Rising window patterns are fairly rare but give a clear signal.

Since candlesticks are the basic building block of most technical analysis, the ability to recognize different candlestick patterns is a crucial trading skill.

In this Guide to Rising Window Patterns, we’ll explain:

First though, let’s start with a definition.

What Is a Rising Window Pattern?

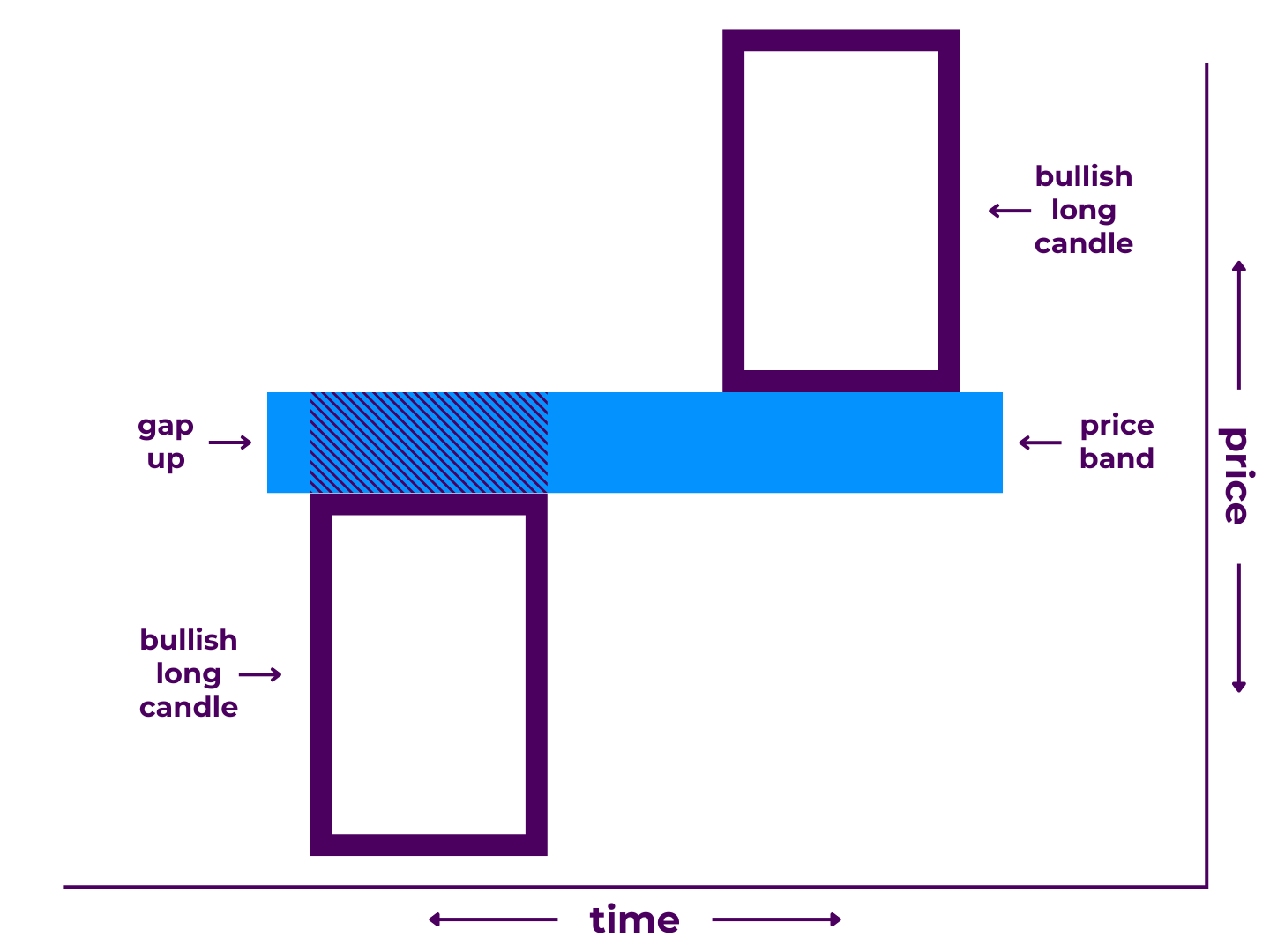

A rising window pattern is a 2-candlestick formation that may signal a bullish continuation. It may appear during an uptrend and is made up of two large bullish candles with a gap between them.

It is the bullish version of the window pattern, making it the opposite of the falling window. It is also a precursor to the upside tasuki gap. For both, the unfilled gap represents a make-or-break price band that could shape upcoming price action.

Of course, no candlestick pattern guarantees a particular outcome. Instead, they offer clues as to what is going on in the market.

So the question is, what does a window really tell you?

What Rising Window Patterns Mean

Like many candlestick patterns, the name itself doesn’t reveal much.

And unlike some, English speakers do not use the Japanese name for it. The term “window” probably comes from how it looks. The long candles are like the top and bottom panels of an open window, with the gap representing the opening itself.

In trading terms:

- During the first period, price continued the pre-existing uptrend.

- The second period opened with a gap up and continued driving upward.

This sets the stage for bullish continuation, as buying pressure seems to be all but nonexistent.

How To Recognize Rising Window Candlestick Patterns

Traders are attracted to patterns partly because they are easy to spot.

However, it’s also easy to see things on the charts that aren’t truly there (or anticipate events that never come to fruition). That’s one of the reasons why waiting for confirmation is so important.

Technically, a rising window pattern must:

- Appear during an uptrend

- Begin with a bullish long candle

- Have a gap up after the first candle

- End with another bullish long candle

In practicality though, many traders will make various exceptions.

- The first candle doesn’t necessarily have to be a long candle, as long as it is a candlestick that gives a strong bullish bias (such as a dragonfly doji).

- The second candle doesn’t necessarily have to be a long candle, as long as it is bullish and does not fill the gap.

Depending on who you ask, any of these standards may be more or less important. Moreover, some of these variations may be more properly classified as other continuation candlestick patterns, such as the upside tasuki gap.

Remember, identifying the reversal itself is more important than labeling the formation. That’s not to say these standards are completely unimportant (as we’ll touch on shortly). It’s just to say that the implications are more important than the criteria.

In other words, you need to put it into context.

Where Rising Windows Fit in the Chart Narrative

The markets are often characterized as a battle between the bulls and the bears.

Rising window patterns show that the bulls pressed their advantage on candle one, continued between candles one and two, and continued further through the end of candle two.

On the chart, it looks like a runaway train.

It might happen like this on a daily time frame:

Just before the market opened on the first day, positive news broke that generated tremendous optimism in an already bullish environment. That day, price soared. But it didn’t stop there. After the market closed, price continued to advance. Once the market opened on the second day, even more buyers joined in as everyone assumed the best-case scenario. Predictably, the total gains on day two were even larger than day one.

From here, the bears are left to pick up the pieces as bulls toast their luck.

In the short-term, it amounts to a one-sided beat-down.

The question traders need to ask themselves is, “Can the bears muster any sort of response or will the march upwards continue?”

To answer that question, you’ll need more than just an understanding of Japanese candlesticks and candlestick patterns. You’ll want to analyze both within the context of greater chart patterns as well as trend and price levels. You’ll also want to make use of your own chart markup and indicators.

Analyze the history of your preferred asset(s) with respect to window patterns and apply it to your own trading style.

Now, you can test (and/or stretch) the criteria we mentioned above to find the most tradeable opportunities. For example, you may find that the larger the gap, the more reliably rising windows play out. Or, you may find something else entirely.

Here is where the story in the charts begins to come into focus.

This is what we call technical analysis.

How To Trade Rising Window Patterns

Bullish continuation points are great places to add to your long position or move your stop loss up.

Rising window patterns serve as easy-to-spot signs of potential bullish continuation that may serve as a launch point for the next big leg up.

Generally, you can put more weight into multi-stick patterns than single candles. They give you more information over a longer amount of time. Still, it is considered unwise to trade based on candlestick patterns alone. They rarely have extremely high hit rates by themselves.

You need additional points of confluence to shift the probabilities in your favor.

Some of the more important ones include:

- Volume – For bullish continuation, you typically want to see higher trading volume as price moves higher. Therefore, rising windows accompanied by a volume spike may be a good omen.

- Price Formations – Bullish continuation patterns like the rising window tend to perform better when there is thin (or non-existent) resistance in their way. The further above and weaker the better.

- Matching Momentum – Oscillating indicators like the RSI or stochastics are commonly used to identify continuation by analyzing slope, percentile, and/or divergence.

The fewer such factors corroborating the continuation, the less confident you can be about it.

It would be difficult to form a comprehensive trading strategy around window patterns (whether bullish or bearish). There simply isn’t enough there to develop a strong edge. Even with a great understanding of trading math, orders, psychology, risk management, options, and automation, you’d still have a hard time.

You’re much better off building your strategy around other tools then using continuation patterns as an additional point of confirmation.

Patterns like the window are much better idea givers than trade makers.

Other Candlestick Pattern Types

The rising window is but one of many candlestick patterns.

You’d be wise to get familiar with all of the other ones too.

- Abandoned Baby – Bearish | Bullish

- Breakaway – Bearish | Bullish

- Counterattack Lines – Bearish | Bullish

- Doji Star – Evening | Morning

- Engulfing – Bearish | Bullish

- Gap Three Methods – Upside | Downside

- Harami – Bearish | Bullish

- Harami Cross – Bearish | Bullish

- In Neck – Bearish | Bullish

- Kicking – Down | Up

- Ladder – Top | Bottom

- Last Engulfing – Bottom | Top

- Mat Hold – Bearish | Bullish

- Matching – High | Low

- Meeting Lines – Bearish | Bullish

- On Neck – Bearish | Bullish

- Separating Lines – Bearish | Bullish

- Star – Evening | Morning

- Stomach – Below | Above

- Tasuki Gap – Downside | Upside

- Three Inside – Down | Up

- Three Methods – Falling | Rising

- Three Outside – Down | Up

- Three-Line Strike – Bullish | Bearish

- Tri-Star – Bearish | Bullish

- Tweezer – Top | Bottom

Sure, there are quite a few of them. But don’t let that intimidate you.

It’s unnecessary to memorize all the names and criteria for every pattern. What’s more important is to learn the principles of price action and technical analysis.

In fact, you’re free to forget all of the names and specifications as long as you can look at a group of candlesticks and understand what they are trying to tell you.

Takeaways

To review:

Rising windows are a type of candlestick pattern that signals a potential bullish continuation. While not a guarantee, their appearance may indicate that market conditions are going to remain the same. Thus, they can help you find winning trades.

Of course, there are other candlestick patterns that you should learn about. And even so, the ability to recognize patterns is not enough to trade successfully on its own.

Nonetheless, you’ve now added one more tool to your toolkit.

Have questions or more information to add? Contribute to the conversation in the comments below! Or, if you know someone who could benefit from this post, share it with them. You can also check out our Candlestick Patterns Guide to improve your candlestick analysis skills.

0 Comments