Bullish three-line strike patterns are a rare but relatively high-performing candlestick pattern.

Learning how to read and trade them adds a valuable weapon to your trading arsenal. Most technical analysis is based on Japanese candlestick charts, after all. In this post, we’ll go over everything you need to know to trade bullish three-line strike candle patterns.

Bullish Three-Line Strike Pattern Guide

To start, let’s define them.

What Is a Bullish Three Line Strike Candlestick Pattern?

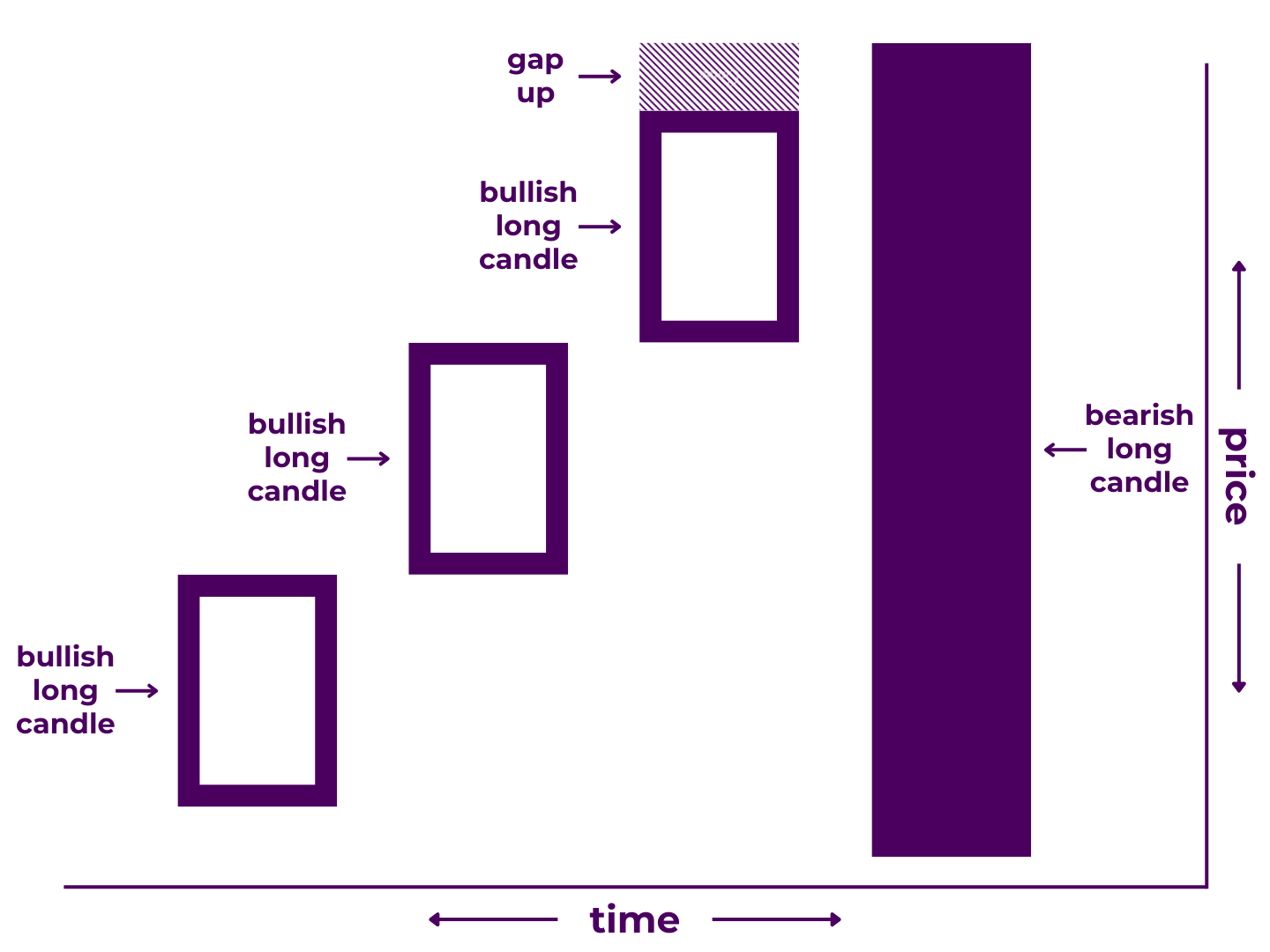

A bullish three-line strike is a bearish reversal formation. They occur during uptrends and consist of 1) the large-bodied candlesticks moving up and 2) a large-bodied candlestick moving down that is preceded by a gap up and closes below the open of the first candle.

***Please note, many sources list the bullish three-line strike as a bullish continuation pattern. However, various quantitative analyses show that it actually acts as a bearish reversal pattern, which also matches the way the pattern looks.

It is the bullish version of the three-line strike pattern, and therefore the opposite of the bearish three-line strike pattern. (Yes, you read that right. The confusion is due to naming issues, which we will discuss in the next section.) It is also similar to the bearish engulfing, three outside down, bearish breakaway, and ladder top patterns.

Of course, no candlestick pattern guarantees a particular outcome. They are more like suggestions than promises.

So, what do bullish three-line strike patterns really tell you?

What Bullish Three-Line Strike Patterns Mean

Three-line strikes may have the worst naming conventions of any candlestick pattern.

Unlike some patterns, English speakers do not use the Japanese name for this one. Instead, the term “three-line strike” is probably meant to represent the fact that the fourth candle cancels (or strikes) out the action of the first three. While this does make some sense, you’d assume a “three line” pattern would have only three lines.

Moreover, a “bullish” three line strike is actually a bearish reversal pattern while a “bearish” three line strike is actually a bullish reversal pattern. In our estimation, these patterns were mislabeled at some point because this doesn’t make any sense.

In trading terms:

- First Period – The price increases significantly, in line with the upward trend.

- Second Period – The price increases significantly, in line with the upward trend.

- Third Period – The price increases significantly, in line with the upward trend.

- Pre/Post-Market Trading – The price increases.

- Fourth Period – The price decreases significantly and closes lower than the open of the first period.

This threatens the ongoing uptrend and creates several decision zones that are likely to play a major role in determining trend direction. If buyers cannot push price back above the formation, it may lead to a bearish reversal and subsequent downtrend.

Figuratively, bullish three-line strikes indicate that the bulls may have struck out.

How To Recognize Bullish 3 Line Strike Candlestick Patterns

Patterns are attractive partly because they stand out.

To the untrained eye, they may mean nothing. But to those with experience, they are something like a beacon. They draw your attention to a specific segment of price action, encouraging you to look more closely.

To gain this insight, all you need to do is learn the rules and practice finding them on the charts.

By definition, a bullish three line strike pattern has several requirements.

- It must appear during a general uptrend.

- The first three candles must be bullish long-line candlesticks.

- The fourth candle must be a bearish long-line candlestick.

- The fourth candle must open with a gap up.

- The fourth candle must close below the body of the first candle.

As you can see, most of this pattern’s rules center around the fourth candlestick.

However, some exceptions may be acceptable.

- The first three candles don’t all necessarily have to be long candles, as long as they represent a significant cumulative price increase.

- The fourth candle doesn’t necessarily have to open with a gap, as long as it closes below the open of the first and all other criteria are met.

- The fourth candle doesn’t necessarily have to close below the open of the first, as long as it closes near it and all other criteria are met.

You may find better results by stretching some of these criteria (or even adding your own). For instance, your analysis may reveal that three-line strike patterns with larger gaps perform more reliably than those with smaller gaps. Or, you may find something else entirely.

Technically, these variations may fall more accurately under other candlestick reversal patterns.

This is okay though, as implication supersedes classification. And similar patterns usually have similar implications (though not always).

Yet, that does not mean that these standards are wholly irrelevant. In fact, certain ones are definitely mandatory, such as the direction of the candles in relation to trend. It just means that deeper examination may help you identify more and/or better trading opportunities.

Ultimately, how seriously you take each of these guidelines is up to you. Don’t forget that the purpose of analyzing candlestick patterns is to interpret underlying price action. Your pattern labeling skills are less important.

To this end, you need to understand where they fit.

Where Bullish 3 Line Strikes Fit in the Chart Narrative

The markets are often described as a battle between the bulls and the bears.

Bullish three line strike patterns show that the bulls pressed their advantage on candles one through three (and between candles three and four) then relinquished control to the bears by the end of candle four.

On the chart, it looks like an unexpected downturn.

Price surged dramatically for three straight days, extending the prevailing trend. After regular trading hours closed on the third day, price rose still further. On the fourth morning however, the tides began to turn. The bears showed up in force, pushing price back down. This led to a flurry of profit taking from buyers, adding even more selling pressure. A few hours later, news broke that created newfound fear in the asset’s fundamentals. From there, price plummeted. By the final bell, the movement of the previous three days was completely erased, with price closing below the open of the first day.

The stage is now set for a fight over the price levels highlighted by this price action. If sellers can defend these levels, the chance of a bearish reversal increases.

Please note: This is only an illustration. Bullish three-line strike patterns can reflect any number of real-world scenarios.

In the short-term, it amounts to a crippling counterattack.

The question for traders:

“Can the bears hit a homerun or will their reversal attempt strike out?”

To answer that question, you’ll need more than an understanding of Japanese candlesticks and candlestick patterns. You’ll want to evaluate both within the context of longer-term chart patterns as well as trend and price levels. You’ll also want to make use of your own chart markup and indicators.

Explore the history of your preferred asset(s) with respect to three-line strike candlestick patterns and apply your findings to your own trading style.

The more thorough your technical analysis, the more clear the story in the charts becomes.

How To Trade Bullish Three Line Strike Candle Patterns

Bearish reversal patterns are great places to enter shorts or exit longs, especially when you see them coming.

As such, bullish three-line strike candle patterns serve as easy-to-spot signs of potential changes from bullish to bearish momentum. They may even lead to cycle-ending tops.

In most cases, you can assign greater weight to multi-stick patterns than single candles because they provide more information over a longer duration. However, you should wait for all candles to close before making any decisions. Otherwise, there is a good chance that you’ll get caught in a fake out.

Additionally, there are a few other things you should consider before trading candlestick patterns.

First and foremost, they are never a “sure thing.” According to Bulkowski’s Encyclopedia of Candlestick Patterns, if you treat them as bearish reversal signals, bullish 3 line strikes have a hit rate of 84% (while bearish 3 line strikes have a hit rate of 65% as bullish reversal signals). Although these numbers are pretty good compared to most candlestick patterns, they still aren’t a certainty. And obviously, this comes in direct opposition to the continuation signal narrative.

What’s more, candlestick patterns do not have uniform price targets or measured moves like chart patterns do. That makes position management trickier.

Plus, failed reversal patterns often lead to continuation or consolidation. Thus, you’d be wise to seek additional confirmation factors to increase your odds of a successful trade.

- Volume – Reversals are often accompanied by elevated trading volume. For thee line strike patterns, you want to see a spike on the fourth candle (or shortly thereafter).

- Price Formations – Bearish reversal patterns that form just below important resistance levels tend to be more reliable. They also reinforce the strength of these levels.

- Oscillator Shift – Oscillating indicators like the RSI or stochastics are commonly used to identify reversals by analyzing slope, percentile, and/or divergence.

The more corroborating elements are present, the more confident you can be about the strength of a downward three-line strike reversal signal.

Even so, it would be difficult to build a successful trading strategy around any single candlestick pattern. There simply isn’t enough there to develop a strong edge. It would still be suboptimal with an expert understanding of trading math, order execution, market psychology, risk management, options, and automation.

In essence, 3 line strike patterns are more useful idea givers than trade makers.

Better yet, you’ll probably find more success building your strategy around other tools and using candlestick patterns as the final point of confirmation.

Other Candlestick Pattern Types

There are many bearish reversal candlestick patterns.

The bullish three-line strike is only one.

Likewise, there are many bullish reversal candlestick patterns. Not to mention, you have bearish continuation candlestick patterns and bullish continuation candlestick patterns.

For most traders though, tackling all candlestick patterns at once may be the best learning path.

- Abandoned Baby – Bearish | Bullish

- Breakaway – Bearish | Bullish

- Counterattack Lines – Bearish | Bullish

- Doji Star – Evening | Morning

- Engulfing – Bearish | Bullish

- Gap Three Methods – Upside | Downside

- Harami – Bearish | Bullish

- Harami Cross – Bearish | Bullish

- In Neck – Bearish | Bullish

- Kicking – Down | Up

- Ladder – Top | Bottom

- Last Engulfing – Bottom | Top

- Mat Hold – Bearish | Bullish

- Matching – High | Low

- Meeting Lines – Bearish | Bullish

- On Neck – Bearish | Bullish

- Separating Lines – Bearish | Bullish

- Star – Evening | Morning

- Stomach – Below | Above

- Tasuki Gap – Downside | Upside

- Three Inside – Down | Up

- Three Methods – Falling | Rising

- Three Outside – Down | Up

- Tri-Star – Bearish | Bullish

- Tweezer – Top | Bottom

- Window – Falling | Rising

Sure, it is quite a long list.

Luckily for us all, you don’t need to memorize every pattern and its criteria. Instead, focus on price action and technical analysis principles. The goal is to be able to look at any group of candlesticks and understand what they mean.

The more candlestick patterns you study, the easier this will become.

Takeaways

To review:

Bullish 3-line strikes are a type of candlestick pattern that signal a potential bearish reversal. While not a guarantee, their appearance may indicate that market conditions are shifting in favor of sellers. When used properly, this can help you find winning trades.

Of course, there are other candlestick patterns that you should learn about. Still, the ability to recognize patterns is not enough to trade successfully on its own.

Nonetheless, you’ve now added one more weapon to your trading arsenal.

Have questions or more information to add? Contribute to the conversation in the comments below! Or, if you know someone who could benefit from this post, share it with them. You can also check out our Candlestick Patterns Guide to improve your candlestick analysis skills.

0 Comments