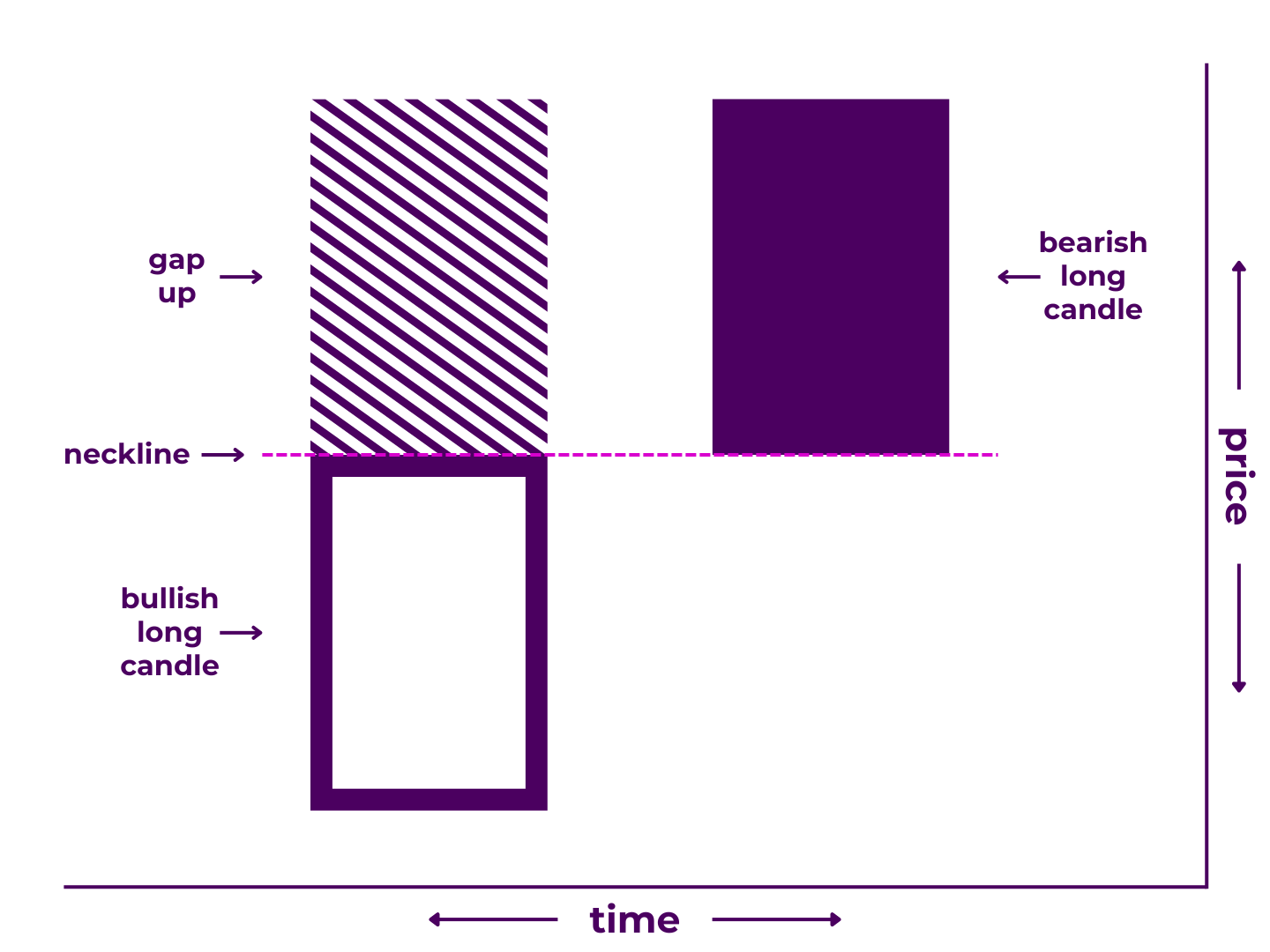

A doji star pattern is a 3-candlestick formation that may signal a reversal.

It is made up of a large candle moving in the direction of current trend, a doji, and another large candle that moves in the opposite direction of the first (and trend).

It comes in both bearish and bullish variations, known respectively as the evening doji star and morning doji star.

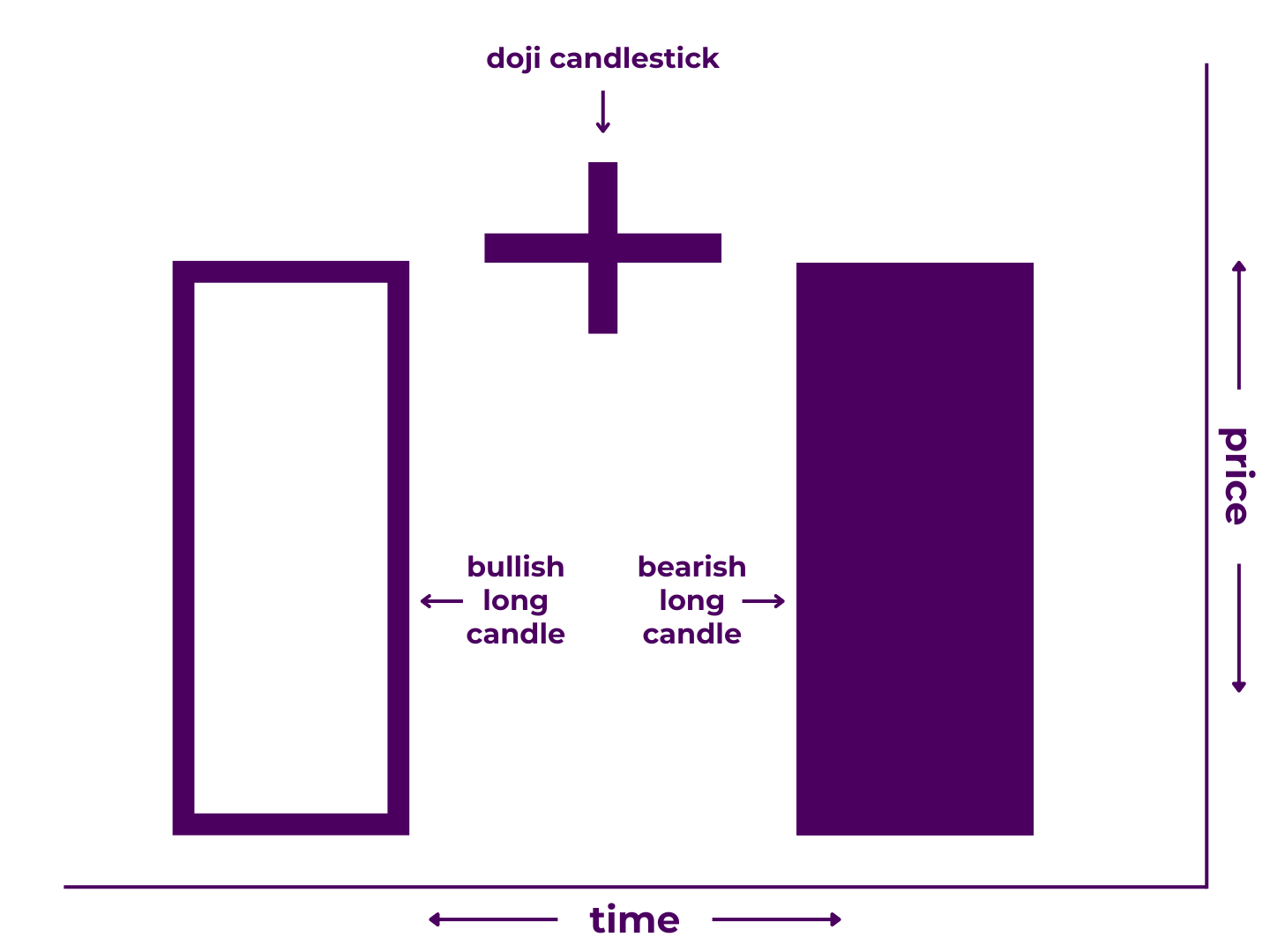

Bearish ones look like this:

Bullish ones look like this:

In trading terms:

- During the first period, the price drove strongly in the same direction as the overall trend.

- During the second period, neither side was able to maintain control.

- During the third period, price drove strongly in the opposite direction of the first period and trend.

Doji star patterns show that one side attempted to press their advantage on candle one, stalled on candle two, and finally surrendered all the momentum on candle three.

Pattern Type: Reversal

Number of Candlesticks: 3

Looks Like/Narrative Meaning: U-turn or counterpunch

Technical Specifications***

Technically, a doji star pattern must:

- Begin with a long candle moving with trend

- End with a candle of similar size moving against trend

- Have any doji other than a four-price doji as the second candle

- Contain no gaps

In practicality though, many traders will make various exceptions.

- The first and third candles can be different lengths, as long as they are both long line candles and/or test important price levels.

- The second candle doesn’t necessarily have to be a doji, as long as it is a short line candle.

- There can be more than one doji (or short candle) between the first and final candlestick.

***Depending on who you ask, any of these standards may be more or less important. Moreover, some of these variations may be more properly classified as other reversal candlestick patterns.

Related Patterns

- Similar to Abandoned Baby Pattern

- Similar to Star Pattern

For more detail, read our full breakdown on How to Trade Doji Star Candlestick Patterns.

Engulfing

An engulfing candlestick pattern is a 2-candlestick formation that may signal a reversal.

It is made up of one candle moving in the direction of current trend followed by a second candle that opens and closes above and below that of the first candle, or vice versa.

It comes in both bearish and bullish variations.

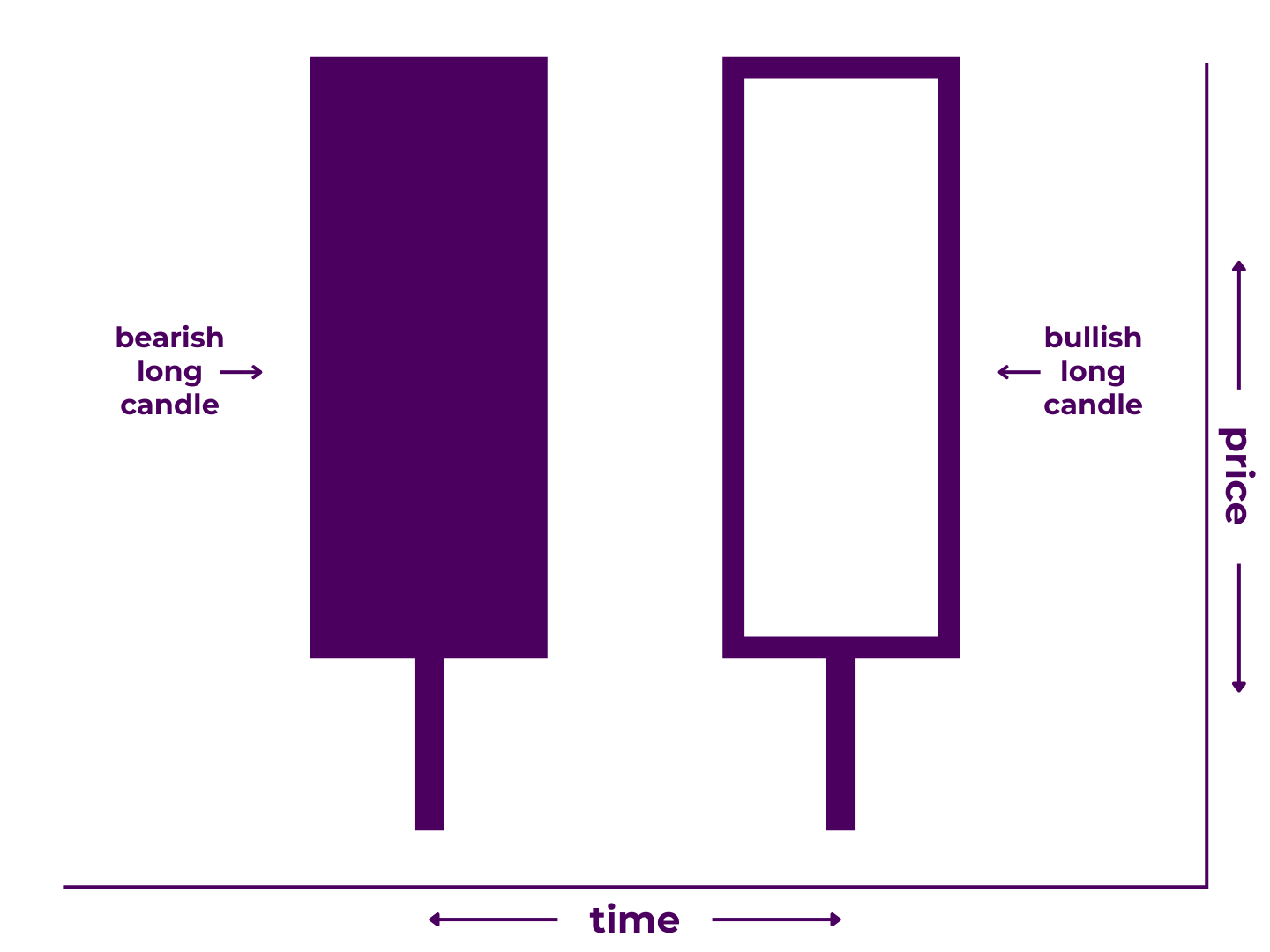

Bearish ones look like this:

Bullish ones look like this:

In trading terms:

- During the first period, price continued the ongoing trend.

- The second period opens with a gap in the direction of trend that is quickly filled as price proceeds to reclaim all the ground from the first day and then some, closing outside the open and close of the previous candle.

Engulfing candlestick patterns show that the momentum fizzled out on candle one, demonstrated by a counter-trend move on candle two.

Pattern Type: Reversal

Number of Candlesticks: 2

Looks Like/Narrative Meaning: dam break or counterpunch

Technical Specifications***

Technically, an engulfing candle pattern must:

- Begin with a candle moving in the direction of trend

- End with a candle of greater size moving against trend

- Have the first candle’s body contained completely within the body of the second

In practicality though, many traders will make various exceptions.

- The first candle can be a neutral candle (ie. a doji), as long as it is fully contained within the body of the second.

- The first candle can move against trend, as long as it is fully contained within the body of the second.

- The open of the second candle can be even with the close of the first candle, especially in markets where gaps are less common like cryptocurrency.

***Depending on who you ask, any of these standards may be more or less important. Moreover, some of these variations may be more properly classified as other reversal candlestick patterns.

Related Patterns

- Precursor of Three Outside Pattern

For more detail, read our full breakdown on How to Trade Engulfing Candlestick Patterns.

Harami

A harami pattern is a 2-candlestick formation that may signal a reversal.

It is made up of a long candle moving in the direction of current trend followed by a small candle moving in the opposite direction. The trading range of the second candle must be completely contained within that of the first.

It comes in both bearish and bullish variations.

Bearish ones look like this:

Bullish ones look like this:

In trading terms:

- During the first period, price continued the ongoing trend.

- Before the second period opened, price moved against the trend, opening within the range of the prior candle body.

- During the second period, price moved against trend to a modest degree, closing within the range of the prior candle body.

Harami patterns show that one side attempted to press their advantage on candle one, lost momentum between candles, and fully stalled out by the close of candle two.

Pattern Type: Reversal

Number of Candlesticks: 2

Looks Like/Narrative Meaning: birth of a counter-trend or counter-trend incubator

Technical Specifications***

Technically, a harami pattern must:

- Begin with a long candle moving with trend

- End with a short candle moving slightly against trend

- Have the second candle’s body and wicks contained completely within the body of the first

In practicality though, many traders will make various exceptions.

- The first candle doesn’t have to be a long candle, as long as it contains the second candle and moves in the direction of trend.

- The second candle doesn’t have to move against trend as long as it is neutral and/or very small.

- The second candle’s wick doesn’t have to be contained within the body of the first, as long as its body is.

- The open of the second candle can be even with the close of the first candle, especially in markets where gaps are less common like cryptocurrency.

- If additional, consecutive candles after the second candle remain contained within the body of the first candle, all would be included in the harami pattern.

***Depending on who you ask, any of these standards may be more or less important. Moreover, some of these variations may be more properly classified as other reversal candlestick patterns.

Related Patterns

- Similar to Harami Cross Pattern

- Precursor of Three Inside Pattern

For more detail, read our full breakdown on How to Trade Harami Candlestick Patterns.

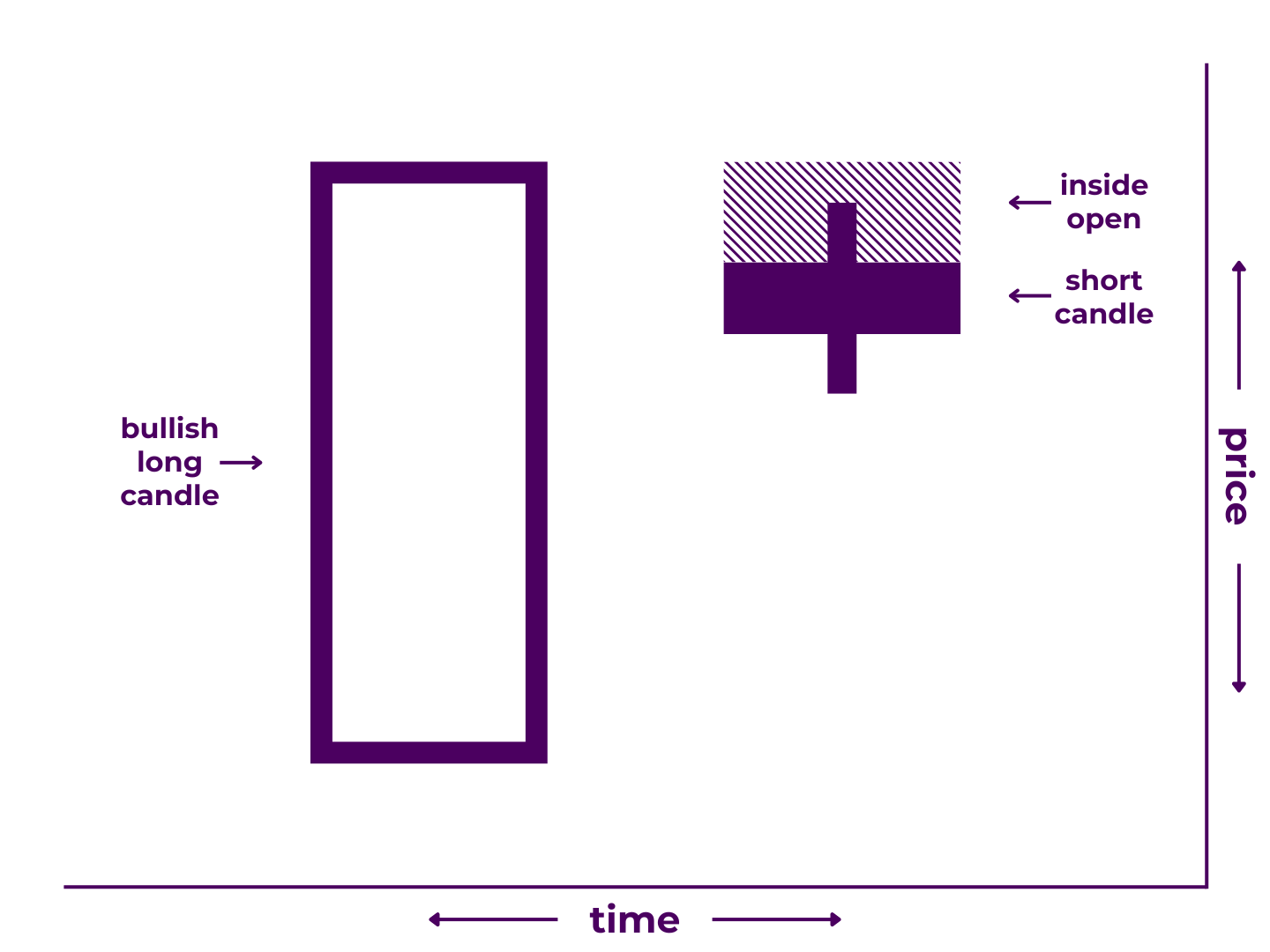

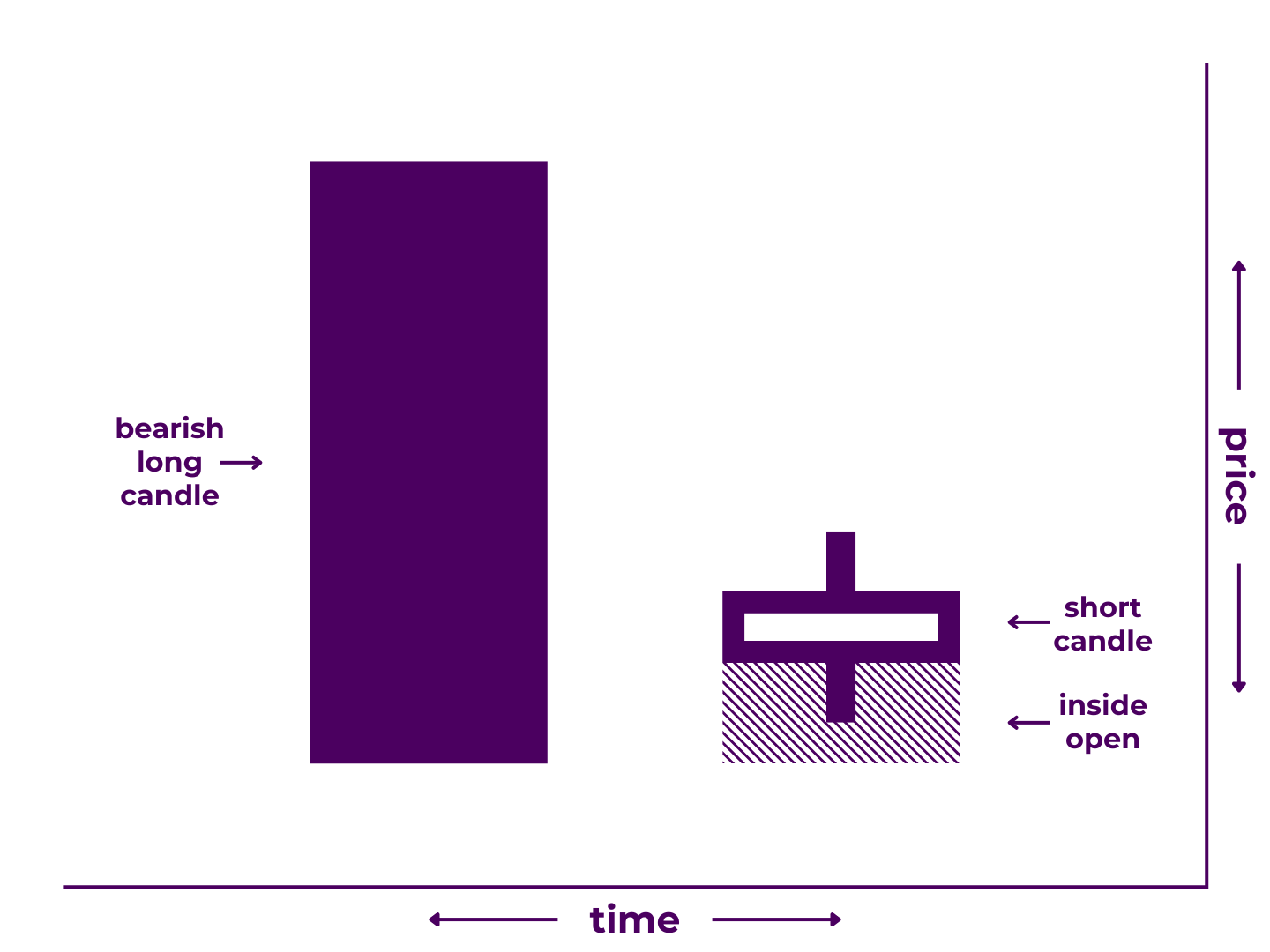

Harami Cross

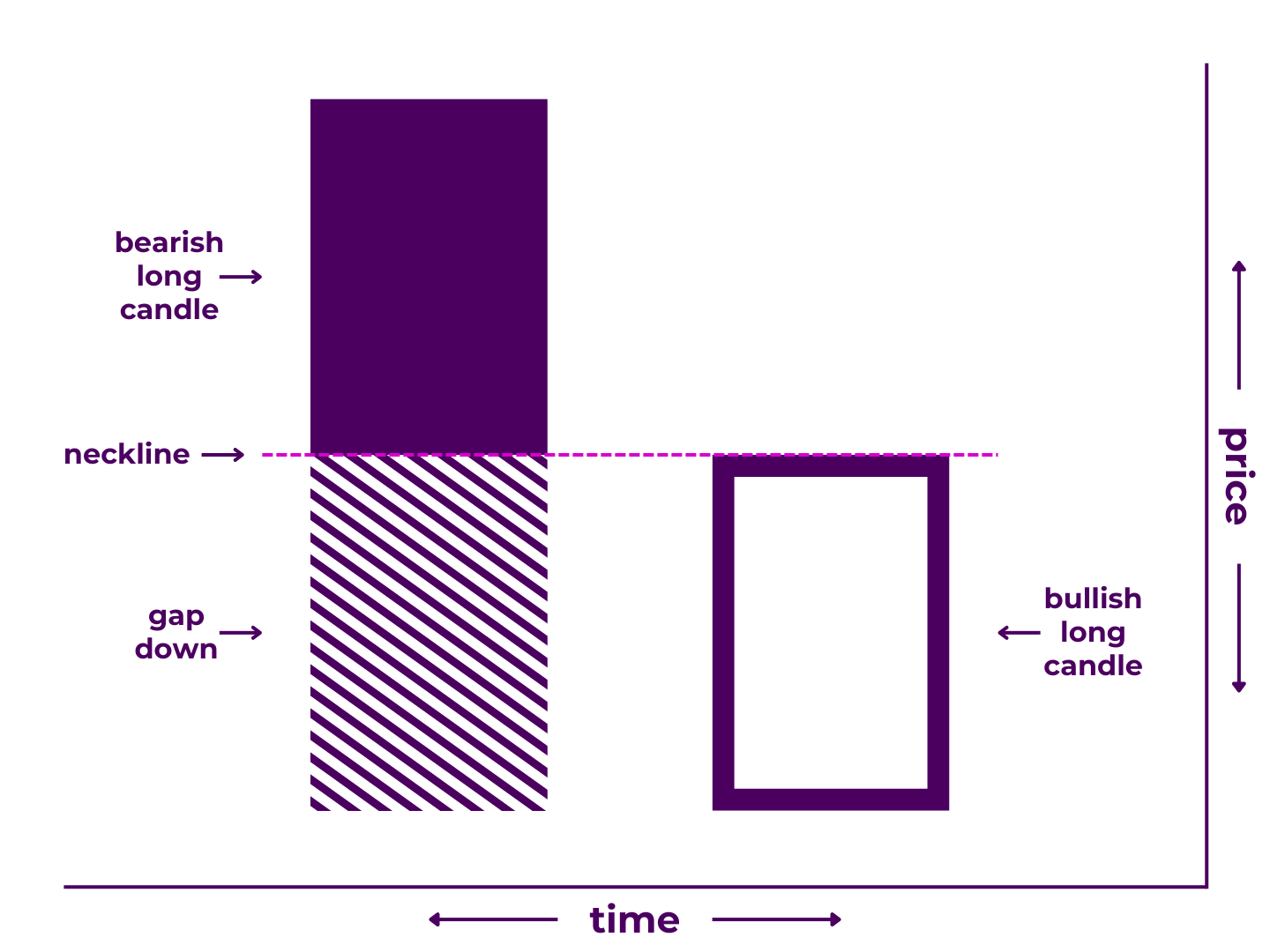

A harami cross pattern is a 2-candlestick formation that may signal a reversal.

It is made up of a long candle moving in the direction of current trend followed by a doji candlestick. The trading range of the second candle must be completely contained within that of the first.

It comes in both bearish and bullish variations.

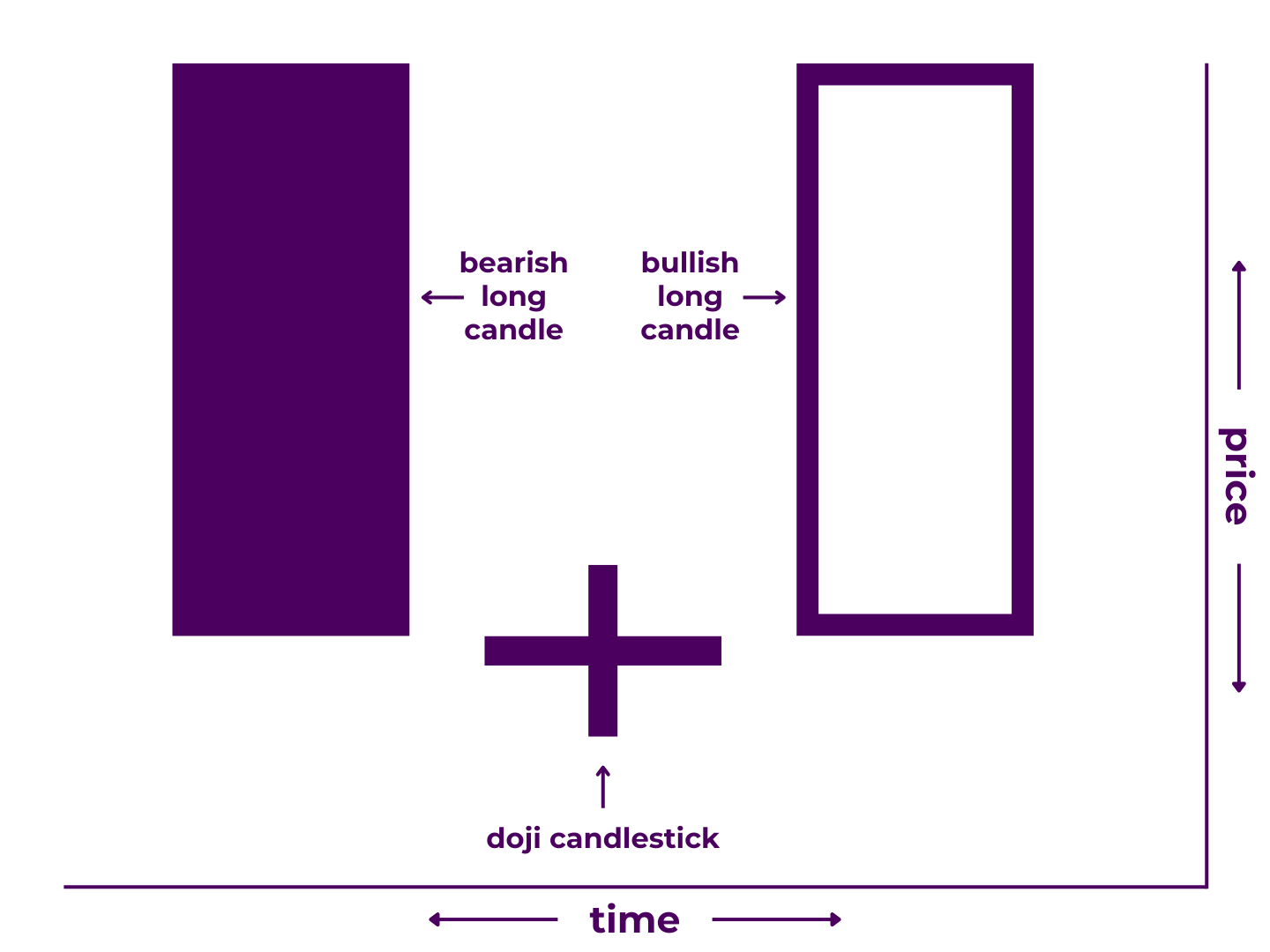

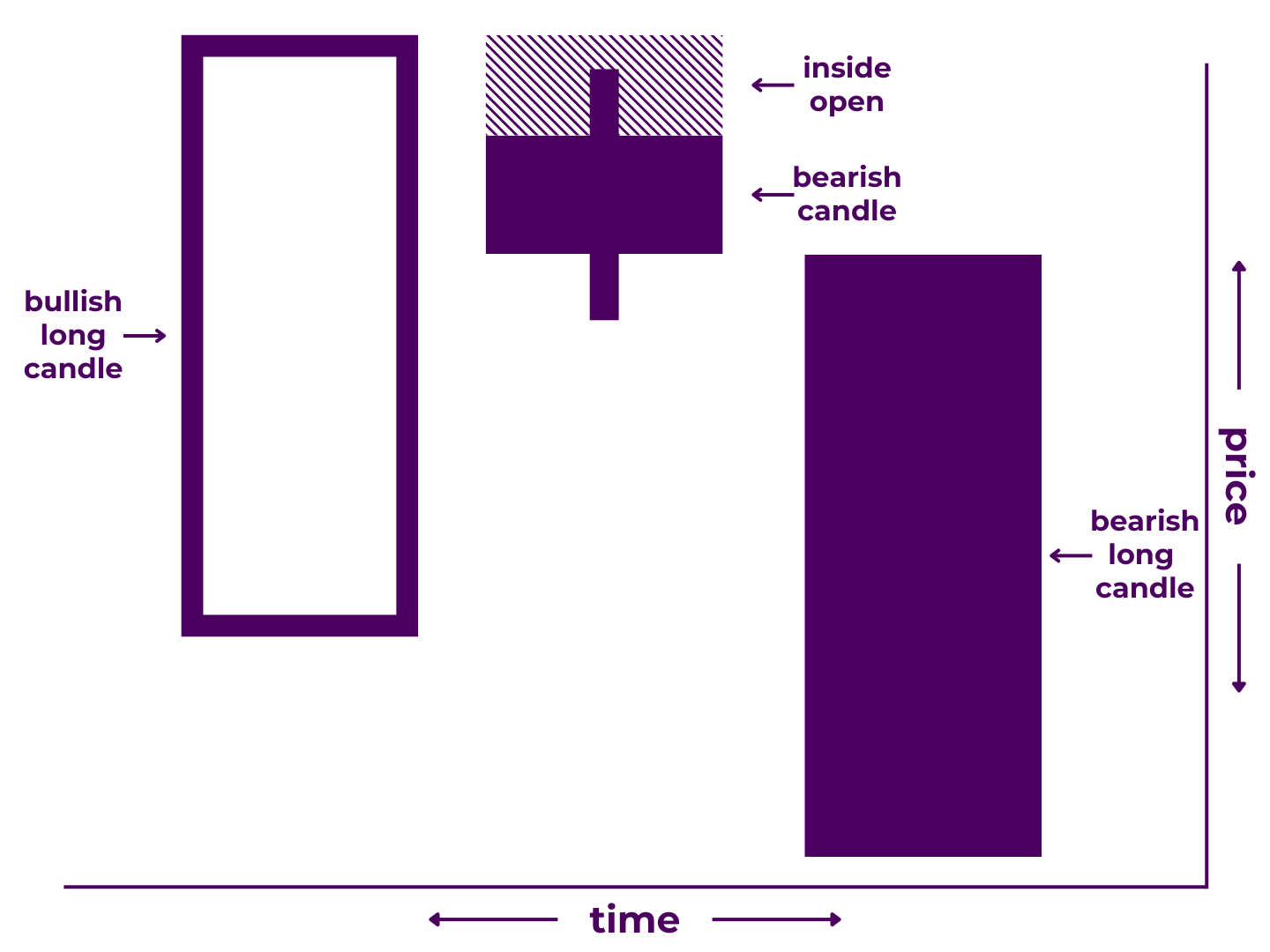

Bearish ones look like this:

Bullish ones look like this:

In trading terms:

- During the first period, price continued the ongoing trend.

- Before the second period opened, price moved against the trend, opening within the range of the prior candle body.

- During the second period, price stayed within the range of the prior candle body and closed at (or very near to) the open.

Harami cross patterns show that one side attempted to press their advantage on candle one, lost momentum between candles, and fully stalled out by the close of candle two.

Pattern Type: Reversal

Number of Candlesticks: 2

Looks Like/Narrative Meaning: birth of a counter-trend or counter-trend incubator

Technical Specifications***

Technically, a harami cross pattern must have:

- Begin with a long candle moving with trend

- End with a doji candlestick

- Have the second candle’s body and wicks contained completely within the body of the first

In practicality though, many traders will make various exceptions.

- The first candle doesn’t have to be a long candle, as long as it contains the second candle and moves in the direction of trend.

- The second candle’s wicks don’t have to be contained within the body of the first, as long as the open and close are.

- The open and close of the second candle can be even with the close of the first candle, especially in markets where gaps are less common like cryptocurrency.

- If additional, consecutive doji after the second candle remain contained within the body of the first candle, all would be included in the harami pattern.

***Depending on who you ask, any of these standards may be more or less important. Moreover, some of these variations may be more properly classified as other reversal candlestick patterns.

Related Patterns

- Similar to Harami Pattern

- Precursor of Three Inside Pattern

For more detail, read our full breakdown on How to Trade Harami Cross Candlestick Patterns.

Star

A star pattern is a 3-candlestick formation that may signal a reversal.

It is made up of a large candle moving in the direction of current trend, a short candle, and another large candle that moves in the opposite direction of the first (and trend).

It comes in both bearish and bullish variations, known respectively as the evening star and morning star.

Bearish ones look like this:

Bullish ones look like this:

In trading terms:

- During the first period, the price drove strongly in the same direction as the overall trend.

- During the second period, neither side was able to maintain control.

- During the third period, price drove strongly in the opposite direction of the first period and trend.

Star patterns show that one side attempted to press their advantage on candle one stalled on candle two, and finally surrendered all the momentum on candle three.

Pattern Type: Reversal

Number of Candlesticks: 3

Looks Like/Narrative Meaning: U-turn or counterpunch

Technical Specifications***

Technically, a star pattern must:

- Begin with a long candle moving with trend

- End with a candle of similar size moving against trend

- Have a short candle as the second candle

- Contain no gaps

In practicality though, many traders will make various exceptions.

- The first and third candles can be different lengths, as long as they are both long line candles and/or test important price levels.

- There can be more than one short candle between the first and final candlestick.

- There can be one or more gaps, as long as the overall structure remains the same.

***Depending on who you ask, any of these standards may be more or less important. Moreover, some of these variations may be more properly classified as other reversal candlestick patterns.

Related Patterns

- Similar to Abandoned Baby Pattern

- Similar to Doji Star Pattern

For more detail, read our full breakdown on How to Trade Star Candlestick Patterns.

Three Inside

A three inside pattern is a 3-candlestick formation that may signal a reversal.

It is made up of a large candle moving in the direction of trend followed by a shorter countertrend candle that opens and closes within the body of the first, then another countertrend candle that breaks through and closes beyond the open of the first candle.

It comes in both bearish and bullish variations, known respectively as the three inside up and three inside down.

Bearish ones look like this:

Bullish ones look like this:

In trading terms:

- During the first period, price drove strongly in the direction of trend.

- Before the second period opened, price moved against the trend, opening within the range of the prior candle body.

- During the second period, price moved against trend to a modest degree, closing within the range of the prior candle body.

- During the third period, price continued moving against trend, this time closing beyond the open of the first period.

Three inside patterns show that one side attempted to press their advantage on candle one, suffered immediate push back between market hours and through on candle two, and finally lost all momentum by the end of candle three.

Pattern Type: Reversal

Number of Candlesticks: 3

Looks Like/Narrative Meaning: U-turn or counterpunch

Technical Specifications***

Technically, a three inside pattern must:

- Begin with a long candle moving with trend

- Have a second candle that is an inside candle and moves against trend

- End with a long candle that breaks through the level set by first candle’s open and closes beyond it

In practicality though, many traders will make various exceptions.

- The first candle doesn’t necessarily have to be a long candle, as long as the second candle is an inside candlestick that moves against trend.

- The first second candle doesn’t necessarily have to be against trend, as long as it is an inside candle.

- There can be more than one inside candle between the first and final candles, as long as the final candle closes beyond the first candle’s open.

***Depending on who you ask, any of these standards may be more or less important. Moreover, some of these variations may be more properly classified as other reversal candlestick patterns.

Related Patterns

- Extension of Harami

- Extension of Harami Cross

For more detail, read our full breakdown on How to Trade Three Inside Candlestick Patterns.

Three Outside

A three outside pattern is a 3-candlestick formation that may signal a reversal.

It is made up of one candle moving in the direction of the current trend, followed by a large engulfing candlestick moving against trend, and finally a third candlestick that continues the move against trend.

It comes in both bearish and bullish variations, known respectively as the three outside down and three outside up.

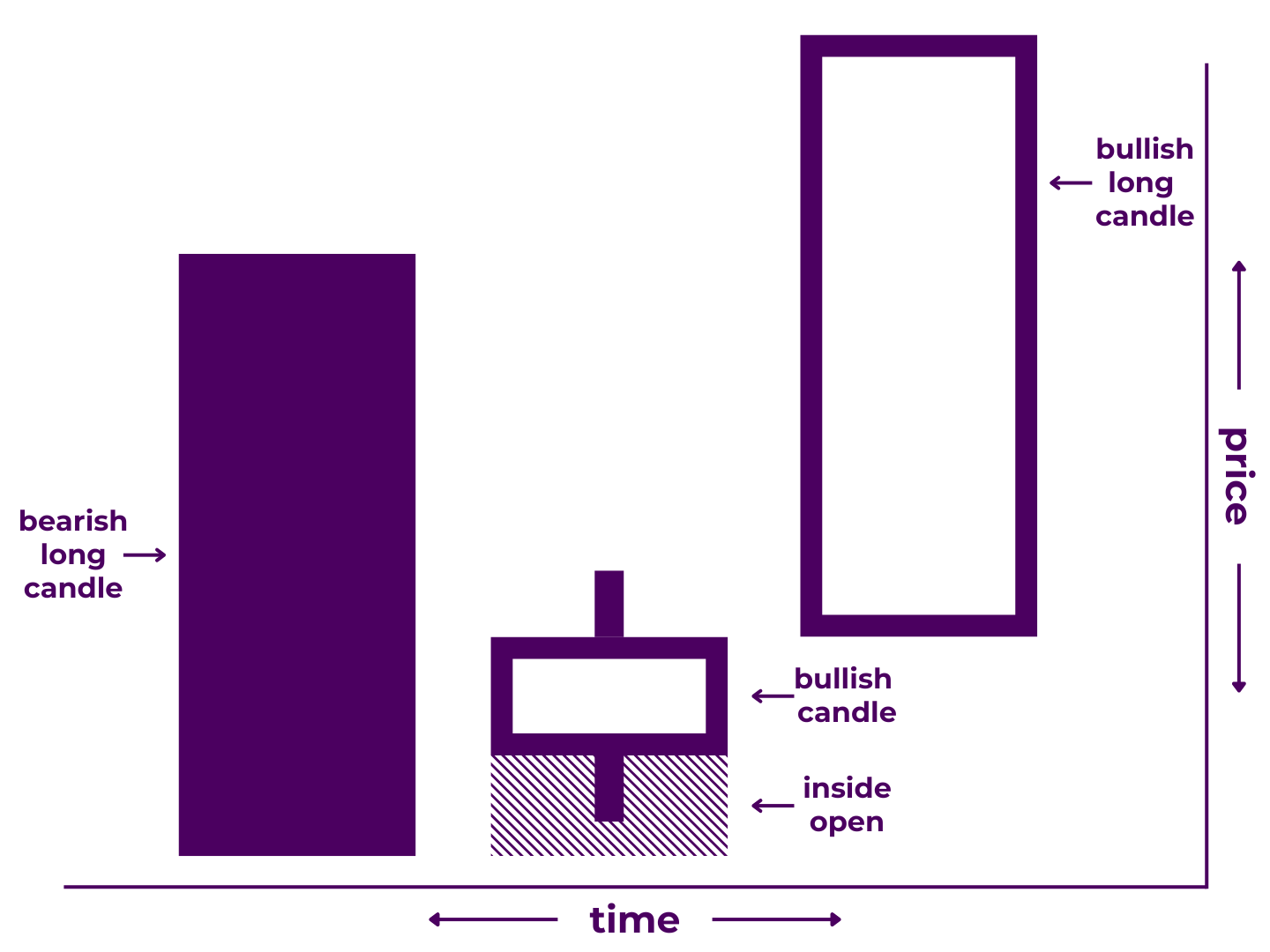

Bearish ones look like this:

Bullish ones look like this:

In trading terms:

- During the first period, price continued the ongoing trend.

- Before the second period opened, price continued moving with trend, creating a gapped open.

- During the second period, price moved against trend dramatically, closing beyond the open of the first period.

- During the third period, price moved against trend even further.

Three outside patterns show that one side attempted to press their advantage on candle, then again between candles one and two, were completely upended by the end of candle two, and continued to lose ground on candle three.

Pattern Type: Reversal

Number of Candlesticks: 3

Looks Like/Narrative Meaning: complete turnaround or devastating counterstrike

Technical Specifications***

Technically, a three outside pattern must:

- Begin with a (non-short) candle moving in the direction of trend

- Have a long engulfing candlestick moving against trend as the second candle

- End with a third candle moving in the same direction as the second (and against trend)

In practicality though, many traders will make various exceptions.

- The first candle can be a neutral/short candle (ie. a doji), as long as it is fully contained within the body of the second.

- The first candle can move against trend, as long as it is fully contained within the body of the second.

- The open of the second candle can be even with the close of the first candle, especially in markets where gaps are less common like cryptocurrency.

***Depending on who you ask, any of these standards may be more or less important. Moreover, some of these variations may be more properly classified as other reversal candlestick patterns.

Related Patterns

- Extension of Engulfing Candlestick Pattern

For more detail, read our full breakdown on How to Trade Three Outside Candlestick Patterns.

Tweezers

A tweezers pattern is a 2-candlestick formation that may signal a reversal.

It is made up of a large candlestick moving in the direction of trend followed by another one moving against trend. The wicks must be nearly even on the trend side of both candles and the first close must match the second open.

It comes in both bearish and bullish variations, known respectively as the tweezer top and tweezer bottom.

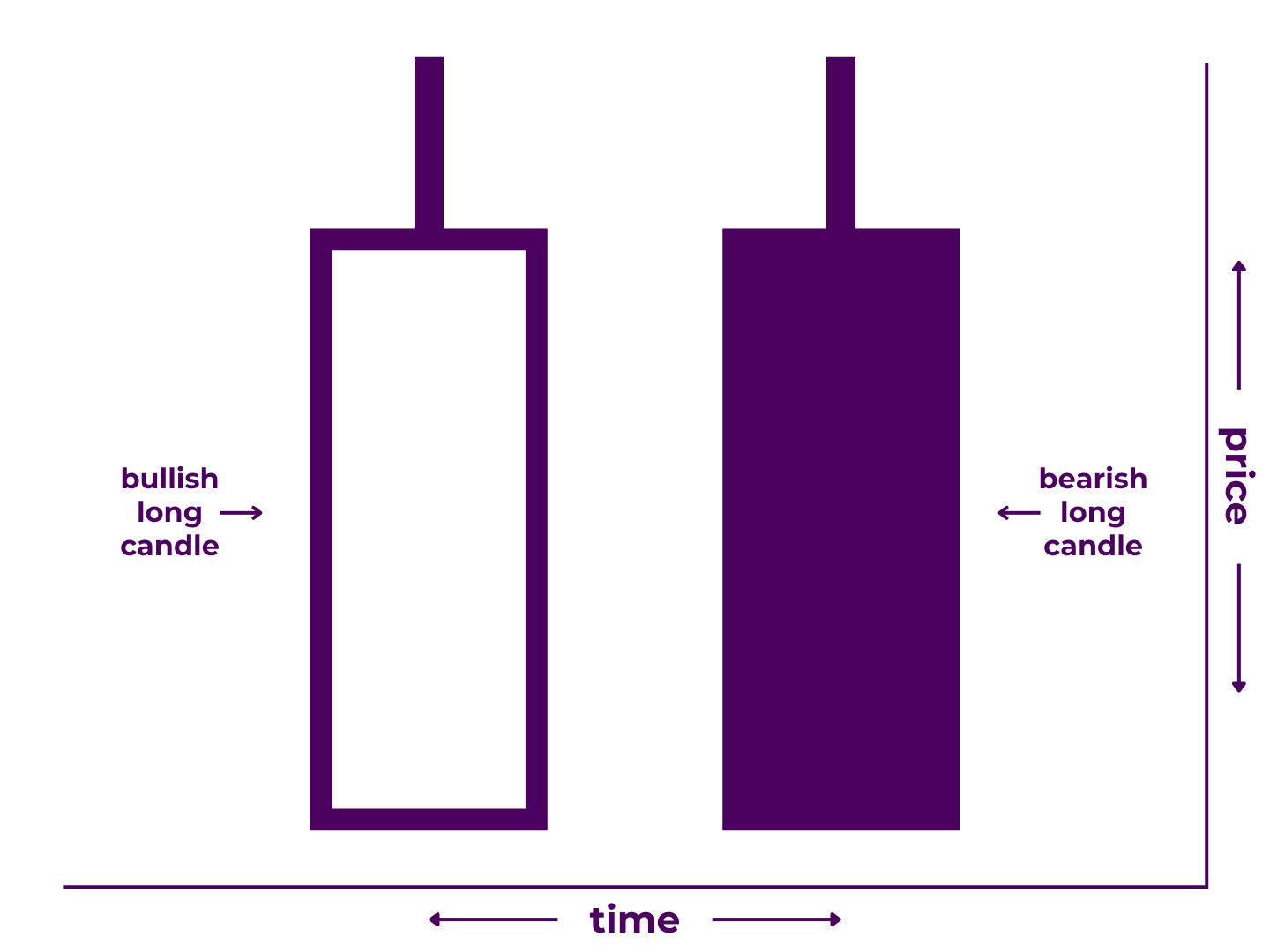

Bearish ones look like this:

Bullish ones look like this:

In trading terms:

- During the first period, the price drove strongly in the direction of trend but pulled back slightly before closing.

- During the second period, price begins moving in the direction of trend until it reaches the high or low of the previous period before switching directions to drive (and close) against trend.

Tweezers patterns show that one side attempted to press their advantage on candle one but lost their momentum sometime in the middle of candle two.

Pattern Type: Reversal

Number of Candlesticks: 2

Looks Like/Narrative Meaning: an about-face or price action 180

Technical Specifications***

Technically, a tweezers pattern must:

- Begin with a long candle moving with trend that has a wick in the direction of trend, such as a belt hold candlestick

- End with a long candle moving against trend that has a wick that matches the wick of the first candle

In practicality though, many traders will make various exceptions.

- The second candle doesn’t necessarily have to be a long candle as long as the wicks of both candles are even.

- The wicks don’t have to match exactly as long as both candles are long candles in which the open of the second matches the close of the first.

- The candles don’t necessarily have to have wicks as long as the candle bodies are nearly identical in size.

***Depending on who you ask, any of these standards may be more or less important. Moreover, some of these variations may be more properly classified as other reversal candlestick patterns.

Related Patterns

- none

For more detail, read our full breakdown on How to Trade Tweezer Candlestick Patterns.

Takeaways

Obviously, there are quite a few different candlestick patterns.

However, you don’t have to memorize all the names and exact specifications. Instead, focus on the principles of price action and technical analysis. That way, you’ll see what is going on with any candlestick formation, whether it fits into one of these categories or not.

At the end of the day, understanding candlestick patterns is only one piece of the puzzle. You’ll need more tools in the toolkit to read the full story in the charts—and even more than that if you want to put together a complete trading strategy.

Know of an important candlestick pattern we missed? Have some special insight into trading a specific pattern? Contribute to the conversation in the comments below! Or, share this post with a trader it might help. And if you haven’t already, check out our Candlestick Patterns Guide to learn the best ways to trade candlestick patterns.

0 Comments