So you want to learn about candlestick patterns that show up during bullish reversals, huh?

Smart choice.

If you can identify a bullish reversal early enough, you find opportunities for winning trades. These patterns can help you do just that.

Bullish Reversal Candlestick Patterns

- Bullish Abandoned Baby

- Bullish Counterattack Lines

- Morning Doji Star

- Bullish Engulfing

- Bullish Harami

- Bullish Harami Cross

- Morning Star

- Three Inside Up

- Three Outside Up

- Tweezer Bottom

Identifying Bullish Reversal Candlestick Patterns

Candlestick patterns that signal bullish reversal are very distinct.

Not only do they signal a potential change in market conditions, they also imply a direction.

Of course, they do not guarantee that the downtrend is going to become an uptrend. Instead, they are more like a warning sign or omen.

In fact, most candlestick patterns hover around a 50% hit rate. So they are not a “sure thing” by any means. Still, they are one of the most popular trading tools for a reason.

Even when they fail, they can act as a indication of the opposite. That’s one reason why it is helpful to learn about all of the types of candlestick patterns—including bullish continuation patterns, bearish reversal patterns, and bearish continuation patterns.

More than anything, it might be best to look at them as inflection points.

Plus, learning about them increases your overall understanding of price action.

This is technical analysis, after all.

It may not be easy but it is lucrative.

Bullish Abandoned Baby

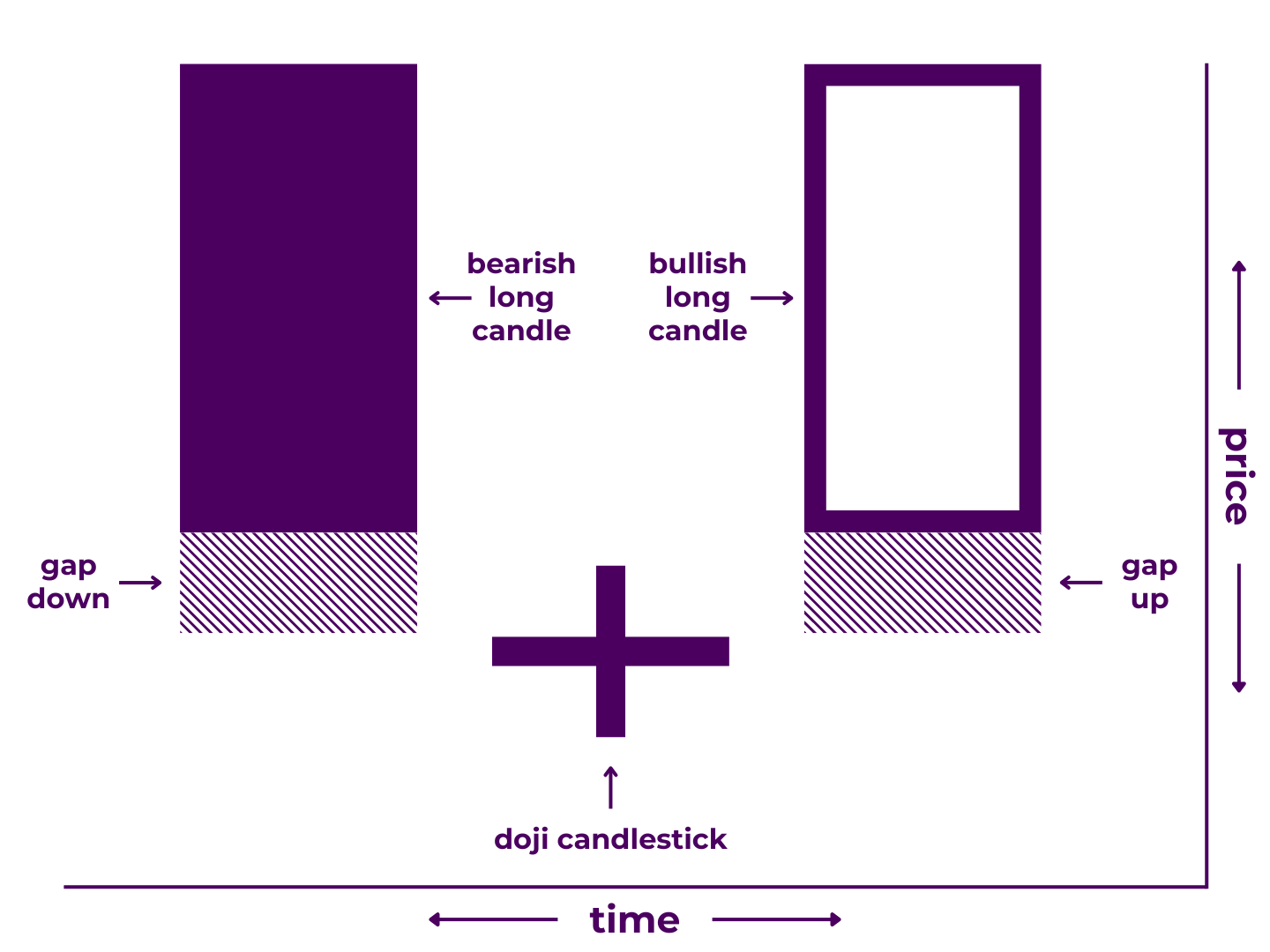

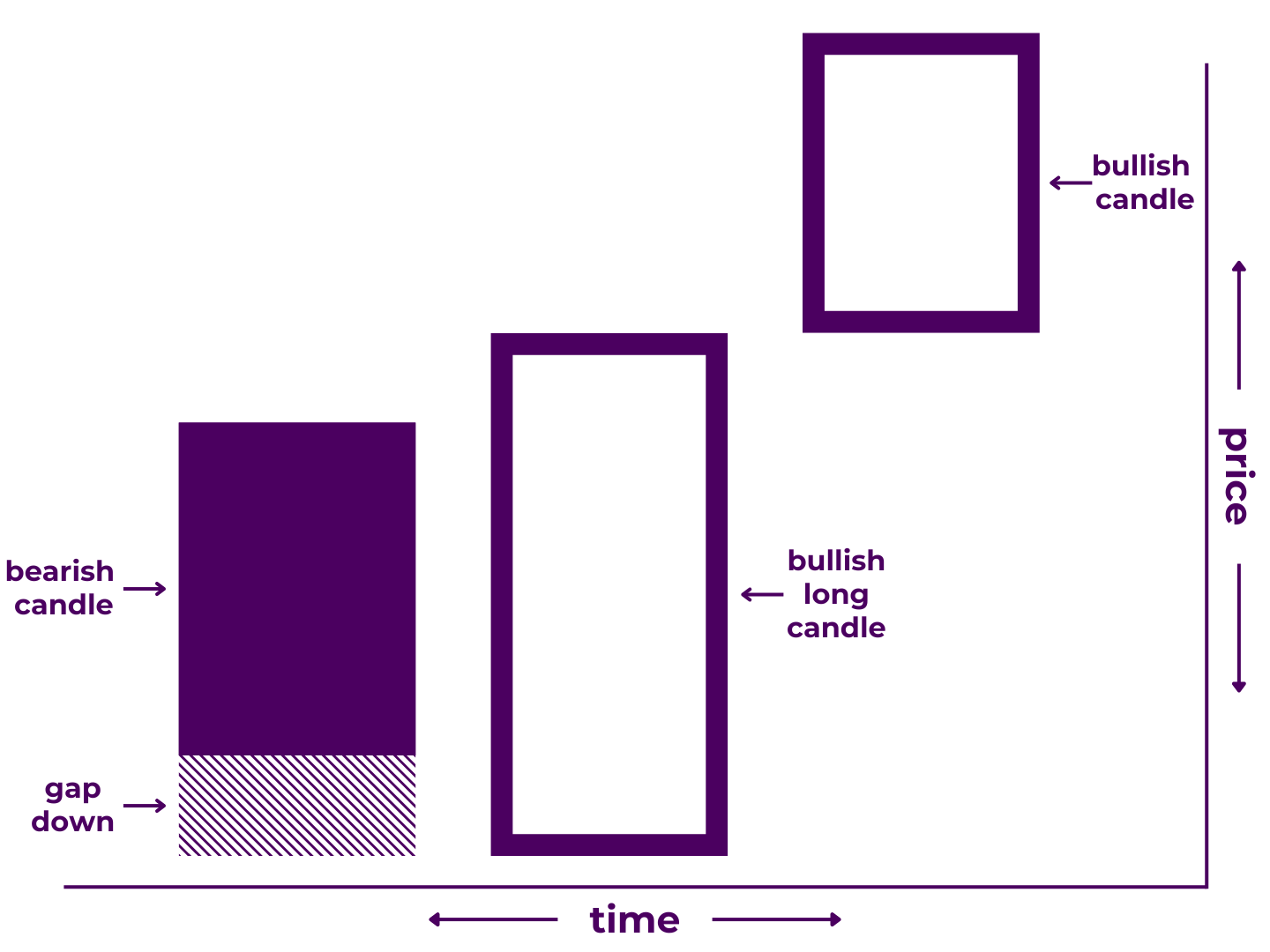

A bullish abandoned baby pattern is a 3-candlestick formation that may signal a bullish reversal.

It may appear during a downtrend and is made up of a large bearish candle, a doji that gaps down, and a large bullish candle that gaps up.

In trading terms:

- During the first period, the price continued the pre-existing downtrend.

- The second period opened with a gap down, after which neither the bulls nor the bears were able to maintain control.

- The third period opened with a gap back up and continued increasing, threatening the pre-existing downtrend.

Bullish abandoned baby patterns show that the bears attempted to press their advantage on candle one, stalled on candle two, and finally surrendered momentum to the bulls on candle three.

Pattern Type: Bullish Reversal

Number of Candlesticks: 3

Looks Like/Narrative Meaning: U-turn or counterpunch

Technical Specifications***

Technically, a bullish abandoned baby pattern must:

- Appear during a downtrend

- Begin with a bearish long candle

- Have a doji as the second candle

- Have gaps before and after the doji

- End with a bullish long candle of similar size to the first candle

In practicality though, many traders will make various exceptions.

- The first and third candles can be different lengths, as long as they are both long line candles and/or test important price levels.

- The second candle doesn’t necessarily have to be a doji, as long as it is a short line candle.

- The gaps can go, especially in markets where gaps are less common like cryptocurrency.

- There can be more than one doji (or short candle) between the first and final candlestick.

***Depending on who you ask, any of these standards may be more or less important. Moreover, some of these variations may be more properly classified as other bullish candlestick patterns.

Related Patterns:

- Similar to Morning Doji Star Pattern

- Similar to Morning Star Pattern

- Subtype of Abandoned Baby Pattern

- Opposite of Bearish Abandoned Baby Pattern

For more detail, read our full breakdown on Trading Bullish Abandoned Baby Candlestick Patterns.

Bullish Counterattack Lines

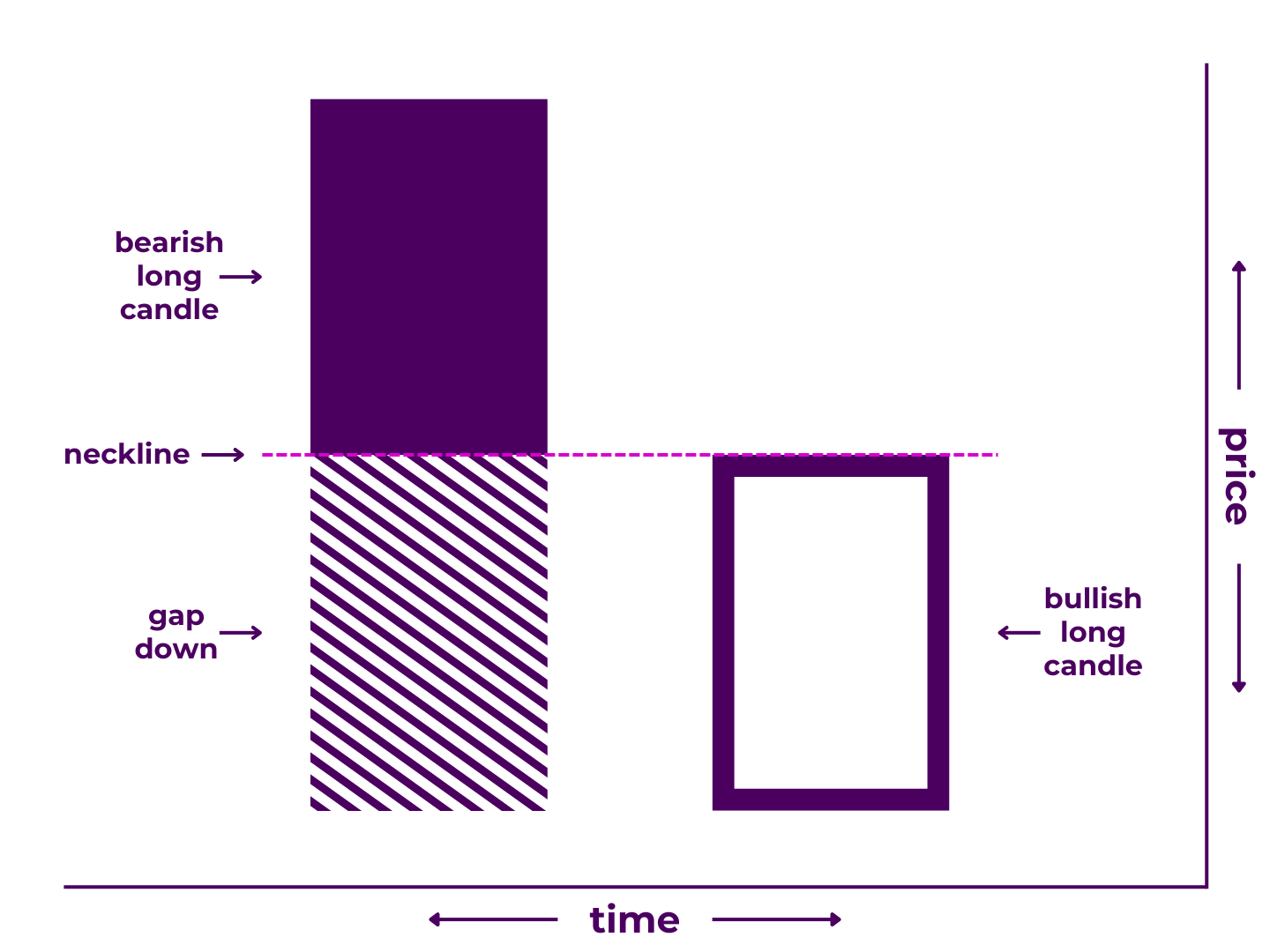

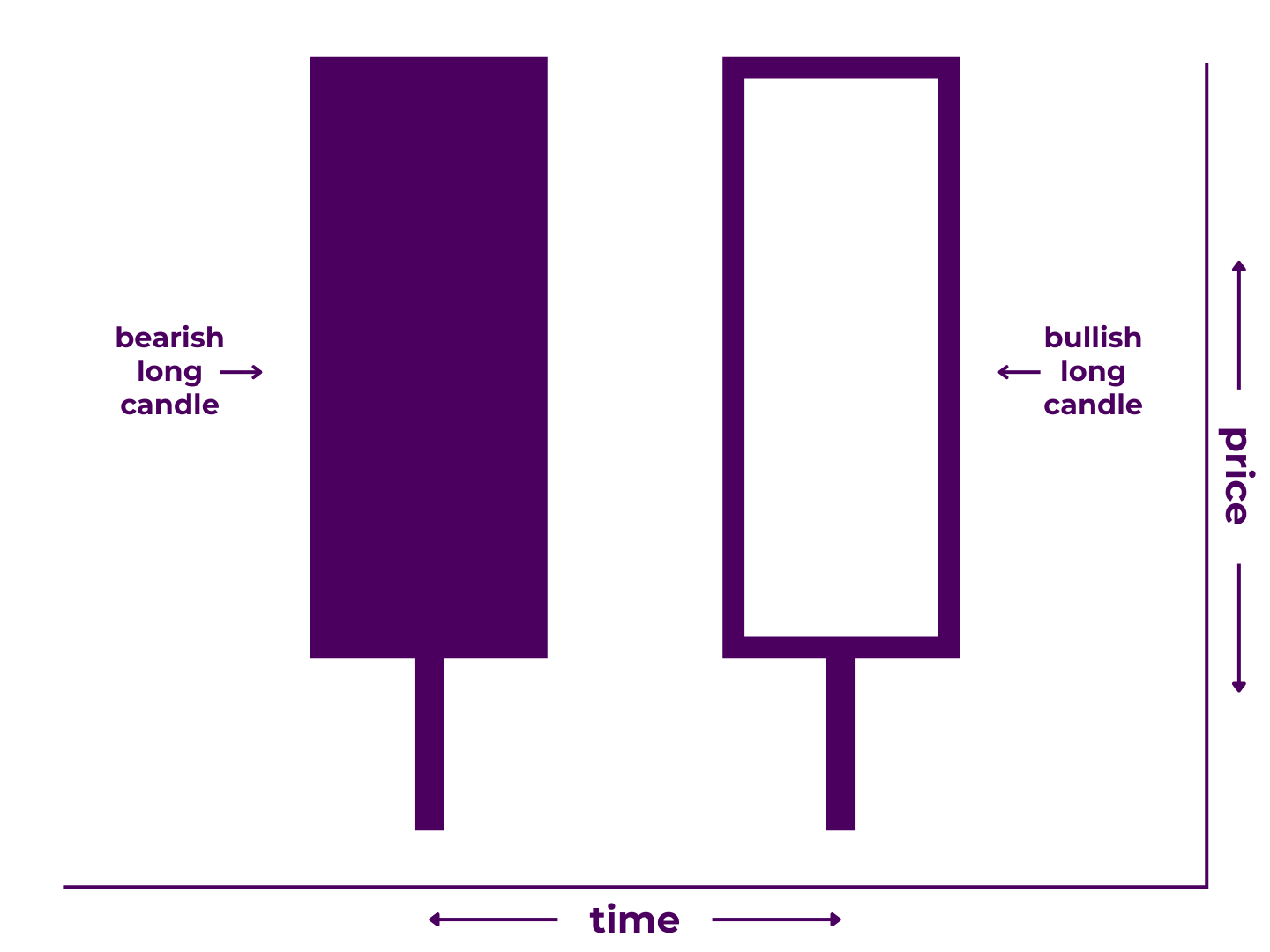

A bullish counterattack line pattern is a 2-candlestick formation that may signal a bullish reversal.

It may appear during a downtrend and is made up of a large bearish candle followed by a large bullish candle that opens with a large gap down then moves higher, filling the gap to close near the first candle’s close.

In trading terms:

- During the first period, price continued the pre-existing downtrend.

- The second period opens with a gap down but price moves back up, immediately filling the gap and ending with a similar close to the following period.

Bullish counterattack line patterns show that the bears attempted to press their advantage on candle one, continued to do so between candles, but then lost all momentum by the close of candle two.

Pattern Type: Bullish Reversal

Number of Candlesticks: 2

Looks Like/Narrative Meaning: a turning point or drawing of battle lines

Technical Specifications***

Technically, a bullish counterattack line pattern must:

- Appear during a downtrend

- Begin with a bearish long candle

- End with a bullish long candle of similar size to the first candle

- Have both candles’ closes at approximately the same price

- Completely fill the gap by end of the second candle

In practicality though, many traders will make various exceptions.

- The candles don’t necessarily have to be long candles, as long as they are the same size.

- The candles don’t necessarily have to be the same size, as long as they are long candles.

- It can take two candles to fill the gap, as long as the combined length of the second and third candles equals the length of the first.

***Depending on who you ask, any of these standards may be more or less important. The only real non-negotiables are the direction of the candles and the immediate gap fill. Moreover, some of these variations may be more properly classified as other bearish candlestick patterns.

Related Patterns:

- Similar to Bullish In Neck Pattern

- Similar to Bullish On Neck Pattern

- Subtype of Counterattack Lines Pattern

- Opposite of Bearish Counterattack Lines Pattern

For more detail, read our full breakdown on Trading Bullish Counterattack Lines Candlestick Patterns.

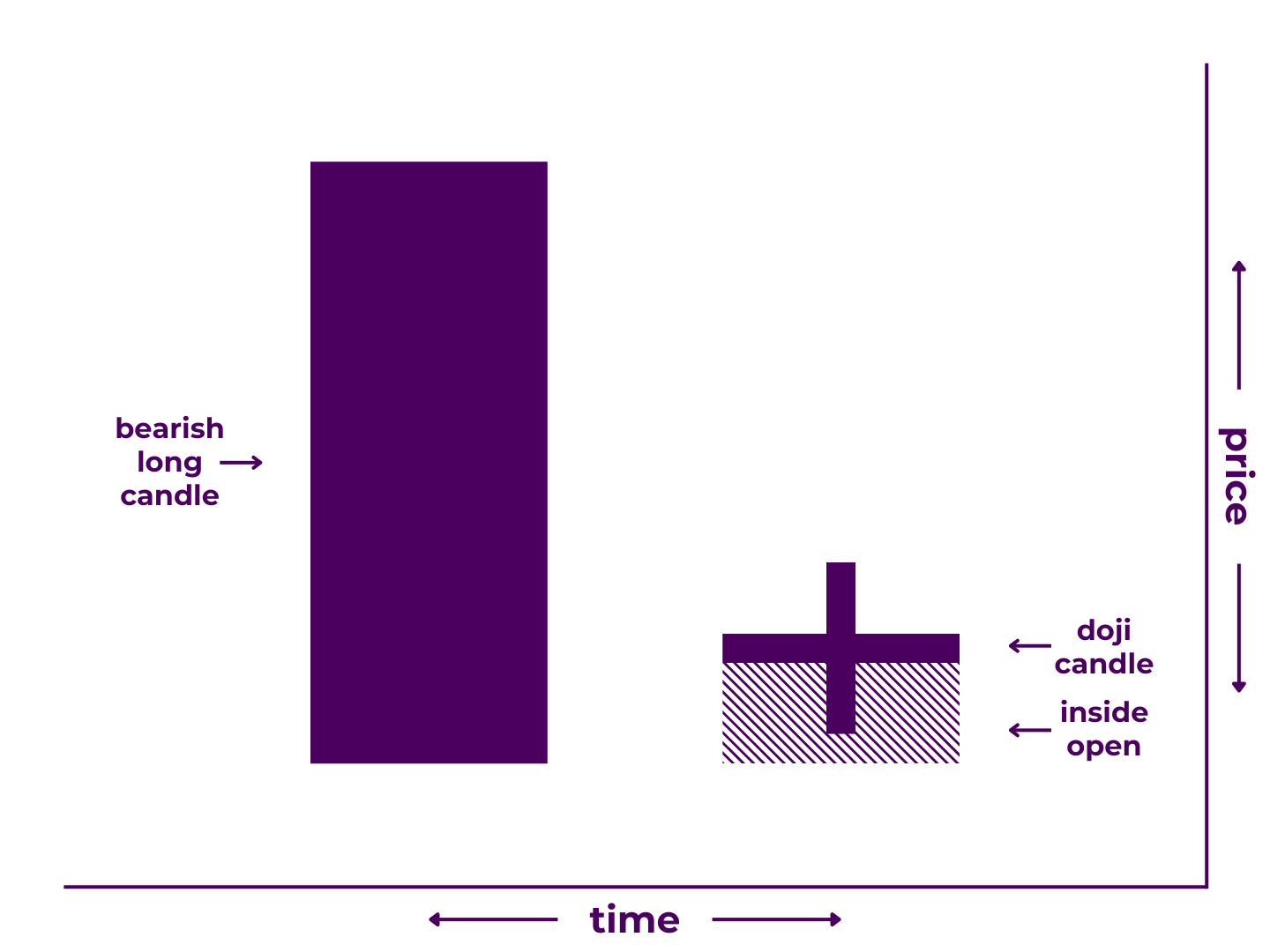

Morning Doji Star

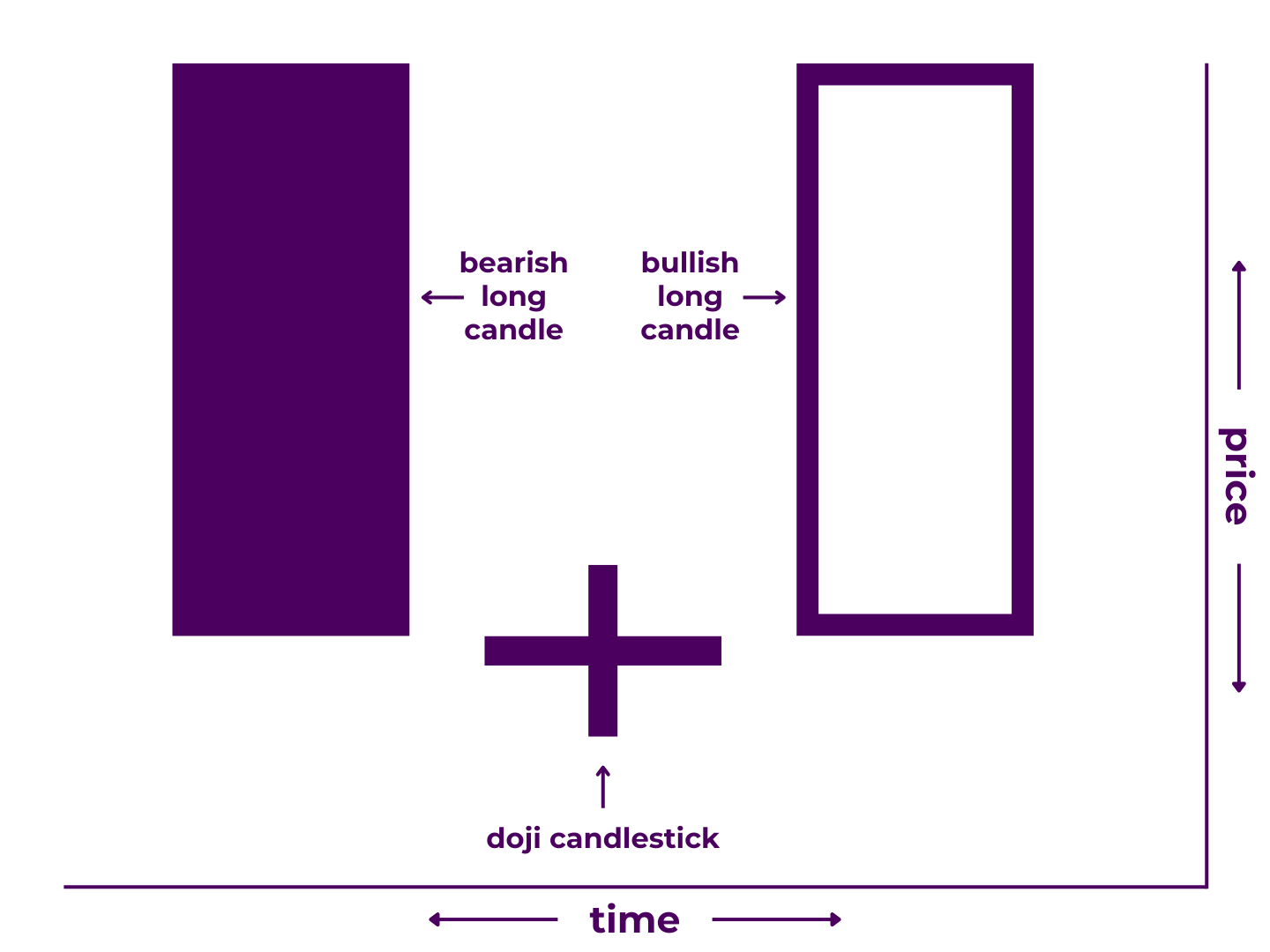

A morning doji star pattern is a 3-candlestick formation that may signal a bullish reversal.

It may appear during a downtrend and is made up of a large bearish candle followed by a doji and a large bullish candle.

In trading terms:

- During the first period, price continued the pre-existing downtrend.

- During the second period, neither side was able to maintain control.

- During the third period, price moved back up, threatening the downtrend.

Morning doji star patterns show that the bears attempted to press their advantage on candle one, stalled on candle two, and finally surrendered momentum to the bulls on candle three.

Pattern Type: Bullish Reversal

Number of Candlesticks: 3

Looks Like/Narrative Meaning: U-turn or counterpunch

Technical Specifications***

Technically, an morning doji star pattern must:

- Appear during a downtrend

- Begin with a bearish long candle

- Have any doji other than a four-price doji as the second candle

- End with a bullish long candle of similar size to the first candle

- Contain no gaps

In practicality though, many traders will make various exceptions.

- The first and third candles can be different lengths, as long as they are both long line candles and/or test important price levels.

- The second candle doesn’t necessarily have to be a doji, as long as it is a short line candle.

- There can be more than one doji (or short candle) between the first and final candlestick.

***Depending on who you ask, any of these standards may be more or less important. Moreover, some of these variations may be more properly classified as other bearish candlestick patterns.

Related Patterns

- Similar to Bullish Abandoned Baby Pattern

- Similar to Morning Star Pattern

- Subtype of Doji Star Pattern

- Opposite of Evening Doji Star Pattern

For more detail, read our full breakdown on Trading Morning Doji Star Candlestick Patterns.

Bullish Engulfing

A bullish engulfing candlestick pattern is a 2-candlestick formation that may signal a bullish reversal.

It may appear during a downtrend and is made up of a bearish candle and a large bullish candle that opens below and closes above the first, fully containing the trading range of the first.

In trading terms:

- During the first period, price continued the pre-existing downtrend.

- The second period opens with a gap down that is quickly filled as price proceeds to move back up above the opening price of the previous period.

Bullish engulfing candlestick patterns show that the bears attempted to press their advantage on candle one, continued to do so between candles one and two, but then completely lost the momentum by the end of candle two.

Pattern Type: Bullish Reversal

Number of Candlesticks: 2

Looks Like/Narrative Meaning: dam break or counterpunch

Technical Specifications***

Technically, a bullish engulfing candle pattern must:

- Appear during a downtrend

- Begin with a bearish candle

- End with a bullish long candle

- Have the first candle’s body contained completely within the body of the second

In practicality though, many traders will make various exceptions.

- The first candle can be a neutral candle (ie. a doji), as long as it is fully contained within the body of the second.

- The first candle can move against trend, as long as it is fully contained within the body of the second.

- The second candle doesn’t necessarily have to be a long candle, as long as it fully contains the body and wicks of the first.

- The open of the second candle can be even with the close of the first candle, especially in markets where gaps are less common like cryptocurrency.

***Depending on who you ask, any of these standards may be more or less important. Moreover, some of these variations may be more properly classified as other bearish candlestick patterns.

Related Patterns

- Precursor of Three Outside Up Pattern

- Subtype of Engulfing Candlestick Pattern

- Opposite of Bearish Engulfing Pattern

For more detail, read our full breakdown on Trading Bullish Engulfing Candlestick Patterns.

Bullish Harami

A bullish harami pattern is a 2-candlestick formation that may signal a bullish reversal.

It may appear during a downtrend and is made up of a large bearish candle followed by a small bullish (or neutral) candle. The trading range of the second candle must be completely contained within the body of the first.

In trading terms:

- During the first period, price continued the pre-existing downtrend.

- Before the second period opened, price moved higher, opening within the range of the prior candle body.

- During the second period, price continued to move higher to a modest degree, closing within the range of the prior candle body.

Bullish harami patterns show that the bears attempted to press their advantage on candle one, lost momentum between candles, and fully stalled out by the close of candle two.

Pattern Type: Bullish Reversal

Number of Candlesticks: 2

Looks Like/Narrative Meaning: birth of a counter-trend or counter-trend incubator

Technical Specifications***

Technically, a bullish harami pattern must:

- Appear during a downtrend

- Begin with a bearish long candle

- End with a bullish short candle

- Have the second candle’s body and wicks contained completely within the body of the first

In practicality though, many traders will make various exceptions.

- The first candle doesn’t have to be a long candle, as long as it is bearish and contains the second candle.

- The second candle doesn’t have to move against trend as long as it is neutral and/or very small (ie. a doji).

- The second candle’s wicks don’t have to be contained within the body of the first, as long as its body is.

- The open of the second candle can be even with the close of the first candle, especially in markets where inside candles are less common like cryptocurrency.

- If additional, consecutive candles after the second candle remain contained within the body of the first candle, all would be included in the harami pattern.

***Depending on who you ask, any of these standards may be more or less important. Moreover, some of these variations may be more properly classified as other bearish candlestick patterns.

Related Patterns

- Similar to Bullish Harami Cross Pattern

- Precursor of Three Inside Up Pattern

- Subtype of Harami Pattern

- Opposite of Bearish Harami Pattern

For more detail, read our full breakdown on Trading Bullish Harami Candlestick Patterns.

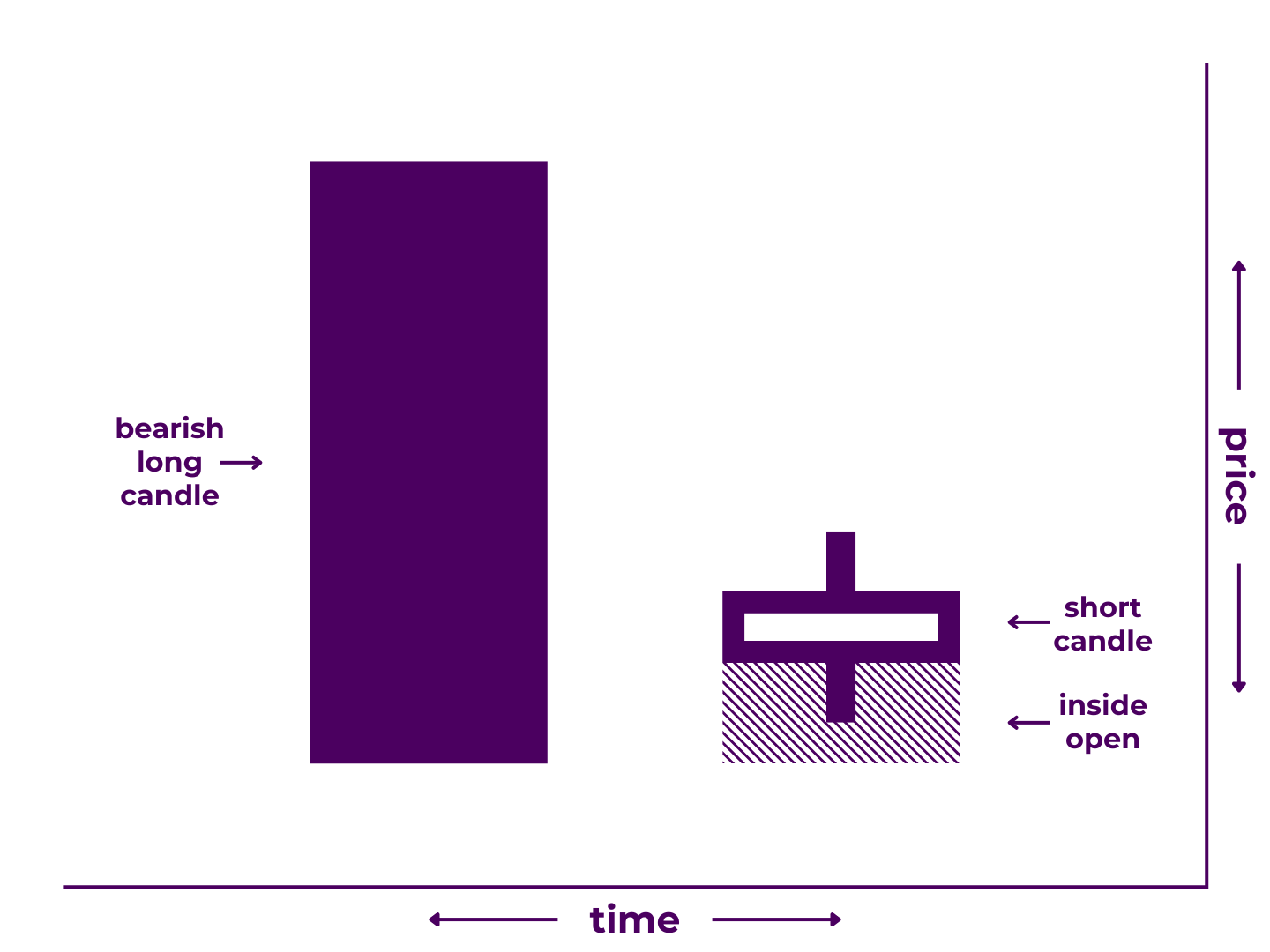

Bullish Harami Cross

A bullish harami cross pattern is a 2-candlestick formation that may signal a bullish reversal.

It may appear during a downtrend and is made up of a large bearish candle followed by an inside doji candlestick. The trading range of the second candle must be completely contained within that of the first.

In trading terms:

- During the first period, price continued the pre-existing downtrend.

- Before the second period opened, price moved higher, opening within the range of the prior candle body.

- During the second period, price stayed within the range of the prior candle body and closed at (or very near to) the open.

Bullish harami cross patterns show that the bears attempted to press their advantage on candle one, lost momentum between candles, and fully stalled out by the close of candle two.

Pattern Type: Bullish Reversal

Number of Candlesticks: 2

Looks Like/Narrative Meaning: birth of a counter-trend or counter-trend incubator

Technical Specifications***

Technically, a bullish harami cross pattern must:

- Appear during a downtrend

- Begin with a bearish long candle

- End with a doji candlestick

- Have the second candle’s body and wicks contained completely within the body of the first

In practicality though, many traders will make various exceptions.

- The first candle doesn’t have to be a long candle, as long as it contains the second candle and moves in the direction of trend.

- The second candle’s wicks don’t have to be contained within the body of the first, as long as the open and close are.

- The open and close of the second candle can be even with the close of the first candle, especially in markets where inside candles are less common like cryptocurrency.

- If additional, consecutive doji after the second candle remain contained within the body of the first candle, all would be included in the harami cross pattern.

***Depending on who you ask, any of these standards may be more or less important. Moreover, some of these variations may be more properly classified as other bearish candlestick patterns.

Related Patterns

- Similar to Bullish Harami Pattern

- Precursor of Three Inside Up Pattern

- Subtype of Harami Cross Pattern

- Opposite of Bearish Harami Cross Pattern

For more detail, read our full breakdown on Trading Bullish Harami Cross Candlestick Patterns.

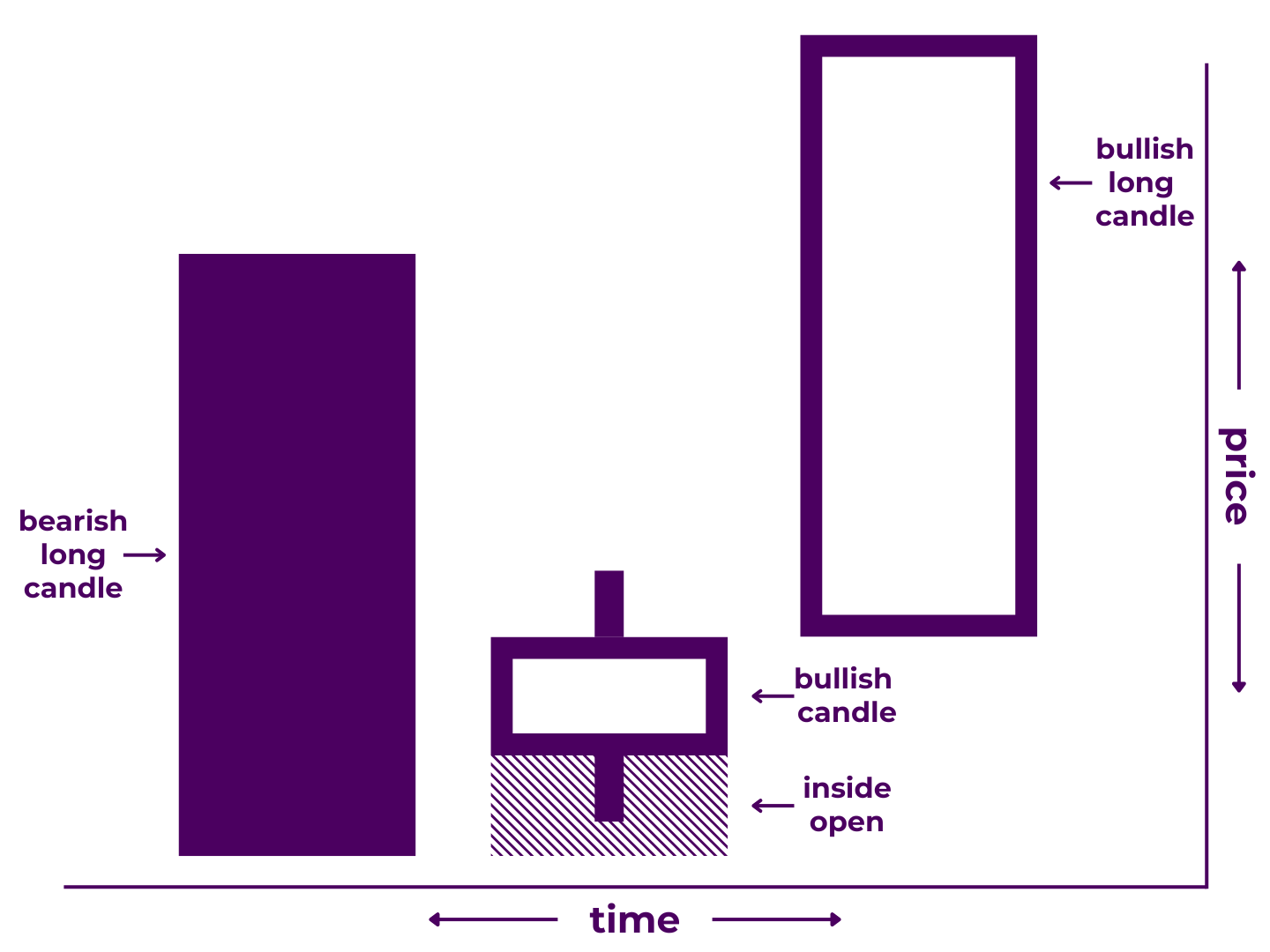

Morning Star

A morning star pattern is a 3-candlestick formation that may signal a bullish reversal.

It may appear during a downtrend and is made up of a large bearish candle followed by a short candle and a large bullish candle.

In trading terms:

- During the first period, price continued the pre-existing downtrend.

- During the second period, neither side was able to gain much ground.

- During the third period, price moved back up, threatening the downtrend.

Morning star patterns show that the bears attempted to press their advantage on candle one, stalled on candle two, and finally surrendered momentum to the bulls on candle three.

Pattern Type: Bullish Reversal

Number of Candlesticks: 3

Looks Like/Narrative Meaning: U-turn or counterpunch

Technical Specifications***

Technically, an morning star pattern must:

- Appear during a downtrend

- Begin with a bearish long candle

- Have a short candle as the second candle

- End with a bullish long candle of similar size to the first candle

- Contain no gaps

In practicality though, many traders will make various exceptions.

- The first and third candles can be different lengths, as long as they are both long line candles and/or test important price levels.

- There can be more than one short candle between the first and final candlestick.

- There can be one or more gaps, as long as the overall structure remains the same.

***Depending on who you ask, any of these standards may be more or less important. Moreover, some of these variations may be more properly classified as other bearish candlestick patterns.

Related Patterns

- Similar to Bullish Abandoned Baby Pattern

- Similar to Morning Doji Star Pattern

- Subtype of Star Pattern

- Opposite of Evening Star Pattern

For more detail, read our full breakdown on Trading Morning Star Candlestick Patterns.

Three Inside Up

A three inside up pattern is a 3-candlestick formation that may signal a reversal.

It may appear during a downtrend and is made up of a large bearish candle followed by a shorter bullish (or neutral) inside candle and another bullish candle that closes above the open of the first candle.

In trading terms:

- During the first period, price continued the pre-existing downtrend.

- Before the second period opened, price moved higher, opening within the range of the prior candle body.

- During the second period, price moved higher to a modest degree, closing within the range of the prior candle body.

- During the third period, price continued moving higher, this time closing above the open of the first period.

Three inside up patterns show that the bears attempted to press their advantage on candle one, suffered immediate pushback between candles one and two, and completely surrendered momentum over the course of candles two and three.

Pattern Type: Bullish Reversal

Number of Candlesticks: 3

Looks Like/Narrative Meaning: U-turn or counterpunch

Technical Specifications***

Technically, a three inside up pattern must:

- Appear during a downtrend

- Begin with a bearish long candle

- Have a bullish inside candle as the second candle

- End with a bullish candle that closes above the first candle’s open

In practicality though, many traders will make various exceptions.

- The first candle doesn’t necessarily have to be a long candle, as long as the second candle is a bullish inside candlestick.

- The second candle can be bearish, as long as it is an inside candle.

- The second candle’s wicks don’t necessarily have to be contained within the body of the first, as long as its body is.

- The open of the second candle can be even with the close of the first candle, especially in markets where inside candles are less common, like cryptocurrency.

- There can be more than one inside candle between the first and final candles, as long as the final candle closes above the first candle’s open.

***Depending on who you ask, any of these standards may be more or less important. Moreover, some of these variations may be more properly classified as other bearish candlestick patterns.

Related Patterns

- Extension of Bullish Harami

- Extension of Bullish Harami Cross

- Subtype of Three Inside Pattern

- Opposite of Three Inside Down Pattern

For more detail, read our full breakdown on Trading Three Inside Up Candlestick Patterns.

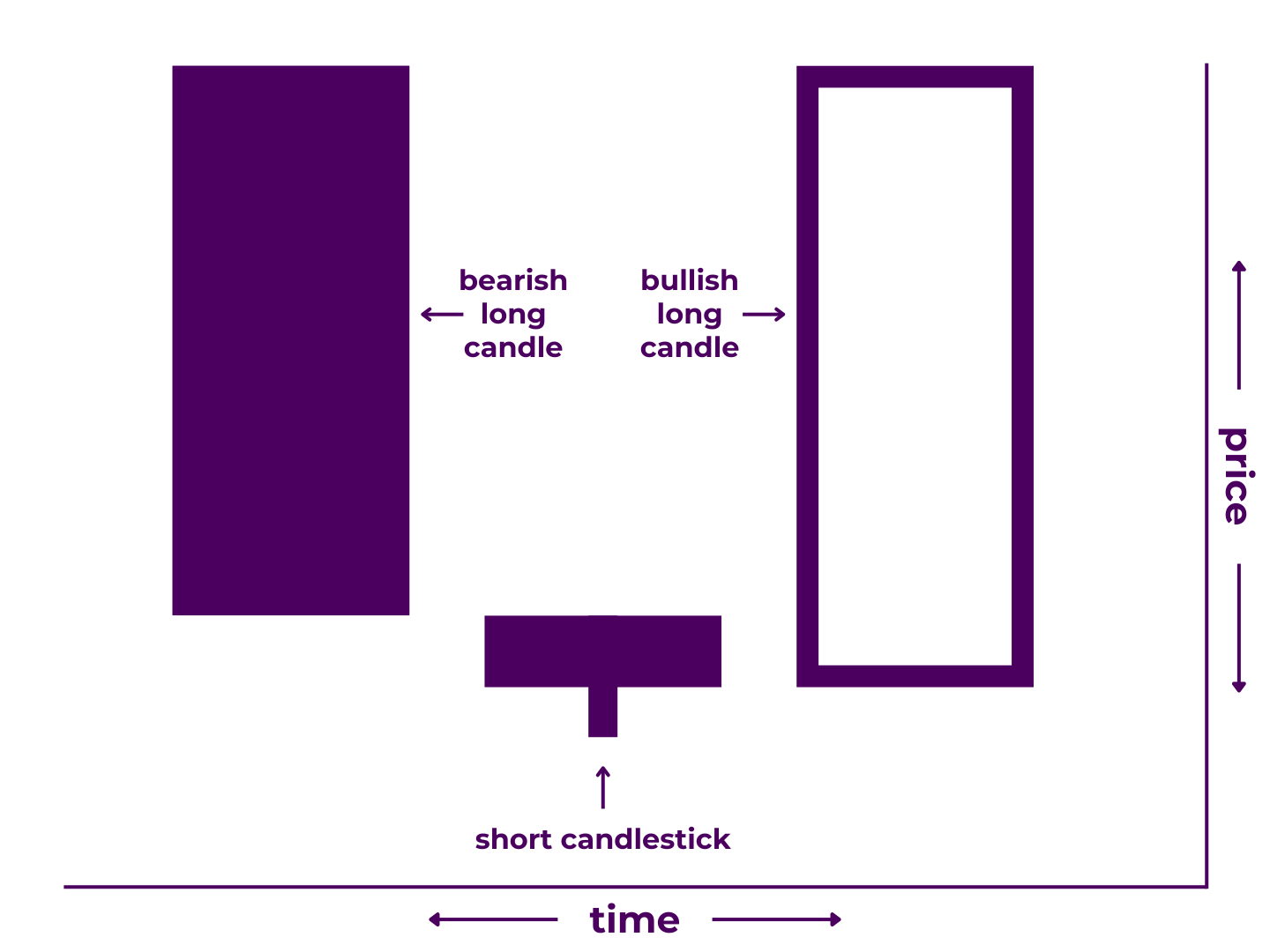

Three Outside Up

A three outside up pattern is a 3-candlestick formation that may signal a bullish reversal.

It may appear during a downtrend and is made up of a bearish candle followed by a large bullish engulfing candlestick and another bullish candle after that.

In trading terms:

- During the first period, price continued the pre-existing downtrend.

- Before the second period opened, price continued moving lower, creating a gap down open.

- During the second period, price moved dramatically higher, closing above the open of the first period.

- During the third period, price continued the upward movement of the period before.

Three outside up patterns show that the bears attempted to press their advantage on candle one, continued to do so between candles one and two, but were completely upended by the end of candle two, and lost even more ground on candle three.

Pattern Type: Bullish Reversal

Number of Candlesticks: 3

Looks Like/Narrative Meaning: complete turnaround or devastating counterstrike

Technical Specifications***

Technically, a three outside up pattern must:

- Appear during a downtrend

- Begin with a (non-short) bearish candle

- Gap down to open the second candle

- Have a bullish long candle as the second candle that fully contains the first

- End with another bullish candle

In practicality though, many traders will make various exceptions.

- The first candle can be a short or neutral (ie. a doji), as long as it is fully contained within the body of the second.

- The first candle can be bullish, as long as it is fully contained within the body of the second.

- The second candle doesn’t necessarily have to be a long candle, as long as it fully contains the body and wicks of the first.

- The open of the second candle can be even with the close of the first candle, especially in markets where gaps are less common like cryptocurrency.

***Depending on who you ask, any of these standards may be more or less important. Moreover, some of these variations may be more properly classified as other bearish candlestick patterns.

Related Patterns

- Extension of Bullish Engulfing Candlestick Pattern

- Subtype of Three Outside Pattern

- Opposite of Three Outside Down Pattern

For more detail, read our full breakdown on Trading Three Outside Up Candlestick Patterns.

Tweezer Bottom

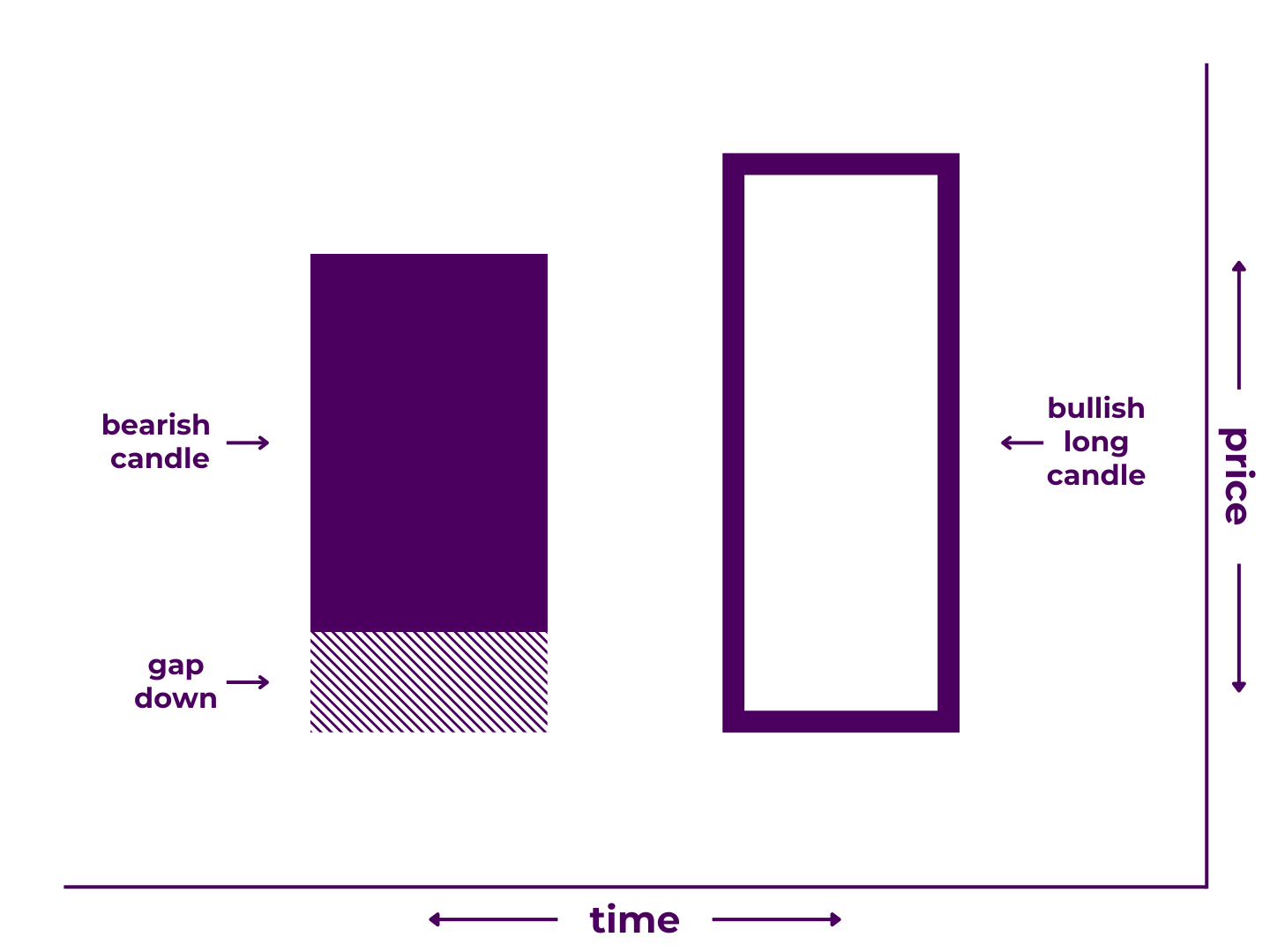

A tweezer bottom pattern is a 2-candlestick formation that may signal a bullish reversal.

It may appear during a downtrend and is made up of a large bearish candlestick followed by a large bullish candlestick where the bottom of the bodies and wicks of each candle match each other.

In trading terms:

- During the first period, price continued the pre-existing downtrend before pulling back above the low.

- During the second period, price moved back down until it reached the prior period’s low then rose back up near the open of the first period.

Tweezer bottom patterns show that the bears attempted to press their advantage on candle one but surrendered the momentum over the course of candle two.

Pattern Type: Bullish Reversal

Number of Candlesticks: 2

Looks Like/Narrative Meaning: an about-face or price action 180

Technical Specifications***

Technically, a tweezer bottom pattern must:

- Appear during a downtrend

- Begin with a bearish long candle that has an lower wick, such as a bearish belt hold

- End with a bullish long candle that has an lower wick of approximately the same length as the first

In practicality though, many traders will make various exceptions.

- The second candle doesn’t necessarily have to be a long candle, as long as the wicks of both candles are even.

- The wicks of the two candles don’t necessarily have to match exactly, as long as both candles are long candles in which the open of the second matches the close of the first.

- The candles don’t necessarily have to have wicks, as long as the candle bodies are nearly identical in size.

***Depending on who you ask, any of these standards may be more or less important. Moreover, some of these variations may be more properly classified as other bearish candlestick patterns.

Related Patterns

- Subtype of Tweezers Pattern

- Opposite of Tweezer Top Pattern

For more detail, read our full breakdown on Trading Tweezer Bottom Candlestick Patterns.

Takeaways

As you can see, there are many different bullish candlestick reversal patterns.

Luckily, you don’t have to memorize them all to become a successful trader. Learning the principles of price action and technical analysis are far more important. However, studying candlestick patterns is one of the best ways to do so.

In the end, understanding candle patterns is but one piece of the trading puzzle. You’ll need more weapons at your disposal to understand how to win the battle of the charts. Still, by learning the different types of candlestick patterns, you’re one step closer to creating a complete trading strategy.

Know of an important candlestick pattern we missed? Have some special insight into trading a specific pattern? Contribute to the conversation in the comments below! Or, share this post with a trader it might help. And if you haven’t already, check out our Candlestick Patterns Guide to learn the best ways to trade candlestick patterns.

0 Comments