Bullish separating lines patterns are a lesser known but relatively high-performing candlestick pattern.

Learning how to read and trade them adds a valuable weapon to your trading arsenal. Most technical analysis is based on Japanese candlestick charts, after all. In this post, we’ll go over everything you need to know to trade bullish separating lines candle patterns.

Bullish Separating Lines Pattern Guide

To start, let’s define them.

What Is a Bullish Separating Lines Candlestick Pattern?

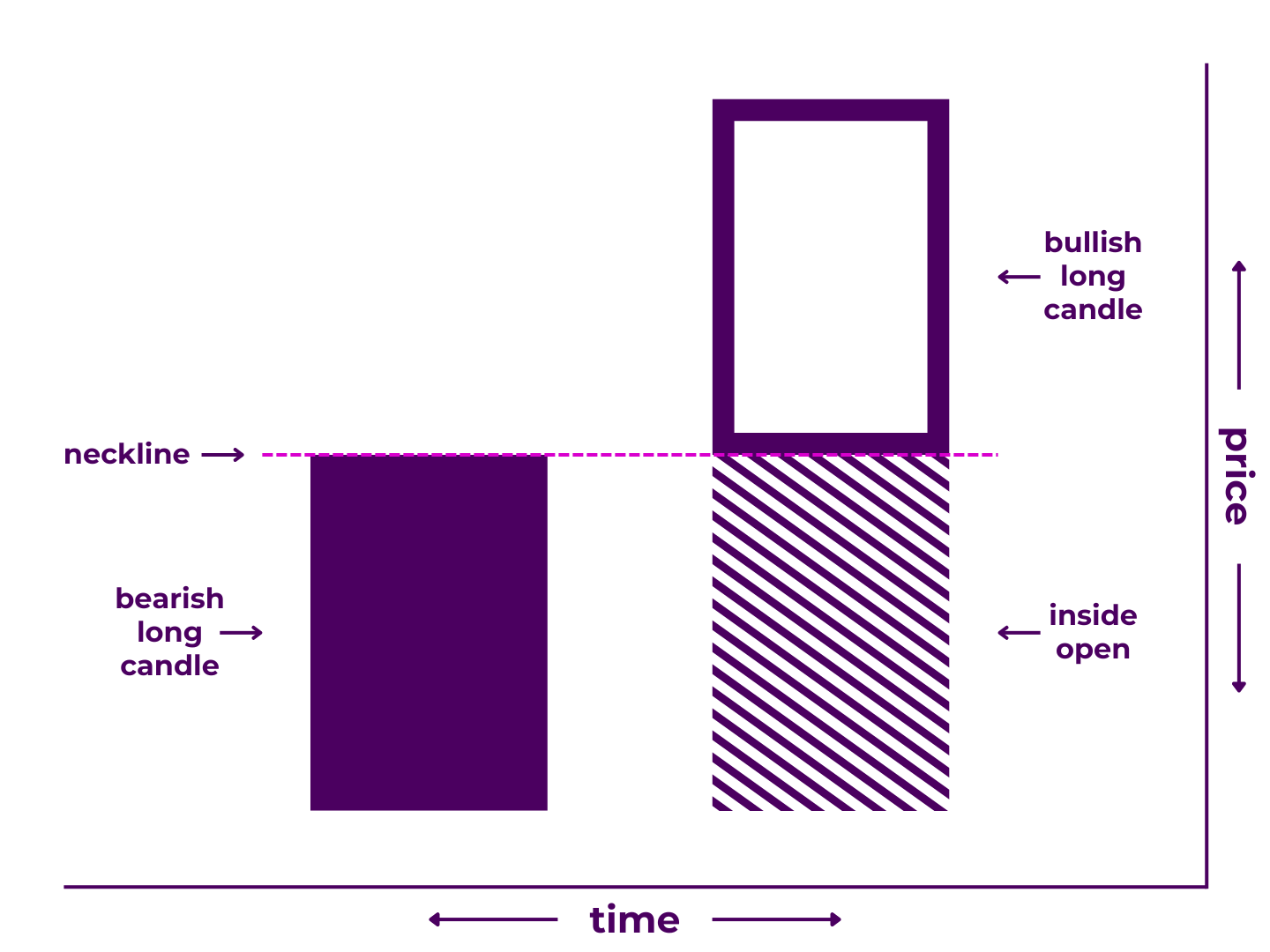

A bullish separating lines is a bullish continuation formation. They occur during uptrends and consist of 1) a large-bodied candlestick moving down and 2) a large-bodied candlestick with the same open as the first candle that moves up.

It is the bullish version of the separating lines pattern, and therefore the opposite of the bearish separating lines pattern.

Of course, no candlestick pattern guarantees a particular outcome. They are more like suggestions than promises.

So, what do bullish separating lines patterns really tell you?

What Bullish Separating Lines Patterns Mean

Unlike some patterns, English speakers do not use the Japanese name for this one.

The term “separating lines” reflects the nature of the pattern, two candles with the same origin and diverging endpoints. While this does describe the pattern fairly well, it isn’t that memorable and doesn’t provide much insight. This is fairly typical of candlestick pattern naming conventions.

In trading terms:

- First Period – The price decreases significantly, contrary to the upward trend.

- Pre/Post-Market Trading – The price increases significantly, all the way back to the open of the first period.

- Second Period – The price increases significantly.

This helps reinforce the ongoing uptrend. If buyers can keep price above the formation, bullish continuation becomes all but inevitable. Furthermore, it creates several decision zones that may become important support levels in the future.

Figuratively, separating lines indicate that the market may have chosen the high road.

How To Recognize Bullish Separating Lines Candlestick Patterns

Patterns are attractive partly because they stand out.

To the untrained eye, they may mean nothing. But to those with experience, they are something like a beacon. They draw your attention to a specific segment of price action, encouraging you to look more closely.

To gain this insight, all you need to do is learn the rules and practice finding them on the charts.

By definition, a bullish separating lines pattern has several requirements.

- It must appear during a general uptrend.

- The first candle must be a bearish long-line candlestick.

- The second candle must be a bullish long-line candlestick.

- The second candle must open at the top of the first candle’s body.

- The second candle must close above the first candle’s upper wick.

As you can see, most of this pattern’s rules center around the second candlestick.

However, some exceptions may be acceptable.

- The first candle doesn’t necessarily have to be a long candle, as long as it is not a short-line candle (ie. doji).

- The second candle doesn’t necessarily have to be a long candle as long as it is bullish and its other criteria are met.

- The second candle doesn’t necessarily have to open exactly in line with the open of the first candle, as long as it opens near it.

- The second candle doesn’t necessarily have to close above the upper wick of the first candle, as long it is a long bullish candle that closes above the body of the first candle.

You may find better results by stretching some of these criteria (or even adding your own). For instance, your analysis may reveal that separating lines patterns made of two marubozu candles perform more reliably than those made of other candlestick types. Or, you may find something else entirely.

Technically, these variations may fall more accurately under other candlestick continuation patterns.

This is okay though, as implication supersedes classification. And similar patterns usually have similar implications (though not always).

Yet, that does not mean that these standards are wholly irrelevant. In fact, certain ones are definitely mandatory, such as the direction of the candles and the approximately even opens. It just means that deeper examination may help you identify more and/or better trading opportunities.

Ultimately, how seriously you take each of these guidelines is up to you. Don’t forget that the purpose of analyzing candlestick patterns is to interpret underlying price action. Your pattern labeling skills are less important.

To this end, you need to understand where they fit.

Where Bullish Separating Lines Fit in the Chart Narrative

The markets are often described as a battle between the bulls and the bears.

Bullish separating lines patterns show that the bears tried to take control on candle one, lost the impetus between candles one and two, then relinquished command back to the bulls by the end of candle two.

On the chart, it looks like a drawback preceding a bullish tsunami.

The first day surprised everyone, with a powerful move down. Traders went to bed wondering if the uptrend was over but awoke the next morning to the same opening price as the previous day. Shaking off the feeling of déjà vu, they realized that the price had floated back up during overnight trading. Once normal trading hours resumed, long traders piled on heavily. By the close of the second day, price had risen dramatically.

The stage is now set for a fight over the levels highlighted by this price action. If sellers cannot retake these levels, the chance of a bullish continuation increases.

Please note: This is only an illustration. Bullish separating lines patterns can reflect any number of real-world scenarios.

In the short-term, it amounts to a bearish counterpunch followed by a bullish knockout blow.

The question for traders:

“Will the uptrend continue immediately or can the bears do anything to stem the tide?”

To answer that question, you’ll need more than an understanding of Japanese candlesticks and candlestick patterns. You’ll want to evaluate both within the context of longer-term chart patterns as well as trend and price levels. You’ll also want to make use of your own chart markup and indicators.

Explore the history of your preferred asset(s) with respect to separating lines candlestick patterns and apply your findings to your own trading style.

The more thorough your technical analysis, the more clear the story in the charts becomes.

How To Trade Bullish Separating Lines Candle Patterns

Bullish continuation points are great places to add to your long position or adjust your stop loss.

As such, bullish separating lines candle patterns serve as easy-to-spot signs of unchanging bullish momentum. They may even lead to the next big leg up.

In most cases, you can assign greater weight to multi-stick patterns than single candles because they provide more information over a longer duration. However, you should wait for all candles to close before making any decisions. Otherwise, there is a good chance that you’ll get caught in a fake out.

Additionally, there are a few other things you should consider before trading candlestick patterns.

First and foremost, they are never a “sure thing.” According to Bulkowski’s Encyclopedia of Candlestick Patterns, bullish separating lines have a hit rate of 72% (while bearish separating lines have a hit rate of 63%). Sure, that is pretty high but definitely not a certainty.

What’s more, candlestick patterns do not have uniform price targets or measured moves like chart patterns do. That makes position management trickier.

Plus, failed continuation patterns often lead to reversal or consolidation. Thus, you’d be wise to seek additional confirmation factors to increase your odds of a successful trade.

Some of these include:

- Volume – For continuation, you typically want to see reduced trading volume against the trend. That means low volume on the first candle of a separating lines may be a good omen.

- Price Formations – Bullish continuation patterns tend to perform better when there is thin (or non-existent) resistance above them. If it’s a “blue sky breakout,” even better..

- Matching Momentum – Oscillating indicators like the RSI or stochastics are commonly used to identify continuation by analyzing slope, percentile, and/or divergence.

The more corroborating elements are present, the more confident you can be about the strength of a bullish separating lines continuation signal.

Even so, it would be difficult to build a successful trading strategy around any single candlestick pattern. There simply isn’t enough there to develop a strong edge. It would still be suboptimal with an expert understanding of trading math, order execution, market psychology, risk management, options, and automation.

In essence, separating lines patterns are more useful idea givers than trade makers.

Better yet, you’ll probably find more success building your strategy around other tools and using candlestick patterns as the final point of confirmation.

Other Candlestick Pattern Types

There are many bullish continuation candlestick patterns.

The bullish separating lines is only one.

Likewise, there are many bearish continuation candlestick patterns. Not to mention, you have bullish reversal candlestick patterns and bearish reversal candlestick patterns.

For most traders though, tackling all candlestick patterns at once may be the best learning path.

- Abandoned Baby – Bearish | Bullish

- Breakaway – Bearish | Bullish

- Counterattack Lines – Bearish | Bullish

- Doji Star – Evening | Morning

- Engulfing – Bearish | Bullish

- Gap Three Methods – Upside | Downside

- Harami – Bearish | Bullish

- Harami Cross – Bearish | Bullish

- In Neck – Bearish | Bullish

- Kicking – Down | Up

- Ladder – Top | Bottom

- Last Engulfing – Bottom | Top

- Mat Hold – Bearish | Bullish

- Matching – High | Low

- Meeting Lines – Bearish | Bullish

- On Neck – Bearish | Bullish

- Star – Evening | Morning

- Stomach – Below | Above

- Tasuki Gap – Downside | Upside

- Three Inside – Down | Up

- Three Methods – Falling | Rising

- Three Outside – Down | Up

- Three-Line Strike – Bullish | Bearish

- Tri-Star – Bearish | Bullish

- Tweezer – Top | Bottom

- Window – Falling | Rising

Sure, it is quite a long list.

Luckily for us all, you don’t need to memorize every pattern and its criteria. Instead, focus on price action and technical analysis principles. The goal is to be able to look at any group of candlesticks and understand what they mean.

The more candlestick patterns you study, the easier this will become.

Takeaways

To review:

Bullish separating lines are a type of candlestick pattern that signal a potential bullish continuation. While not a guarantee, their appearance may indicate that buyers are primed to remain dominant. When used properly, this can help you find winning trades.

Of course, there are other candlestick patterns that you should learn about. Still, the ability to recognize patterns is not enough to trade successfully on its own.

Nonetheless, you’ve now added one more weapon to your trading arsenal.

Have questions or more information to add? Contribute to the conversation in the comments below! Or, if you know someone who could benefit from this post, share it with them. You can also check out our Candlestick Patterns Guide to improve your candlestick analysis skills.

0 Comments