Shooting star candlesticks are one of the most famous types of candlesticks for good reason.

Japanese candlesticks are the basic building block of most technical analysis. That makes the ability to recognize different candlestick types a crucial trading skill.

In this Guide to Shooting Star Candlesticks, we’ll explain:

First though, let’s start with a definition.

What Is a Shooting Star Candlestick?

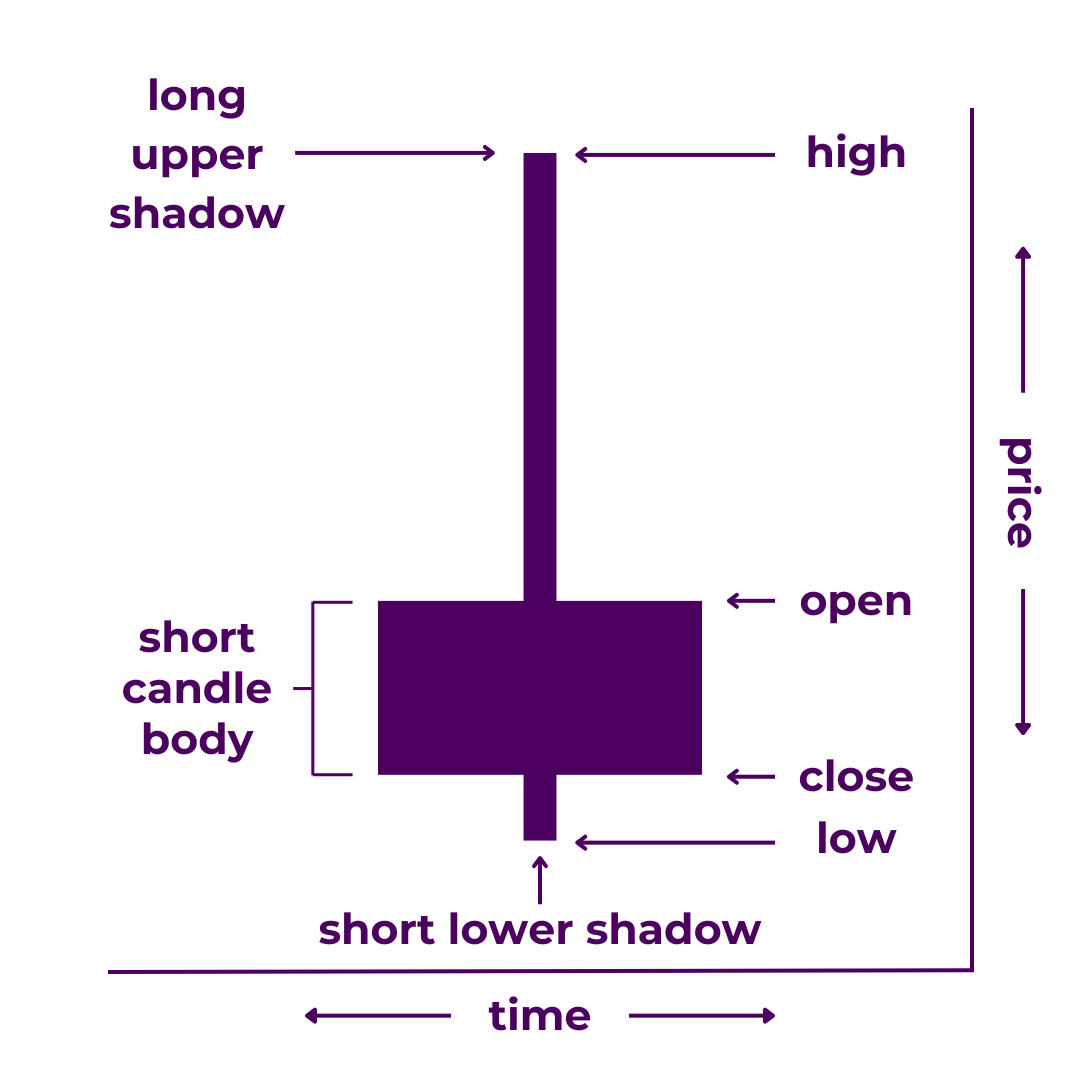

A shooting star is a candlestick with a short real body, little to no lower shadow, and a longer upper shadow. It indicates that the open and close prices are close together and near the bottom of the trading range. Hammer candlesticks are commonly seen during topping formations, reversals, and periods of volatility.

Unlike some other candlestick types, their name does not have a Japanese meaning. Instead, they are named for the look of the candlestick and its connotation. They look like a falling star and may serve as an omen of negative price action. In trading terms, a hammer candle signals that the bears may be gaining strength.

Shooting stars paint a picture of a trend running out of steam. With a short body, the long lower wick usually stands out most. On the chart, it looks like the bulls attempted to push prices higher but the bears said, “Not so fast.”

Technically, the upper wick should be at least twice as long as the body. It doesn’t matter what color the body is. But if the body is negligible or nonexistent, it would instead be classified as a gravestone doji.

Furthermore, some would say that it is only a shooting star if it appears at the end of an uptrend, leading to a bearish reversal—which would make it more of a multi-candlestick pattern.

By the same rule:

- A hammer is an upside-down shooting star that signals a potential bullish reversal during a downtrend.

- An inverted hammer is a shooting star shaped candle that signals a potential bullish reversal during a downtrend.

- A hanging man is a hammer-shaped candle that signals a potential bearish reversal during an uptrend.

It can get a little confusing because both shapes can signal direction, depending on where they appear. This is probably part of the reason many traders call all of them hammers (or inverted/upside-down hammers).

The main thing you need to know is this:

When you see a “T”-shaped candlestick, where it occurs in trend is more important than whether it is rightside up or not.

As always, context over criteria.

More on how to trade shooting star candles in a moment.

First, let’s illustrate how they are formed.

How Are Shooting Star Candles Formed?

A shooting star gives the impression of a bearish comeback.

That impression is usually correct.

Within the time period of the candle, price rose higher then dropped back to end up near where it began. Thus, a shooting star candlestick on a daily chart implies that the bears fought their way back to a near-draw on the day. However, the candle probably took on various shapes before closing as a shooting star.

You’d need shorter timeframes to see a more complete picture.

That’s also why you should usually wait for confirmation. It’s not officially a shooting star until the candle closes. And it can be dangerous to make trades based on incomplete candles.

You can never be 100% sure how a candlestick will look at the end of the time period.

That’s one of the reasons it’s so important not to get too focused on any single candle.

Where Shooting Star Candlesticks Fit in the Chart Narrative

The markets are often characterized as a battle between the bulls and the bears.

Shooting stars indicate that the fight is fierce, with the bears refusing to surrender. Obviously, no single candlestick can determine an entire trend. Still, shooting stars that appear at the right time can have significant implications on future price action.

Be on the lookout for them during:

- Tops – Shooting stars are one of the easiest-to-spot indications of potential local highs and topping formations.

- Reversals – Shooting star candlesticks are often seen in and around reversal formations, especially bearish ones.

- Volatile Periods – When volatility climbs, candles that imply back-and-forth action, like shooting stars, become more common.

They may also appear in certain types of candlestick patterns.

To become a successful trader, understanding candlesticks is a great place to start. But you should also learn how candlestick patterns and chart patterns work. Plus, you need to be able to recognize cycles, trends, and price levels. From there, you can begin to read the story in the charts.

Tools like chart markup and trading indicators can reveal even more. And once you’ve chosen your asset(s) and trading style, the full chart narrative truly comes into focus. The charts will basically speak to you at this point.

By looking at the history of the chart, you can identify how price action played out around prior shooting star candles (or patterns that included them). Moreover, you can compare historical structures in price and your other tools to current price action.

Now, you’re actually doing real technical analysis.

How To Trade Shooting Star Candles

You should never trade based on a single candlestick.

However, certain candle shapes may give you some trading ideas, especially given the right context. Shooting star candlesticks are one of those shapes.

In addition to the overall structure surrounding a shooting star, there are some other things worth paying attention to.

- Trading Volume – The greater the trading volume during any candlestick’s formation, the greater its potential implications on price action.

- Upper Shadow – The longer the wick of a shooting star candle, the more likely it is to set in a strong bearish bias and/or establish resistance.

- Price Formations – Shooting star candlesticks often appear along the top of various bearish price structures, such as double tops.

Generally, the fewer of these factors that are present, the less noteworthy the candle.

In order to form a complete trading strategy, you need to understand the basic math of trading, order types, and trading psychology. Even more importantly, you need to develop your own edge and learn risk management. And if you really want to take it all the way, look into options and trading automation.

Before you get there though, there’s still more to learn about the candles themselves.

Other Types of Candlesticks

The shooting star candlestick is but one of many candlestick types.

You’d be wise to get familiar with all of the other ones too.

- Bearish Belt Hold

- Bullish Belt Hold

- Doji

- Dragonfly Doji

- Gravestone Doji

- Hammer

- Hanging Man

- Inverted Hammer

- Long Candle

- Long-Legged Doji

- Marubozu

- Spinning Top

Not all candlesticks shapes earn names—so you should probably check out the ones that do. Just keep in mind that it’s not necessarily about memorizing all of the ins-and-outs of each. It’s more about ingraining the principles of price action into your brain.

In fact, you’re free to forget all of the names as long as you can look at a candlestick and understand what it means.

Takeaways

To review:

Shooting star candlesticks are a type of candlestick that signals a bearish holdout. They tend to show up during topping formations, reversals, and periods of high volatility. That means they can help you find winning trades.

Of course, there are other types of candlesticks that you should learn about. And even so, candlestick analysis alone is not enough to trade successfully.

Nonetheless, you’ve now added one more tool to your toolkit.

Have questions or more information to add? Contribute to the conversation in the comments below! Or, if you know someone who could benefit from this post, share it with them. You can also check out our Japanese Candlesticks Guide to improve your candlestick analysis skills.

0 Comments