V-bottom chart patterns are extremely common, easy to recognize, and reliable but nuanced.

Chart patterns are one of the most popular forms of technical analysis. That’s unsurprising, considering how easy they are to understand and trade. Not to mention, they work with virtually all tradable assets.

In this V Bottom Pattern Trading Guide, we’ll dive DEEP on:

- How They Work

- What They Mean

- Components & Criteria

- Where They Fit

- Their Psychology

- How To Chart Them

- How to Trade Them

- Similar Chart Patterns

First, let’s start with the basics.

What Is a V Bottom Chart Pattern?

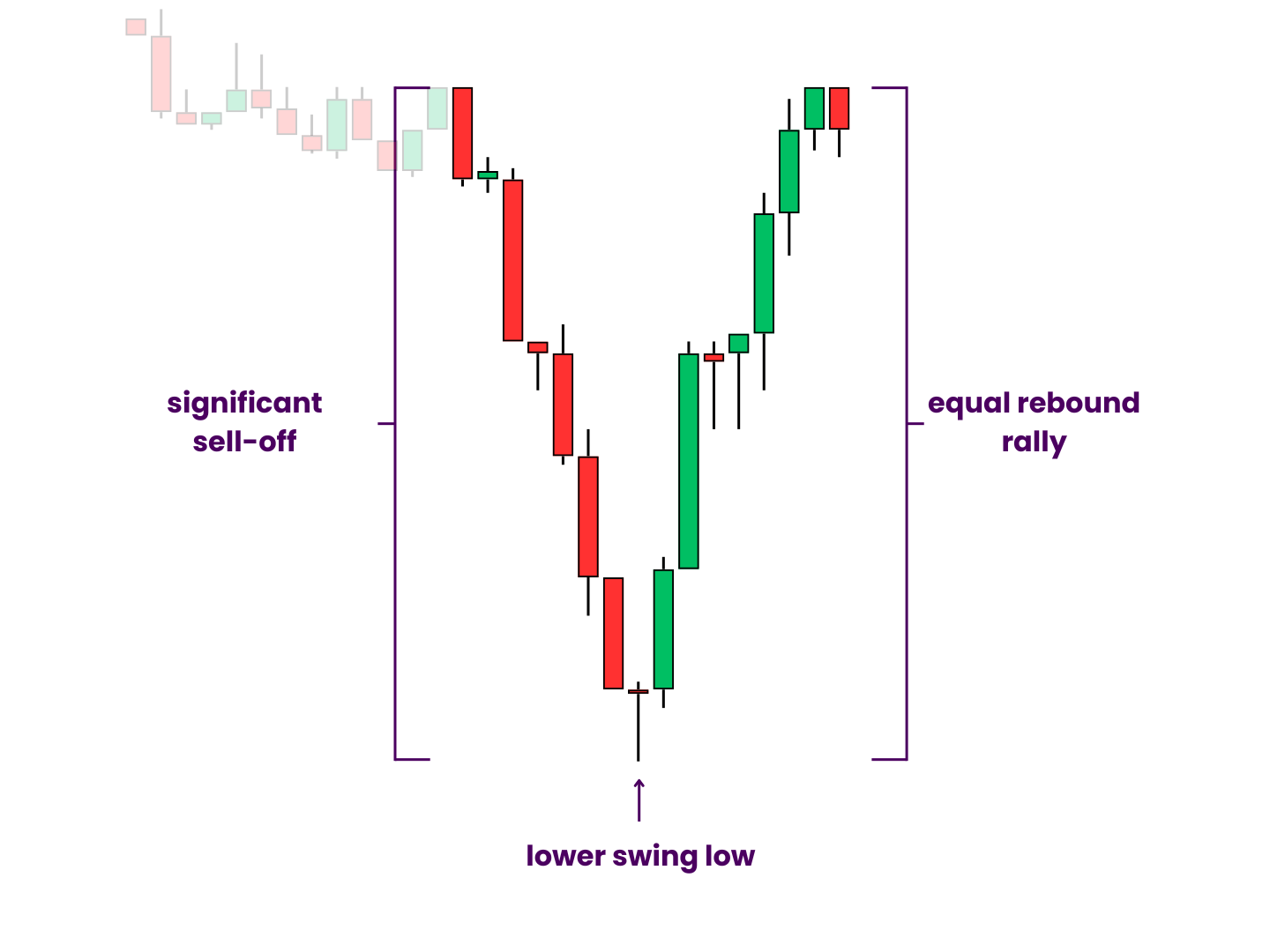

A “V” bottom is a bullish chart pattern that consists of a steep sell-off followed by an equally steep bounce. Price tests a new swing low and has a powerful reaction off of underlying support. It is most commonly used as a bullish reversal signal.

Naturally, it is the opposite of the “V” top pattern. It is also something like the accelerated version of the “U” bottom pattern. V’s and U’s often combine to form compound patterns like double bottoms and and triple bottoms. They also have a variation known as the extended “V” bottom.

As with all chart patterns, they are more a suggestion than promise. You should never look at them as guarantees!

However, they can still help you make money if you know how they work.

How V-Bottoms Work

V-bottoms arise due to a fairly common scenario.

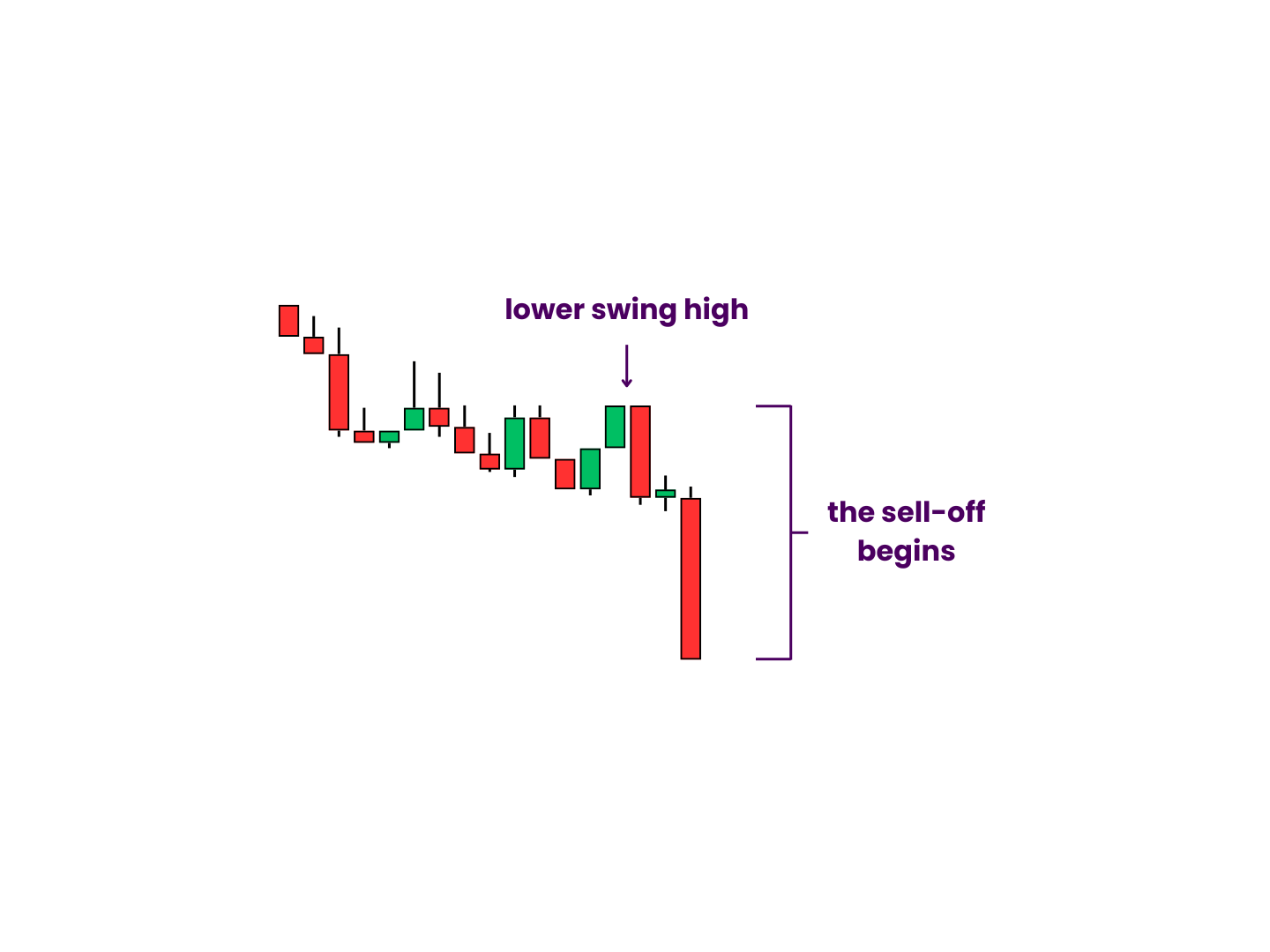

They begin when price reaches a swing high before a big drop.

It then proceeds to plummet, often over only a handful of candles. It falls rapidly until it finds a support level strong enough to withstand the momentum. From this swing low, it bounces back up just as violently.

This happens in such a way that the angles of each side of the valley are equal. On lower-term timeframes, you can often find steep channels around them. As the retracement nears the prior peak, the original breakdown zone sets the pattern’s primary resistance level.

Traders often dream of catching the bottom but the more realistic opportunity is the breakout trade above this “neckline”.

You can trade v-bottoms in stocks, forex, cryptocurrency, and most other markets. They appear across a variety of time frames. And they are very easy to see on the chart. No wonder beginner traders are so attracted to them.

This begs the question, then, what do they actually mean?

What V Bottom Signals Mean

V bottom patterns represent a period of high volatility (and potential accumulation).

In other words, price is in discovery mode, attempting to find out if this downtrend has an end. The deep discounts entice buyers into the market while some sellers take profit. This whipsaw action brings price back up to the same level as it started, but this time with momentum pointed in the other direction.

If the bulls are able to generate enough buying pressure, they can retake the neckline and threaten a new uptrend.

V-bottoms are high-volatility patterns that most often form during downtrends. When they do, they tend to signal reversal (and perhaps even form longer-term bottoms). They form less frequently during uptrends, but may signal continuation when they do.

They are a classic bullish chart pattern, after all.

In this way, v bottom patterns imply a bullish bias but do not seal a bullish outcome. And even though they demonstrate ranging behavior, they can play out as an accumulation pattern—or the beginning of one.

Before you can identify v bottoms, however, you need to understand their makeup.

So let’s take a look at how they are made.

“V” Bottom Pattern Components & Criteria

V bottoms are one of the simplest chart patterns there is.

They are basically just a powerful move down followed by an equally powerful move back up. Still, they have components with specific criteria just like all patterns do.

Some of these are seen as guidelines. However, several of them are absolutely mandatory. If these conditions are not met, then the v-bottom is invalid. It loses all supposed predictive power. The price targets should be disregarded. The trend lines are then the only things that may still hold some weight.

Therefore, it is crucial you make sure all the pieces are in the proper place.

Initial Sell-Off

It happens fast. Before anyone realizes, price undergoes a significant sell-off. It’s abrupt, sometimes in as few as two or three candles. Sell-offs that set up V bottoms need to be visually striking. They often conjure up words like fear, crash, and capitulation. Price moves down much faster than recent averages, with bearish candles longer than the last 20–50. You’d expect it to shatter several resistance levels on the way down (unless price is already at all-time lows). On lower-term time frames, you’ll often find that the first leg of the V fits inside a steep descending channel.

Criteria: The initial sell-off must be large, relative to recent price action. Serious traders might even apply exact criteria using historical percentile and/or standard deviation calculations.

Rebound Rally

After a sharp turn, price rallies as severely as it fell. Technically, you should be able to identify a rising support line that matches the angle of the initial sell-off. Again, you may have to “zoom in” to shorter time frames. And if you find a well-developed ascending channel, it may be a good sign. Either way, what matters most is that the bounce needs to make its way back to the origin level of the sell-off level quickly. Just like the first side of the V, this move could make a great trade within itself. It is just very difficult to anticipate such rapid short-term reversals.

Criteria: The rally must be large, approximately matching the initial sell-off in both speed and magnitude.

V Tip

The tip of the V represents a short-term reversal. It often occurs at a strong level of historical support, reinforcing it. It could also come as a result of bearish exhaustion after massive wins (ie. if price is already at its ATL). In this case, it is likely to establish its own level(s) of strong support, especially when accompanied by high volume. This makes it a crucial pivot point. In fact, the levels set by the V often play a major role in long-term bottoms, whether alone or as part of a compound pattern. Long-wicked candlestick types like hammers, dragonfly doji, and long-legged doji are common. So are candlestick patterns.

Criteria: The bottom of the V must occur within only a few candles, preferably three or less. Visually, it should look like the tip of a spear.

Special Note on V Bottoms:

Uniquely among chart patterns, V patterns have a special relationship with candlestick patterns. Bullish reversal candlestick patterns show up at the tip of V-bottoms fairly frequently. They don’t all have the best hit rates. But they do come with their own smaller-scale price targets, which gives you extra options.

Some of the ones you’re most likely to see:

- Bullish Harami (& Bullish Harami Cross)

- Bullish Engulfing

- Morning Stars (& Morning Doji Stars)

- Tweezer Bottoms

Neckline(s)

For V-bottom patterns, the “neckline” is essentially the primary horizontal resistance. It is formed by drawing a horizontal line at the original dropdown price and/or prior swing high. Once tested by the rally, it becomes a valid trend line. Moreover, V-bottoms often form in distinct layers, with smaller V’s inside larger ones. Some traders like to look at each of these as necklines, mapping multiple levels. While this can be overkill, it isn’t necessarily invalid. It can be especially useful when these extra necklines align with historical price levels.

Criteria: The neckline should extend horizontally from the pre-sell-off swing high, but sometimes the dropdown zone is more appropriate.

Price Target

The most common price target you’ll see for V-bottoms is the pattern height—specifically, the distance from the lowest close to the neckline. If price breaks up, add the height to the neckline; if price breaks down, subtract the height from the breakdown point. However, this is a very aggressive target. To the upside, it effectively doubles the move from the bottom of the V. To the downside, it would mean another leg down. Either way, that’s a lot of action in a short amount of time. While this can happen, you’d probably do well to find some additional filters to increase its hit rate as a signal.

Example: A V bottom has a total range of $8.00 to $10.00, giving a $2.00 price target. The upward target will always be $12.00, a 20% gain. The downward target will rise from $6.00 (a 25% loss) to $8.00 (a 20% loss) as the pattern matures.

Trend Line Tests

Here again, the V bottom is slightly different from other patterns. Each test of support or resistance is a bit of a battleground, just like any other pattern. However, a more nuanced view is in order. If you find a lower term rising channel with its five required tests, great! If not, you’re left with a fragilely steep support line and fast-approaching horizontal resistance. Sometimes, you won’t even be able to establish a trustworthy support line until the last few candles because the rally has no distinct pullbacks. It’s similar for the neckline, where there is only time for one or two rejections before the market has to make up its mind.

Criteria: Both the neckline and rising support must be tested at least two times each. Ideally, one of them would get at least one more test as more successful tests are seen as an omen of higher reliability.

Fakeouts

The true breakout is often preceded by one or more false breakouts, or fakeouts. These fleeting moves burst through overhead resistance, then trade back below it shortly thereafter. Fakeouts may shatter the structure and invalidate the pattern completely. Or, they may only require a bit of redrawing or zooming out. They could be a sign of bullish enthusiasm or bearish weakness. Or, they could be the byproduct of a stop hunt.

Breakout & Breakout Point

The breakout is the reason everyone comes to the party in the first place. It’s where the fun truly begins. If the price breaks up, we call the v-bottom successful. If it breaks down, we call it a failure. From this point, it stays above or below the formation for good. All that’s left is to see how far it goes.

Criteria: The breakout must close outside the pattern and stay outside the pattern. At the very least, it cannot close below the neckline.

Pullback (& Retest)

Pullbacks after tn be deep or shallow, immediate or delayed. Full retests of the top of the V are common, but not guaranteed. Most patterns perform better without them. Thhe breakout are the norm, but not an inevitability. They cais is true of both upside and downside breakouts.

Criteria: The pullback must not close below the resistance-turned-support line. If it does, it invalidates the breakout.

Trading Volume

V-bottom trading volume is more unpredictable than most chart patterns. That’s because most patterns are consolidation patterns, with decreasing volume. As a high-volatility pattern, the v-bottom volume profile can be more erratic. The initial sell-off usually occurs on high volume. The response rally may as well. Then, volume spikes are always expected during breakouts, with low breakout volume seen as an omen of a potential fakeout. With that said, other chart pattern validation and confirmation factors are especially important when trading V patterns.

Criteria: Trading volume should spike during the breakout. Ideally, it would break out of its own pattern-long contraction and remain elevated until the target is met.

Where V Bottoms Fit in the Chart Narrative

The markets are often characterized as a battle between the bulls and the bears.

It’s like the charts have a story to tell.

Patterns are a natural progression from market cycles, trends, and price levels. They also build on the data from candlesticks and candlestick patterns (even though you can almost always see them on a line chart).

However, chart patterns have an even larger impact on the chart narrative.

That’s partly because they tend to span longer periods of time and therefore carry more weight. But it is also due to their popularity. This is especially true of very distinct patterns like the V bottom. They stand out so much that they attract market players of all shapes and sizes.

This frequently foreshadows dramatic pieces of price action.

“V” Bottom Market Psychology

The ascending triangle is a visualization of the psychology of the market.

It illustrates the bulls’ ability to take back the bears’ gains just as quickly as they are won.

Imagine this scenario:

Price has been going down for months. After a pathetic new lower high, the bears reassert their dominance. No. It’s more like they want a blood bath. With reckless abandon, sellers pile into the battlefield like Khornate Berzerkers. In little over a week, price crashes to historical lows.

Unfortunately for them though, they delved too greedily and too deep. They awoke something in the darkness, a fire in the bellies of the bulls. Catching the scent of all the blood in the streets, ancient and powerful whales arise from their slumber and lead the buyers out of the depths. Glutted on their spoils, the bears offer little opposition. It only takes another week and a half to erase the entire crash.

Now, the bulls are banging on the gates of the dropdown zone from three weeks ago, with vengeance in their hearts.

Lining the battlements, the bears assure each other, “We can hold the line!” and “They’re nothing but rabble.” But deep down, they fear their day of reckoning has finally come.

An impartial spectator may predict the bulls will break through the bears defenses and go on to conquer more territory.

A gambler may bet on who they want to win.

A trader would find a way to profit no matter who wins.

You can picture this scenario anytime you see price undergo an oversized crash followed by a slingshot pump back to square one. It could apply to any tradeable asset. However, no two Vs will have exactly the same story. Nor will they play out in exactly the same way. But true traders consider what both sides are thinking.

The frequency and performance of v-bottoms varies across markets. So study their historical performance on your preferred asset(s) and time frames specifically.

How To Chart V Bottom Patterns

Before you can analyze classic patterns, you need to be able to chart them.

Luckily, all you really need is basic chart markup skills.

TradingView has horizontal lines and that’s all you really need. If you want to highlight the V itself, you can use trend lines and/or extended trend lines. And if you really want to get fancy, you can zoom in and wrap the rebound rally in a parallel channel or use the triangle tool near the end of the pattern.

Then, analyze the ascending triangle pattern with your favorite trading indicators and tools.

You may need to adjust or redraw your lines several times. When you’re new, it can be a bit like trying to read tea leaves. A V bottom might fail to break out and fall but slow down before reaching the downward price target. Then, it slowly curves upward to create an adam and eve pattern. That fails too! But this time, it rebounds more quickly to form a cup and handle. This time the signal succeeds, exploding upward to exceed the original V bottom target by 50%.

That’s why each pattern’s criteria is so important.

Like all technical analysis tools, chart patterns are just a framework for understanding price action.

You’ll need more in your arsenal to consistently make money with them.

How To Trade V Bottom Patterns

The basic concept for trading v-bottoms is very easy to understand.

You can get in on a breakout trade above the primary horizontal resistance (neckline) or reversal trade below it.

The conventional bullish trade is:

- Step 1: Take a long trade if/when the price closes above the neckline.

- Step 2: Place your stop loss just below the horizontal.

- Step 3: Set your profit target by adding the pattern height to the neckline.

The conventional bearish trade is:

- Step 1: Take a short trade if/when the price closes below the rising support level.

- Step 2: Place your stop loss just above the breakout point.

- Step 3: Set your primary profit target by subtracting the pattern height from the breakdown point.

The clarity of these rules makes for a very tradeable pattern.

Plus, there are many things you can do to optimize its use.

Still, you probably shouldn’t aspire to be a “pattern trader.” Learning to use patterns is a great place to start. But you’ll eventually want (or need) to move on to more sophisticated strategies. These may use patterns, but not as the centerpiece. Luckily, traditional chart patterns are easy to integrate into many different trading styles.

A reliable trading strategy requires a dependable edge and calculated risk management. Learn trading math and order types well. Add some options and/or automation if you really want to cook.

However you choose to do your v bottom trading, keep your rules strict.

Signals mean nothing without proper trade execution.

Step 1: Where & How To Enter V Bottom Trades

By now, you should understand the basic entry.

You have multiple options to play the breakout straight.

You could watch the pattern and place a market order on the candle after the breakout. Or, you could forgo the candle watching by implementing price and/or volume alerts. You could even place a stop limit to buy the breakout automatically (though that does have its own risks).

Yet there is more you can do to get the best entry possible.

Catching Knives

“Don’t try to catch a falling knife” is generally good advice in life and on the charts. And while we would never dare to give financial advice, we will say that you reject the sage’s wisdom at your own peril. Unless it’s at $0.00, price can always go lower. With that said, there are traders who target high-risk, high-reward reversal trades. They might use some combination of strong support levels, oversold signals, indicator crosses, or even fundamental news to find trades. And of course, there are those candlestick patterns we mentioned before. (If you’re going to “buy the dip” you need to have a reason.) However they go about it, these traders may find themselves with a potential v-bottom position by coincidence. For scalpers, this may mean little. For swing traders, however, this may be an absolute best-case scenario.

[btc falling knife meme]

Getting In Early

The most logical way to get a higher percentage profit is to buy before the breakout. And while this is a viable but risky strategy for most chart patterns, that risk gets turned up to 11 for V’s. Even if you can find a solid channel on lower timeframes, you could be hard-pressed to find a favorable initial stop loss-level. The sharply angled bounce gives you a small margin of error. And you’re already buying against the greater trend, a trend that has produced powerful bearish moves very recently. Don’t buy early unless you have (well-justified) faith that rebound will reach the neckline. If it can’t do that, the breakout is out of the question. Still, you’ll likely need to be very skilled at managing risky positions during elevated volatility.

Considered Confirmation

Where you assign confirmation can make a big difference to your risk/reward ratio. Volume, higher-term candle closes, candlestick patterns, and indicator signals are all legitimate options. Some traders may even wait to buy the retest of the neckline post-breakout. Ideally, you’d back up your own choice with historical analysis.

Playing the “Fail”

V-bottoms that break down are almost as easy to trade as successful ones (though they may not perform as well). Whether the rally fits into a channel or not, you need a valid rising support line. Assign the measured move to the bottom of the breakdown and you have your bearish price target. If price hits this target, it will result in a continuation of the downtrend. In this way, failed v bottoms have nearly as much long-term potential as successful ones. Just keep in mind there is a good chance that the target will not be reached, and instead progress into a longer consolidation pattern.

Step 2: Where & How To Exit V-Bottom Trades

V-bottoms are one of the most well-known chart patterns.

What’s more, they are incredibly conspicuous. Even if you had never heard of chart patterns before, they would draw your attention. All the extra eyeballs can make them more unpredictable, often contributing to under or overperformance.

That’s just one reason why it’s crucial to know your gameplan going into every trade.

Frontrunning

Overhead resistance may stall price, or prevent it from reaching the target altogether. Make note of prior levels, important moving averages, and other potential obstacles. Conservative bulls may take profits here. Aggressive bears may look for shorts. Both of these exert pressure against the breakout. In response, you could consider locking in some or all your gains here too. Identify these levels and establish your contingency plans in advance.

Staying Exposed

If you’re more patient, you can opt to stay in the trade, giving price more time to reach the target. After all, if the target on either side gets met, the greater trend will likely follow. By using a trailing stop loss, you may be able to stay exposed in a risk-free trade. Just like that, you may have a very strong long-term position.

Breaking It Up

You could also do all of the above by deploying different chunks of capital in different ways. For example, you might sell a portion at a primary profit target, then set a break-even stop loss and let the rest ride. This is common for Bitcoin traders, who often trade to accumulate Bitcoin in lieu of fiat currency due to their deep belief in the asset’s long-term future. Beware though. This hybrid trading/investing approach can make it hard to keep your P&L in perspective. You might be better off dollar cost averaging.

Step 3: Where & How To Stop-Loss V Bottom Trades

You also have options when it comes to stop-losses.

The initial stop loss is typically placed in one of three locations. First, you can place it on the other side of the newly broken trend line. Second, you can place it on the other side of the last minor swing high or low. Third, you can place it on the other side of the pattern. (The last two may or may not be the same level.)

It partly comes down to your risk tolerance. Tighter stops lower potential losses. But they can also lead to premature exits.

Whatever you do, just don’t freewheel it.

Get in the habit.

Set. Stops. (Even if they are loose.)

Moreover, how you use them should match your overall strategy.

Trailing Stop Loss

Some traders prefer trailing stop losses. This more passive technique allows you to lock in unrealized gains without exiting. Instead of cashing out, shadow the trend with your stop loss. Lesser pullbacks, moving averages, Fibonacci extension levels, and other minor levels are all options. If you’re well in the money or trading long-term, you could even go with a fixed percentage. It is such a common practice that some trading platforms and tools allow you to automate it. Sure, it can make you susceptible to stop hunts. But that’s better than losing money.

Break Even Stop Loss

Break-even stop losses are meant to do one thing. They prevent you from taking an L from a winning position, which is one of the worst feelings in trading. As soon as it is appropriate, move your stop loss up to a level that ensures you can’t lose money. You’ll be able to do it earlier if you caught the knife or got in on the way back up. Otherwise, you’ll probably have to wait until some sort of post-breakout support or resistance. This strategy is a great way for newer traders to keep confidence high. It can also protect you from false breakouts.

Other Chart Pattern Types

The “V” bottom pattern operates in the same way as many others.

It is fairly unique in that it is a high volatility pattern and very often one component within a larger double or triple bottom. Yet it usually plays out as a direct bullish reversal pattern or fails and becomes part of a compound consolidation pattern. So either way, you can classify it as an accumulation pattern as well.

It is a good idea to study more of these patterns and their relationships.

The vast majority of them are worth learning about.

- Adam and Eve Patterns

- Ascending Triangle Patterns

- Bear Flag Patterns

- Cup and Handle Patterns

- Descending Triangle Patterns

- Descending Wedge Patterns

- Double Bottom Patterns

- Double Top Patterns

- Head and Shoulders Patterns

- Rising Wedge Patterns

- W Patterns

At the very least, you should do a deep dive on the most popular and common ones. Then, skim the rest of the list if you must. You don’t have to commit every single one to memory.

However, learning about different chart patterns has big advantages. It will help you find more trading opportunities. Perhaps more important, it will expose you to many proven trading ideas. More important still, it will teach you a lot about price action, market psychology, and more.

In the end, how patterns help elucidate the story in the charts is even more useful than the signals they provide.

True traders always consider contingencies for whatever the market brings anyway.

Takeaways

To review:

The “V” bottom is a bullish accumulation pattern.

- It is characterized by a rapid sell-off followed by an equally rapid rally.

- It gives a bullish bias and acts as a reversal signal most often.

- The standard trade is a breakout trade above the resistance line or below the support line.

- V-bottom patterns are simple, eye-catching, well-known, and appear often.

- They are fairly easy to incorporate into many types of trading strategies and perform well.

- They are especially popular among new traders, breakout traders, volatility traders, and pattern traders.

Like all chart patterns, v bottoms don’t guarantee anything. However, they do hint at upcoming possibilities. They also come with a proven trading framework. What’s more, you can study more patterns to find even more opportunities.

Pattern analysis may not be a silver bullet, but it is a useful weapon in your trading arsenal.

Have questions or more information to add? Contribute to the conversation in the comments below! Or, if you know someone who could benefit from this post, share it with them. You can also check out our Chart Patterns Guide to improve your chart analysis skills.

0 Comments