So you want to learn about bearish candlesticks, huh?

Smart choice.

Recognizing signs of bearish conditions in the market is a useful skill all traders should master.

Here, we will go over the 5 different types of candlesticks that may signal bearish sentiment.

Bearish Candlestick Types

Let’s jump into it.

Bearish Candlesticks

Different types of candlesticks imply different biases.

Some candlesticks signal potential bearish price action (like the ones highlighted in this post). Others signal potential bullish price action. Yet others signal potential market indecision.

Key word:

Potential.

That’s why it can seem slightly misleading to label candlesticks this way. To make predictions based on an individual candlestick is folly. Remember, a candlestick is a representation of a single time period in the past.

Bearish candles only tell you that sellers maintained control (or at least finished with control) during the time period of the candle. They do not guarantee that that bearishness will continue into future price action.

However, these labels do exist for a reason.

Certain types of candlesticks are often spotted preceding bearish reversals or during bearishly trending moves.

These are what we call bearish candlesticks.

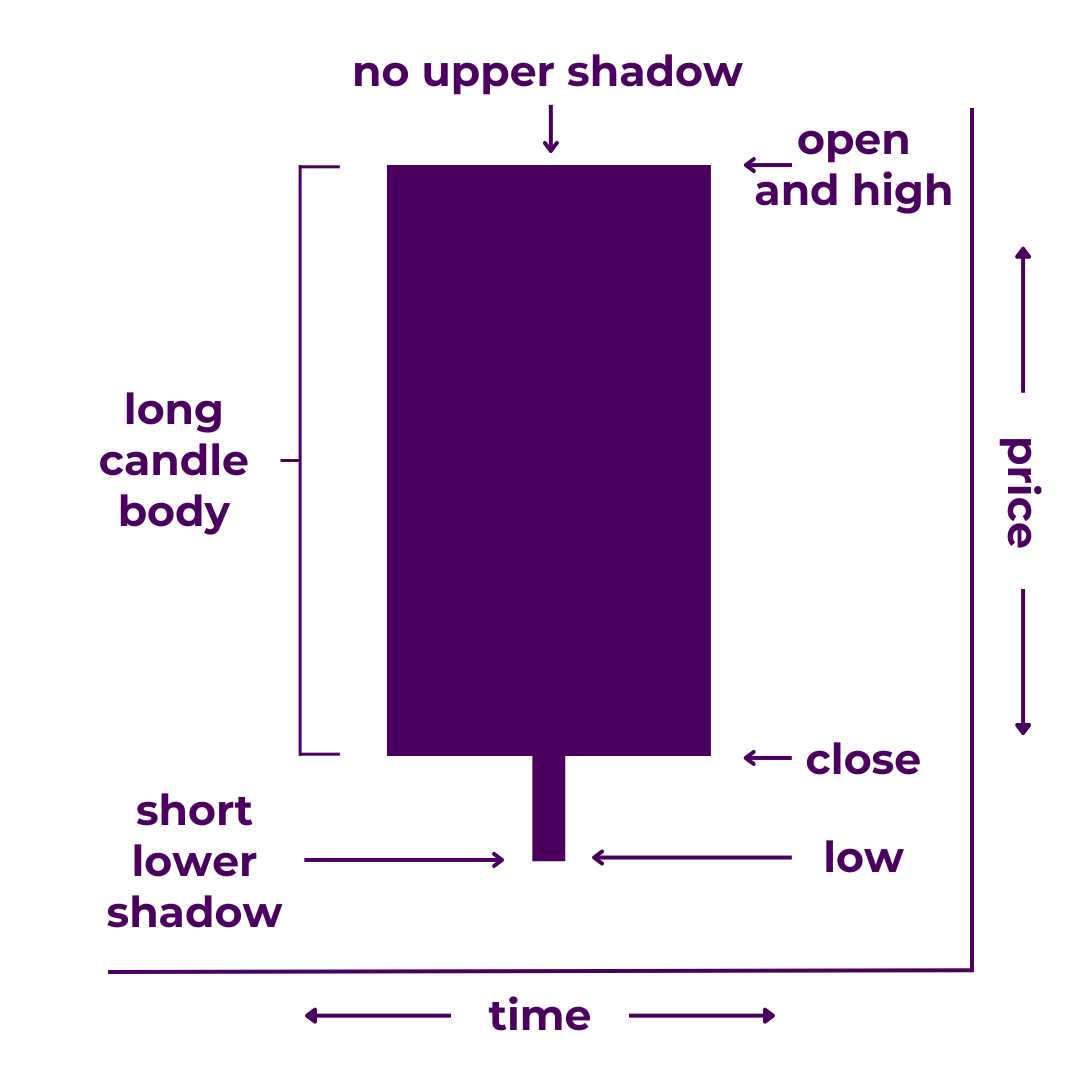

Bearish Belt Hold

A bearish belt hold (or “yorikiri”) is a long candlestick with no upper shadow and a short lower shadow.

It indicates that the open and high prices match and are far above the close and low prices. In trading terms, a bearish yorikiri shows that the price dropped from the open considerably and closed near the low for that time period.

A bearish belt hold paints a picture of near-total dominance. On the chart, it looks like non-stop price movement for an entire period. With such a large body, the color of the candle always stands out. You can almost hear the bulls crying, “Please, no more!” while the bears cheer, “We’ve got them on the ropes!”

Technical Specifications:

Technically, bearish yorikiri should not have an upper wick at all. Some traders may even attempt to assign criteria to the length of the body or lower wick. For most though, this is total overkill.

In addition:

Some traders contend that it’s not officially a bullish belt hold unless it appears at the end of a downtrend, signaling a bullish reversal—which would make it more of a multi-candlestick pattern.

Sentiment: Strong Bearish

Look for Them During

- Volatile Periods

- Trending Moves

- Reversals

Related Candlesticks

- Opposite of the Bullish Belt Hold

- Subtype of Long Candlestick

- Similar to Bearish Marubozu

Read our full breakdown of Bearish Belt Hold Candlesticks.

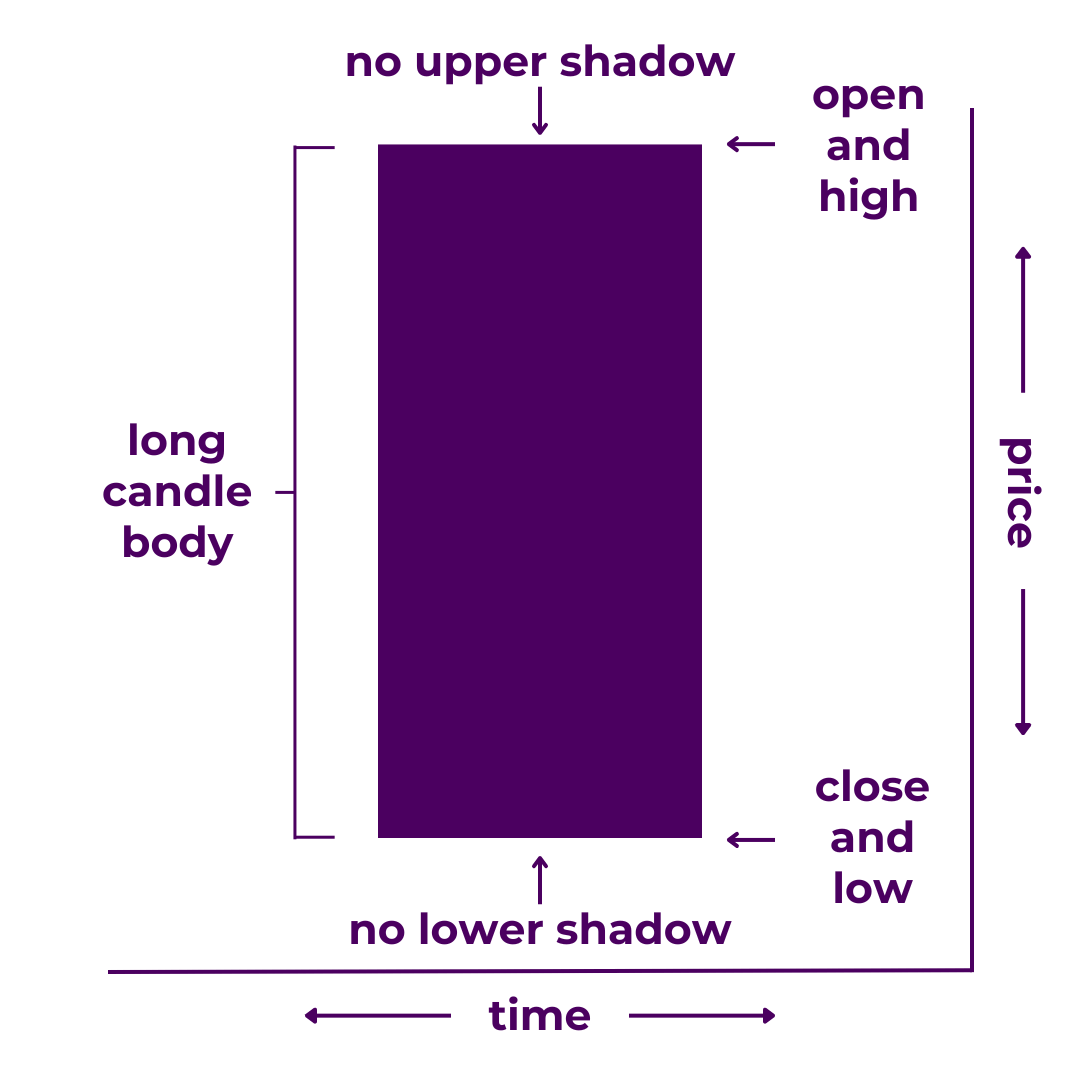

Bearish Marubozu

A bearish marubozu is a long red (or black) candlestick without shadows.

It indicates that price opened at the high and closed at the low of a large trading range. In trading terms, a bearish marubozu candle signals dominance for the sellers.

A bearish marubozu candlestick paints a picture of overwhelming negative momentum. On the chart, it looks like non-stop bearish price movement for an entire period. Without any wicks, the color of the candle always stands out. Bearish marubozu seem to wail, “Going doooown.”

Technical Specifications

Technically, bearish marubozu shouldn’t have any wicks at all. However, “perfect” marubozu are comparatively rare. If the wicks are insignificant, you can basically treat it like a marubozu. All types of bearish long candles have roughly the same implications anyway.

Sentiment: Strong Bearish

Look for Them During

- Trending Moves

- Reversals

- Volatile Periods

Related Candlesticks

- Subtype of Long Candlestick

- Similar to Bearish Belt Hold

- Similar to Bullish Belt Hold

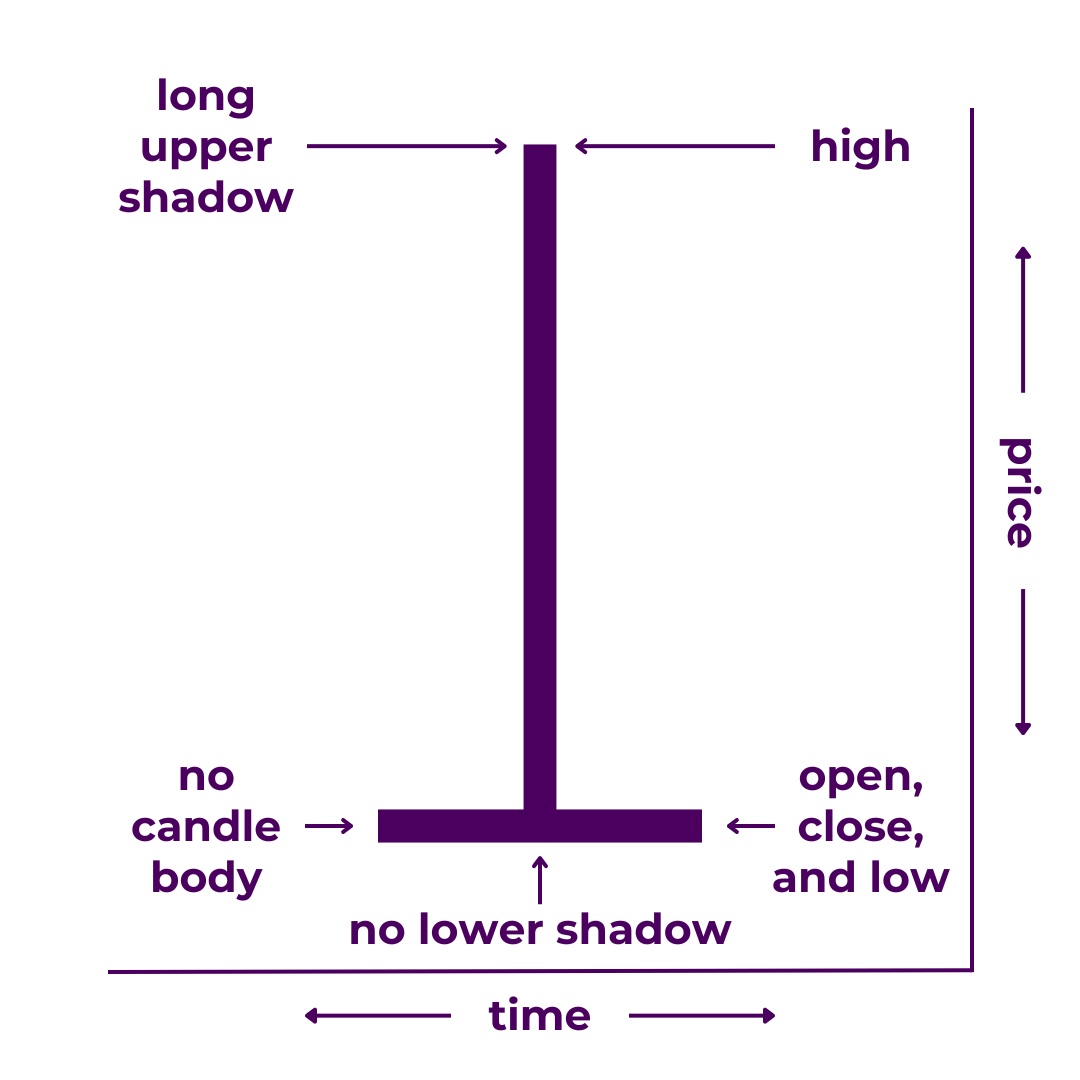

Gravestone Doji

A gravestone doji is a candlestick with no real body, no lower shadow, and a long upper shadow.

It indicates that open and close prices are the same and at the bottom of the trading range. In trading terms, a gravestone doji candle signals bearish momentum.

Gravestone doji paint a picture of a dead price walking. Without a candle body, the long upper wick usually stands out most. On the chart, it looks like the bears are ready to win the tug-o-war. Meanwhile, the bulls cling on for dear life, crying, “Not yet!”

Technical Specifications

Technically, doji should have the exact same opening and closing prices. In practical application though, “perfect” gravestone doji are comparatively rare. If the body is insignificant, you can treat it like a doji (though it may arguably be an inverted hammer or similar).

Sentiment: Strong Bearish

Look for Them During

- Topping Formations

- Reversals

- Trending Moves

- Volatile Periods

Related Candlesticks

- Subtype of Doji

- Opposite of Dragonfly Doji

- Similar to Shooting Stars

- Similar to Inverted Hammers

- Same Implications as Hanging Men

Read our full breakdown of Gravestone Doji Candlesticks.

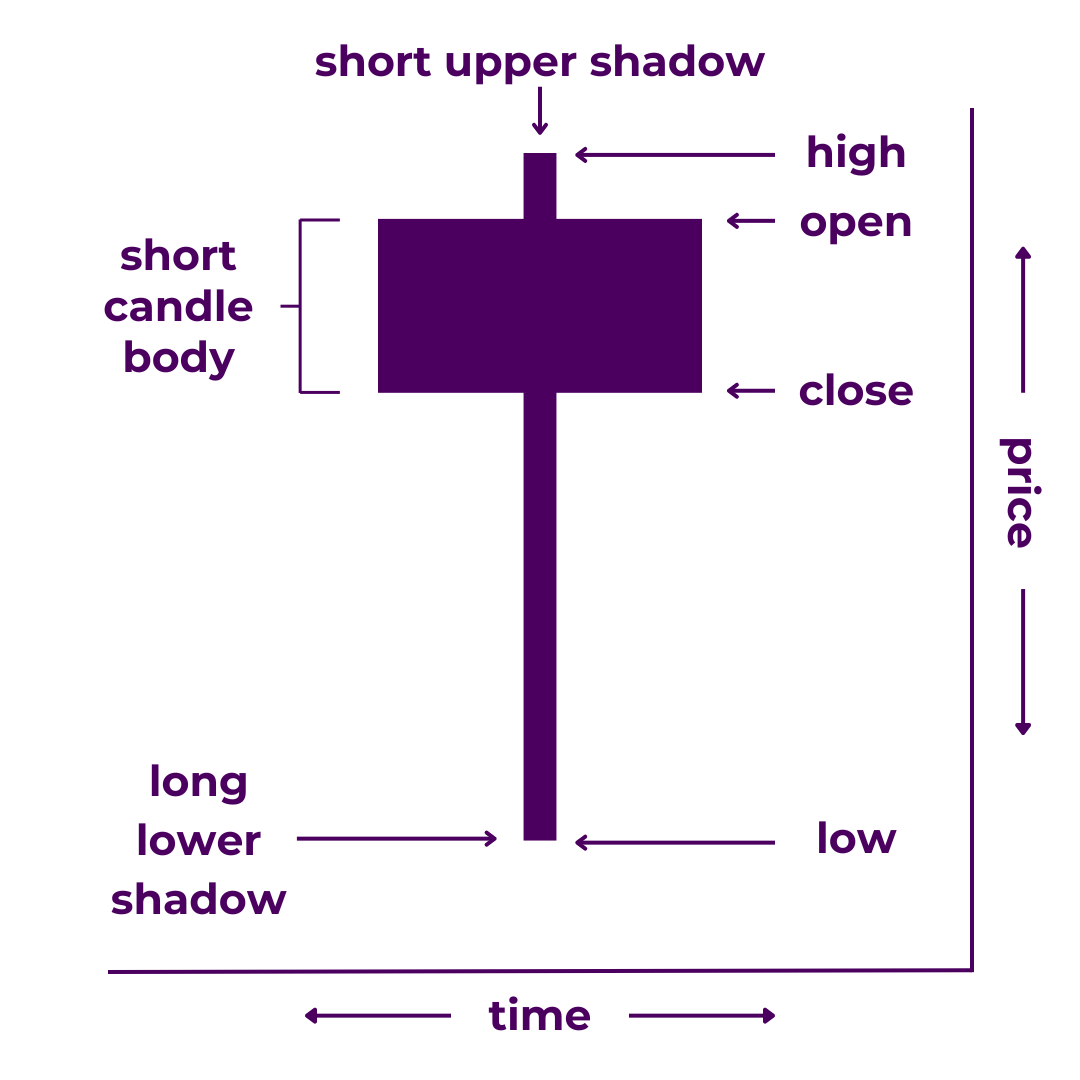

Hanging Man

A hanging man is a candlestick with a short real body, little to no upper shadow, and a longer lower shadow.

It indicates that the open and close prices are close together and near the top of the trading range. In trading terms, a hanging man candle signals that the bears are trying to resist continuation of a bullish trend.

Hanging man candlesticks paint a picture of a last stand. With a short body, the long lower wick usually stands out most. On the chart, it looks like the bears attempted to reverse the trend but the bulls replied, “Not so fast.”

Technical Specifications

Technically, the lower wick should be at least twice as long as the body. It doesn’t matter what color the body is. But if the body is negligible or nonexistent, it should instead be classified as some type of doji.

Furthermore, some would say that it is only a hanging man if it appears at the end of an uptrend, leading to a bearish reversal—which would make it more of a multi-candlestick pattern.

Sentiment: Bearish

Look for Them During

- Topping Formations

- Reversals

- Trending Moves

- Volatile Periods

Related Candlesticks

- Opposite of Inverted Hammer

- Same Implications as Shooting Star

- Looks Like Hammer

- Looks Like Dragonfly Doji

Read our full breakdown of Hanging Man Candlesticks.

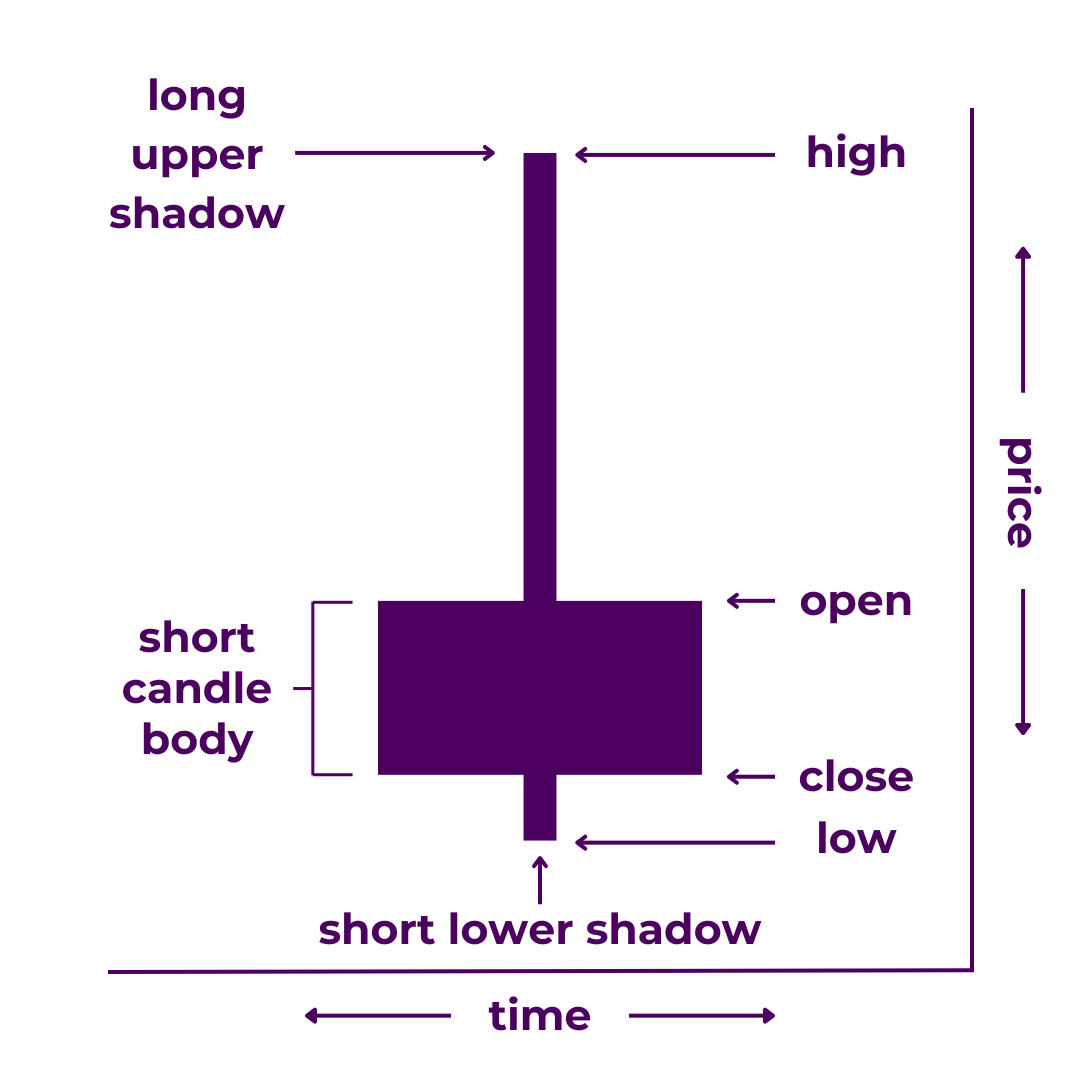

Shooting Star

A shooting star is a candlestick with a short real body, little to no lower shadow, and a longer upper shadow.

It indicates that the open and close prices are close together and near the bottom of the trading range. In trading terms, a hammer candle signals that the bears may be gaining strength.

Shooting stars paint a picture of a trend running out of steam. With a short body, the long lower wick usually stands out most. On the chart, it looks like the bulls attempted to push prices higher but the bears said, “Not so fast.”

Technical Specifications

Technically, the upper wick should be at least twice as long as the body. It doesn’t matter what color the body is. But if the body is negligible or nonexistent, it would instead be classified as a gravestone doji.

Furthermore, some would say that it is only a shooting star if it appears at the end of an uptrend, leading to a bearish reversal—which would make it more of a multi-candlestick pattern.

Sentiment: Strong Bearish

Look for Them During

- Topping Formations

- Reversals

- Volatile Periods

Related Candlesticks

- Opposite of Hammers

- Similar to Gravestone Doji

- Similar to Inverted Hammers

- Same Implications as Hanging Men

Read our full breakdown of Shooting Star Candlesticks.

Takeaways

Obviously, there are a ton of different candlestick types.

However, you don’t have to memorize all the names and exact specifications. Instead, focus on the principles behind the analysis. That way, you’ll see what is going on with any candlestick, no matter its name or implications.

At the end of the day, understanding candlesticks is but one piece of the puzzle. You’ll need more tools in the toolkit to read the full story in the charts—and even more than that if you want to put together a complete trading strategy.

Have questions? Know of an important candlestick type we missed? Have some special insight into trading a specific type? Contribute to the conversation in the comments below! Or, if you know someone who could benefit from this post, share it with them. You can also check out our Japanese Candlesticks Guide to improve your candlestick analysis skills.

0 Comments