So you want to learn about indecision candlesticks, huh?

Smart choice.

Recognizing signs of indecision in the market is a useful skill all traders should master.

Here, we will go over the 3 different types of candlesticks that may signal indecision.

Indecision Candlestick Types

Let’s jump into it.

Indecision Candlesticks

Different types of candlesticks imply different biases.

Some candlesticks signal potential bearish price action. Others signal potential bullish price action. Yet others signal potential market indecision (like the ones highlighted in this post).

Key word:

Potential.

That’s why it can seem slightly misleading to label candlesticks this way. To make predictions based on an individual candlestick is folly. Remember, a candlestick is a representation of a single time period in the past.

Indecisive candles only tell you that neither the bulls nor the bears could maintain control during the time period of the candle. They do not guarantee that that indecision will continue into future price action.

However, these labels do exist for a reason.

Certain types of candlesticks are often spotted preceding periods of consolidation, reversal, or other pivotal moments when the market is trying to make up its mind.

These are what we call indecision candlesticks.

Doji

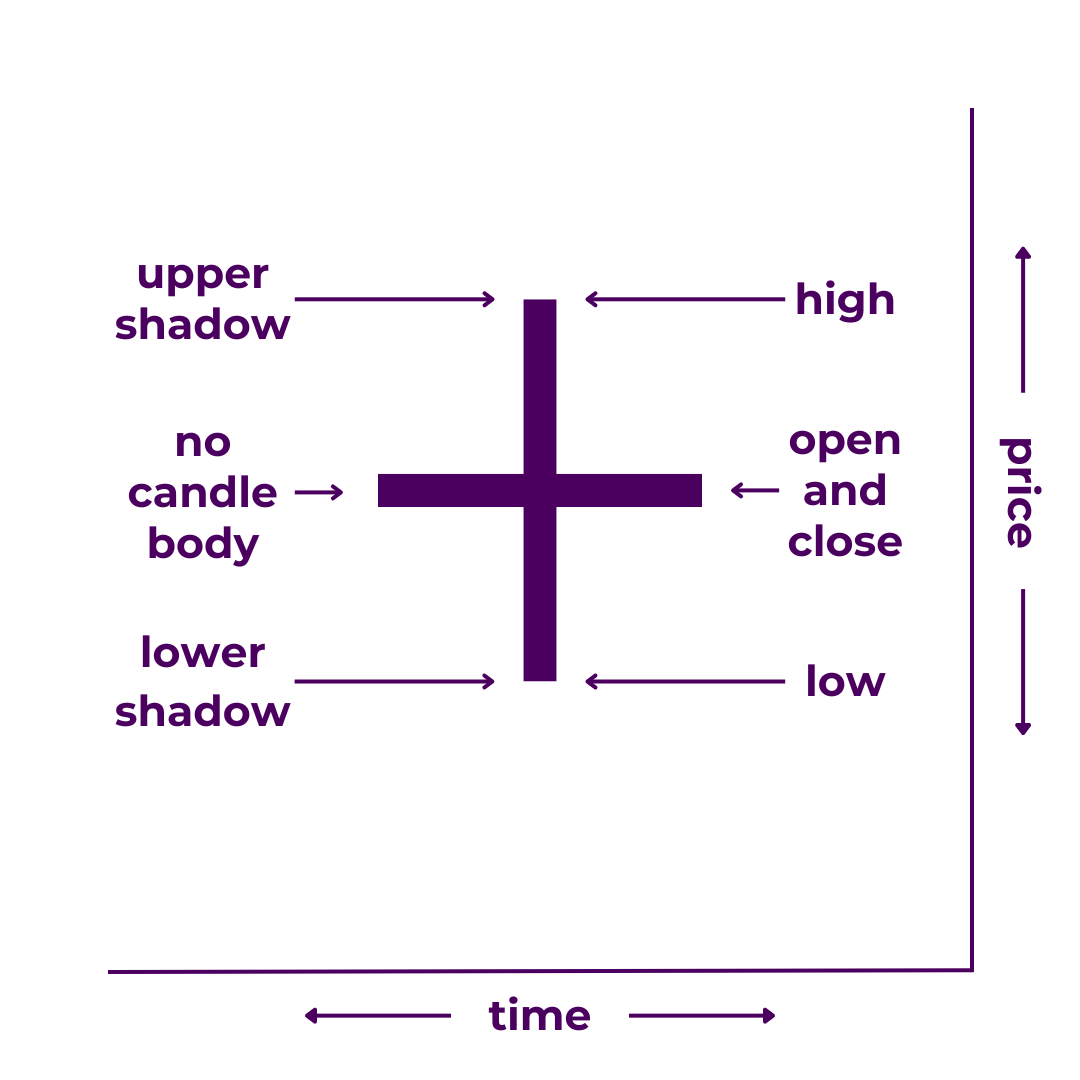

A doji is a candlestick without a real body.

It indicates that the open and close prices are the same, regardless of the total trading range. In trading terms, a doji candle signals indecision.

A doji candlestick paints a picture of a crossroads. Without a candle body, the trading range (wick-to-wick) usually stands out most. On the chart, it looks like a price action tug-o-war. Some doji do give a directional bias. However, most of them send the message that “it could go either way.”

Technical Specifications

Technically, doji should have the exact same opening and closing prices. In practical application though, “perfect” doji are comparatively rare. If the body is insignificant, you can treat it like a doji (though it may technically be a spinning top or similar).

Sentiment: Neutral/Indecision

Look for Them During

- Market Indecision

- Reversals

- Trending Moves

- Volatile Periods

Related Candlesticks

- Parent Type of Dragonfly Doji

- Parent Type of Gravestone Doji

- Parent Type of Long-Legged Doji

- Similar to Spinning Tops

- Similar to Hammers

Read our full breakdown of Doji Candlesticks.

Long-Legged Doji

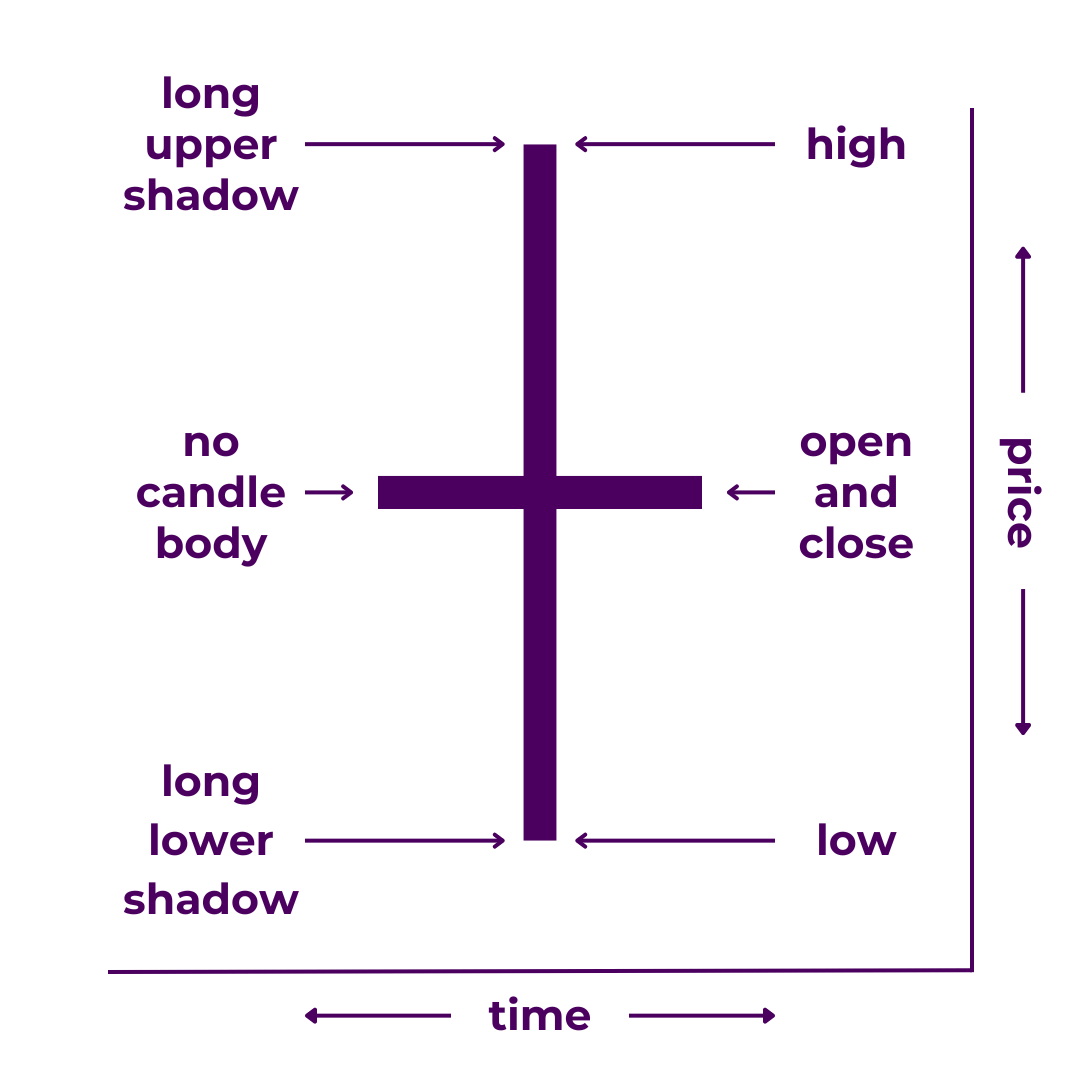

A long-legged doji is a candlestick with no real body and long shadows.

It indicates that the open and close prices are the same, in the middle of a large trading range. In trading terms, a long-legged doji candle signals indecision.

A long-legged doji candlestick paints a picture of a crossroads. Without a candle body, the trading range (wick-to-wick) usually stands out most. On the chart, it looks like a dramatic price action tug-o-war. Unlike some types of doji, long-legged do not give a directional bias. They send a clear message: “It could go either way.”

Technical Specifications

Technically, long-legged doji should have the exact same opening and closing prices and wicks of equal length. In practical application though, “perfect” long-legged doji are comparatively rare. If the body is insignificant and wicks are long, you can treat it like a long-legged doji.

Sentiment: Neutral/Indecision

Look for Them During

- Market Indecision

- Reversals

- Consolidation

- Peak Volatility

Related Candlesticks

- Subtype of Doji

- Similar to Spinning Tops

Read our full breakdown of Long-Legged Doji Candlesticks.

Spinning Top

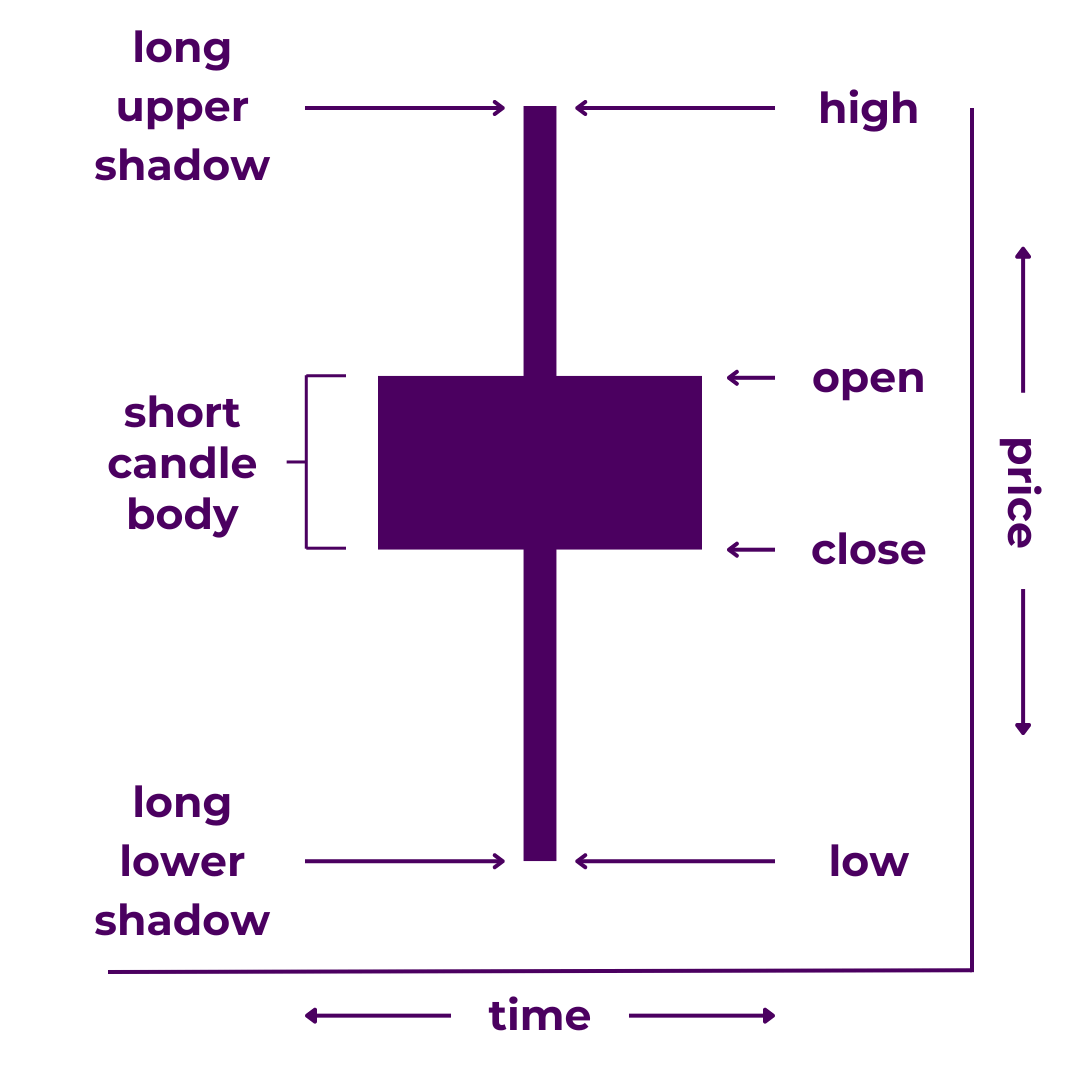

A spinning top is a candlestick with a small body in the middle of long upper and lower shadows.

It indicates a small difference between the open and close prices within a large trading range. In trading terms, a spinning top candle signals indecision.

A spinning top candlestick paints a picture of a crossroads. With a small body, the trading range (wick-to-wick) usually stands out most. On the chart, it looks like a dramatic price action tug-o-war with no clear winner. They send a message: “It could go either way.”

Technical Specifications

Technically, spinning tops should have wicks of equal length. It doesn’t matter which color the body is. In practical application though, “perfect” spinning tops are comparatively rare. If both wicks are much longer than the body and fairly equal, you can treat it like a spinning top. If the body is negligible or non-existent, it would technically be a long-legged doji. However, there is no need to get hung up on the specific classification. The implications are generally the same either way.

Sentiment: Neutral/Indecision

Look for Them During

- Indecision

- Reversals

- Consolidation

- Peak Volatility

Related Candlesticks

- Similar to Doji

- Similar to Long-Legged Doji

Read our full breakdown of Spinning Top Candlesticks.

Takeaways

Obviously, there are a ton of different candlestick types.

However, you don’t have to memorize all the names and exact specifications. Instead, focus on the principles behind the analysis. That way, you’ll see what is going on with any candlestick, no matter its name or implications.

At the end of the day, understanding candlesticks is but one piece of the puzzle. You’ll need more tools in the toolkit to read the full story in the charts—and even more than that if you want to put together a complete trading strategy.

Have questions? Know of an important candlestick type we missed? Have some special insight into trading a specific type? Contribute to the conversation in the comments below! Or, if you know someone who could benefit from this post, share it with them. You can also check out our Japanese Candlesticks Guide to improve your candlestick analysis skills.

0 Comments