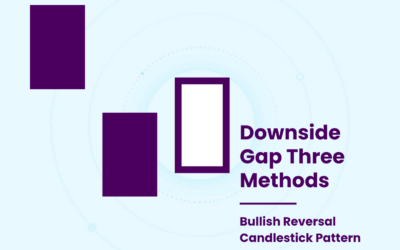

Downside gap three methods patterns are a lesser known but easily recognized candlestick pattern. Learning how to read and trade them adds a...

Candlestick Patterns

Playing Markets

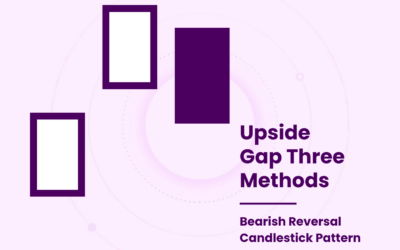

Upside Gap Three Methods

Upside gap three methods patterns are a lesser known but easily recognized candlestick pattern. Learning how to read and trade them adds a valuable...

Gap Three Methods

Gap three methods patterns are a lesser known but easily recognized candlestick pattern. Since candlesticks are the basic building block of most...

Bullish Tri-Star

Bullish tri-star patterns are a fairly uncommon but easily recognized candlestick pattern. Learning how to read and trade them adds a valuable...

Bearish Tri-Star

Bearish tri-star candlestick patterns are a fairly uncommon but easily recognized candlestick pattern. Learning how to read and trade them adds a...

Tri-Star

Tri-star patterns are a fairly uncommon but easily recognized candlestick pattern. Since candlesticks are the basic building block of most technical...

Bullish Three-Line Strike

Bullish three-line strike patterns are a rare but relatively high-performing candlestick pattern. Learning how to read and trade them adds a...

Bearish Three-Line Strike

Bearish three-line strike patterns are a rare but relatively high-performing candlestick pattern. Learning how to read and trade them adds a...

Three-Line Strike

Three-line strike patterns are a rare but relatively high-performing candlestick pattern. Since candlesticks are the basic building block of most...

Bullish Meeting Lines

Bullish meeting lines patterns are an easily recognized but fairly uncommon candlestick pattern. Learning how to read and trade them adds a valuable...

Bearish Meeting Lines

Bearish meeting lines candlestick patterns are an easily recognized but fairly uncommon candlestick pattern. Learning how to read and trade them...

Meeting Lines

Meeting lines patterns are an easily recognized but fairly uncommon candlestick pattern. Since candlesticks are the basic building block of most...